The Bitcoin ETF Will Be Rejected According to Prediction Markets

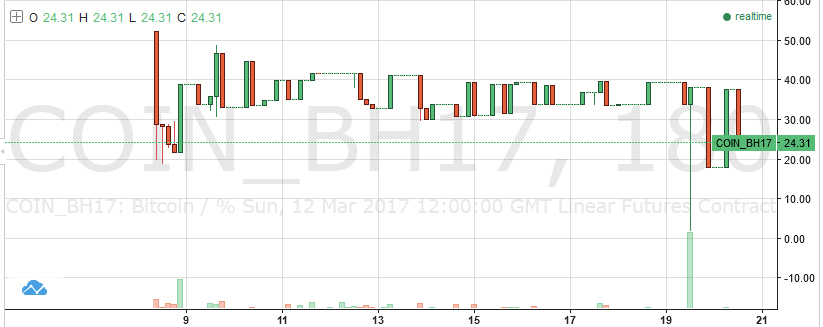

The much-anticipated bitcoin ETF, which has been going through the bureaucratic process for now more than three years, will likely be rejected according to a Bitmex prediction contract launched almost two weeks ago.

Since its listing, the market has always given Winklevoss’ ETF a less than 50% chance, usually standing at around 40% for much of the past week, falling to as low as 18% yesterday.

There were suggestions its sharp drop was due to a bug, but Greg Dwyer, Business Development Manager at BitMEX, told CCN.com:

“There have been no bugs with the ETF prediction market and it is operating exactly as intended. It is currently trading in a range between 24 – 37%. That is, the price represents the probability of the ETF being approved by the SEC come March 11.”

Spencer Bogart, Vice President of Equity Research for Needham & Co, gave the ETF only a 25% chance of approval.

The main reason appears to be due to bitcoin’s volatile nature, but stock markets have previously crashed, some company stocks have instantly become worthless and some have instantly jumped in price.

Furthermore, Kevin Lu, a hedge fund analyst, describes in a detailed article for Seeking Alpha how “Bitcoin is a unique, uncorrelated asset class… and that makes bitcoin extremely desirable from a portfolio construction perspective.”

The SEC’s thinking on the matter is not quite clear. We have reached out for comments, but have received no response in time for publishing.

SEC personnel has just changed or are in the process of changing. As such, the decision might be made in somewhat chaotic circumstances with the new personnel potentially not fully up to speed on the fairly complicated matter.

To illustrate, SEC’s page still lists the old chair, but President Trump has chosen a new nominee, Walter J. Clayton, described by the New York Times as “the Wall Street Lawyer” and as “the insider’s insider.” It further states :

“He had a front-row seat to the financial crisis, advising Barclays Capital in buying the assets of the bankrupt Lehman Brothers in 2008 and Bear Stearns in its fire sale to JPMorgan Chase in 2007. He has advised on mergers and initial public offerings, including the biggest ever, the $25 billion offerings by Alibaba Group of China in 2013.”

Whether that experience makes him more favorable to bitcoin or more against it, remains to be seen, but the new administration does have some bitcoin supporters in its cabinet and emphasizes de-regulation with the aim of fostering economic growth. However, Clayton himself, a law graduate, has not previously made any comments on bitcoin.

He will soon be familiar with the digital currency, if he is not already, and will most probably be a very influential figure in this space. The ETF decision, whether approved or rejected, will have considerable implications. Equally, and perhaps more importantly, he might eventually want to give some sort of guidelines on the currently booming ICO markets.

Finally, the new administration might wish to allow margins and futures trading on regulated exchanges such as Coinbase and Gemini for its refusal by inaction so far has forced many to use somewhat shady and seemingly amateurish exchanges which have led to losses, opening the relevant agencies to criticism for failing to protect the public and worse, for indirectly causing the losses.

Whether they will take any such action is too early to say, but we might soon get a glimpse of the new administration’s approach towards digital currencies, the blockchain space, and, more widely, the Fintech industry.

Image from Shutterstock.