Crypto Firm Galaxy Digital is Losing an Average of $15 Million every Month

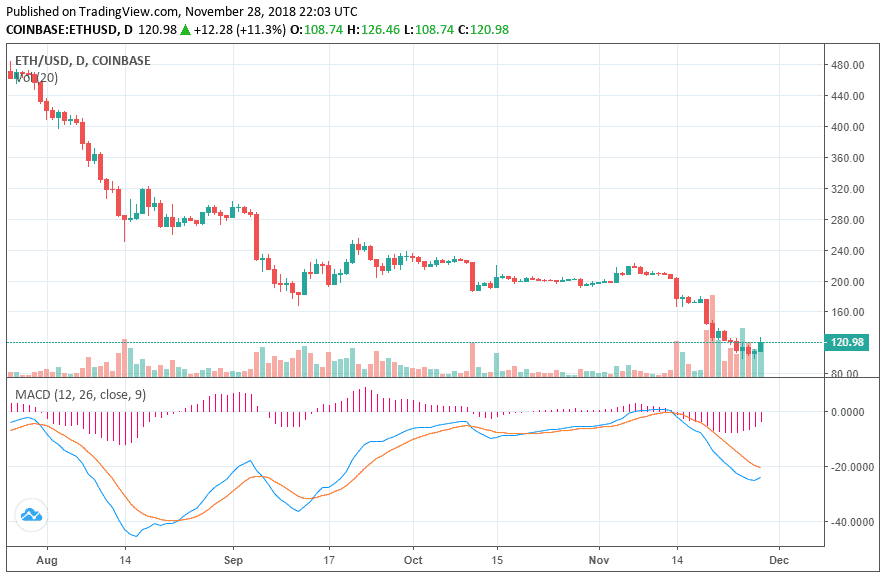

Galaxy Digital Holdings LP, the cryptocurrency merchant bank founded by prominent crypto investor Mike Novogratz, announced losses totaling $41 million for Q3 2018, bringing the total losses for the year so far to $136 million. Bloomberg reports that the Q3 loss was driven by net realised and unrealised losses on digital assets, chiefly caused by losing positions of Ether, XRP, and Bitcoin in a persistently bearish year for the cryptoasset category.

While it is no secret that 2018 has generally been a bad year for cryptocurrency traders, the financial report by Galaxy Digital provides a rare window of insight into just how affected crypto traders have been by depressed and falling asset prices that have persisted throughout the year.

Bad Year Set to Get Worse?

Earlier in the month, CCN.com reported that Novogratz expressed frustration at the current market situation, stating that trying to build a crypto-focused business amidst the carnage “sucks.” According to him, Galaxy Digital faces a completely different set of challenges to a conventional merchant bank, chief of which is that every downward price spike acts as an existential threat to the business and has staff looking over their shoulders.

After losing $134 million in Q1 2018, the company posted an improved performance report in Q2 2018, recording a net income of $35 million and trading losses cut to just $1.5 million. The latest figures, however, show that the company’s position is still far from great, with Q4 figures expected to be even worse following the market rout that has taken place over the past month.

Speaking in its filing, the company identified solid trading volumes and increased competition for arbitrage opportunities as the principal reasons for its poor Q3 performance. It also revealed that the fair value of its digital asset holdings stands at $90.6 million net of short positions, significantly less than the $172 million that the assets cost.

An excerpt from the report reads:

“While we continue to improve and strengthen our trading business, lack of overall trading volume in cryptocurrencies has been a headwind.”

Galaxy Digital’s shares are currently trading at an all-time low after tanking 55 percent in November, but founder Novogratz continues to be bullish on cryptoassets, stating recently that he expects 2019 to see a movement of institutional investors away from crypto funds and into direct crypto investment. He also predicted that 2019 will see bitcoin achieving a record high of $20,000 on institutional FOMO (fear of missing out), after ending 2018 on a high at $9,000.

Featured Image from BIG Crypto/Ethereal Summit/YouTube