Stock Market Investors Should HODL Because Pros Can’t Beat S&P 500

Studies show that fund managers underperform market indices and benchmarks such as the S&P 500 Index. Investors are better off HODL'ing. | Source: Shutterstock

The phrase “beating the market” can be defined as earning returns that outperform the gains of a particular benchmark or index such as the S&P 500 Index. Fund managers are supposed to be experts in timing the market. They’re also supposed to have strategies in place to generate profits under any market condition. More importantly, many fund managers enjoy the support of a team of financial experts who can provide valuable insights as well as the latest research.

On paper, fund managers are supposed to consistently outperform the market because they have certain skills, strategies, and resources. These qualities put them way ahead of retail investors who rely on basic technical or fundamental analysis. However, studies reveal that most fund managers can’t even beat the market.

Most Active Managers Fail to Outperform the S&P 500 Over a Long-Term Investment Horizon

Fund managers generally charge two types of fees for investing their clients’ money. The first type is the total assets under management fee or an annual expense ratio. It usually ranges from close to zero to four percent, or even higher in some cases, per year. For many, this fee is acceptable. The second type of fee is the capital gains fee. Investment funds often charge 20 percent of those gains.

In short, you’re paying these managers regardless of their performance. Perhaps this is one of the reasons why most funds consistently fail to beat the market over the long-term.

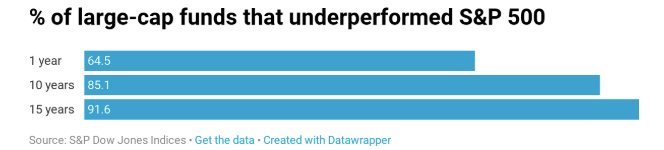

According to a report released by the S&P Dow Jones Indices , 64.5 percent of large-cap funds underperformed the S&P 500 in a span of a year. The number gets worse as you stretch the investment window. Over a 10-year period, 85.1 percent of active managers were beaten by the index. That number goes up to 91.6 percent over a 15-year investment horizon.

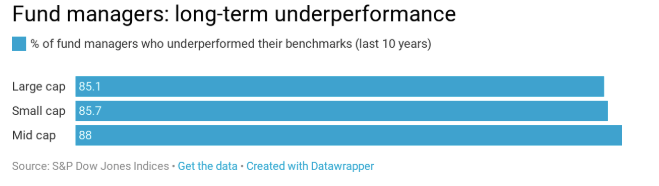

With these results, one can argue that the large-cap funds’ vast asset under management (AUM) amounts prevent fund managers from being nimble and taking advantage of market volatility. However, the same study revealed that all types of funds lag behind the market. In fact, 85.7 percent of small-cap funds were outgunned by their respective benchmarks over a 10-year investment period. The same is true for 88 percent of mid-cap funds.

Other Studies Across the Globe Reveal the Same Results

It appears that U.S. fund managers are not the only ones who are underperforming major indices.

A study involving 9,400 European-based active and passive funds revealed that active managers consistently failed to outshine their index benchmarks over a 10-year time frame. In Australia, 85 percent of the 100 large-cap funds were beaten by the country’s Vanguard market-cap-weighted fund in 2018. In Canada, more than 75 percent of active Canadian fund managers failed to outperform equity trackers.

We are seeing a trend here suggesting that even those who trade and invest for a living rarely win against the overall market. What does it mean for the average retail trader?

Bottom Line: HODL

Fund managers who are supposed to have the skills, strategies, and resources can’t beat the market such as the S&P 500. Chances are, everyday investors are unlikely to beat the market either. Therefore, retail investors are better off using a buy and hold strategy or as the crypto saying goes: holding on for dear life (HODL). It is actually even better if you HODL along with an up-trending market. If you can identify trends and passively sit on your investments, you could possibly outperform even the top fund managers in the world.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.