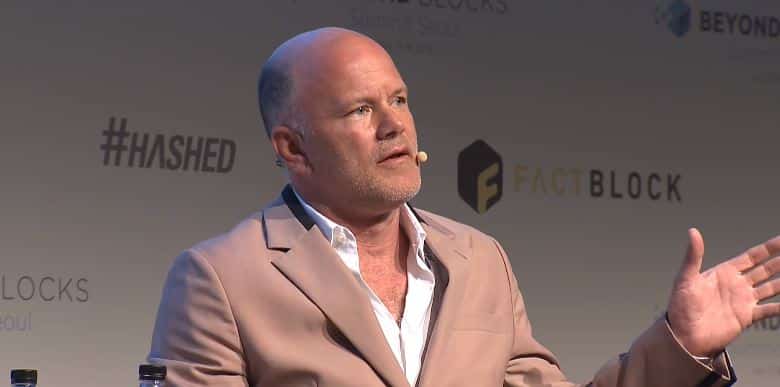

‘Revolutions Don’t Happen Overnight’: Why Mike Novogratz isn’t Giving up on Bitcoin

Bitcoin bull Mike Novogratz — the CEO of cryptocurrency merchant bank Galaxy Digital — is unfazed by the recent bear market, saying bitcoin is “digital gold” that will survive and thrive over the long haul.

Novogratz admitted that he lost money during the 2018 slump due to bad market calls, but that doesn’t dampen his long-term outlook that crypto is a revolution whose time has come.

As CCN.com reported, Galaxy Digital lost $136 million during the first nine months of 2018 due to losing positions in Ether, XRP, and Bitcoin during a relentless down market. Despite this, Novogratz remains as bullish as ever about crypto, especially BTC.

‘Digital Gold’

“I do believe Bitcoin is going to be digital gold,” Novogratz told Bloomberg . “That means it’s the only one of the coins out there that gets to be a legal pyramid scheme — just like gold is.”

Novogratz said bitcoin and gold are similar because of their finite supplies. “All the gold ever mined in the history of the world fits in an Olympic-size swimming pool,” he said. “You’re out of your mind to think that pool’s worth $8 trillion. But it is because we say it is.”

Novogratz said naysayers who are basking in schadenfreude over the current market downturn should realize that mass adoption of a new currency takes time. And early setbacks don’t necessarily spell doom.

“Revolutions don’t happen overnight,” Novogratz underscored.

‘Macro Market On Steroids’

The former Goldman Sachs partner and hedge fund manager said he has never witnessed a financial phenomenon like crypto, which is why he left investment banking to plunge head-long into the nascent cryptocurrency industry.

“For me, crypto was interesting because what macro guys do is try to make complicated things simple. It was macro markets on steroids,” Novogratz recalled. “I’d never seen something go parabolic on a log chart before. I thought, ‘My God, this is the single craziest chart ever.'”

Mike Novogratz and other crypto evangelists say 2019 will be a milestone year fueled by a surge in institutional investments. In fact, he predicts that bitcoin prices will hit record highs in 2019.

“By the end of the first quarter [of 2019], we will take out $10,000,” he said. “After that, we will go back to new highs — to $20,000 or more.”

‘Some of the Smartest People’ Invest in Crypto

Over the summer, the industry scored major street cred after the multi-billion-dollar university endowments of Harvard, Yale, and Stanford University announced that they had invested in crypto.

The move was viewed as an unmistakable signal of institutional confidence in crypto as investment vehicles. Since institutions tend to copy each other, analysts say the move will trigger a chain reaction among other big-name institutional investors, such as pension funds.

“The fact that David Swensen [Yale’s chief investment officer] put an investment into Bitcoin — with his reputation on the line, his endowment on the line — tells you something,” Novogratz said. “Some of the smartest people in the investing world think it’s a store of value.”

Featured Image from Beyond Blocks/YouTube