Record-Breaking U.S. Economy Has A Massive Recession Deficit – Here’s Why

Is the economy really as robust as it seems while the budget deficit balloons at recession levels? | Source: AFP/ Spencer Platt

- A soaring U.S. budget deficit is proof the economy is not well, the chief global strategist of a major investment broker warned this week.

- He predicted the Great Recession in multiple cable news appearances from 2006 – 2007 when others were wildly bullish.

- Even if all is well, for now, wild deficit growth during economic expansion leaves less room for fiscal stimulus if a recession does strike.

The U.S. economy is aiming to extend a stunning record-long decade of expansion into the eleventh year. Markets see plenty of reasons to be hopeful it’s not over yet.

Unemployment remains low and GDP is still full of steam . Bright Q4 corporate earnings and trade war detente with China could push the Dow to 30,000 in a few days.

So why is the U.S. budget deficit growing at recession levels?

Peter Schiff, CEO and chief global strategist for Euro Pacific Capital, said Monday it’s proof the economy is not as strong as it seems in the Trump era.

He warned again Wednesday morning in no uncertain terms:

A sovereign debt and dollar crisis now looms larger than ever.

Here’s why markets should heed his words carefully.

Peter Schiff Predicted The 2007 Market Crash

Peter Schiff is notorious for never having anything nice to say about the economy. (Unless he’s talking about gold or foreign stocks and bonds.) So can we write off Schiff’s pronouncements as the doom-and-gloom shtick of a stalwart “permabear?”

From 2006 – 2007, when most economic commentators were forecasting more pie in the sky, Schiff predicted the market crash of 2007-08 that blindsided nearly everyone.

He sounded the recession alarm non-stop for two years on cable news channels. His interviews from this media tour are remarkable to watch in retrospect.

“Dr. Doom” and “The Armageddon Gang”

The CNBC talking heads jokingly nicknamed Peter Schiff “Dr. Doom.”

In a short feature entitled, “The Armageddon Gang,” Time Magazine called him a “hectoring presence on cable-TV business shows.” It was complete with a photo of Dr. Doom himself holding a scythe like the Grim Reaper.

On Aug 28, 2006, Schiff debated Art Laffer, a Reagan Administration economist on CNBC. Schiff said a recession was coming , would last “for years,” and the American consumer would “see his home equity evaporate.”

Now he’s predicting another recession “that’s going to be worse than ’08. ” Other deficit watchers agree the ballooning deficit is bad for the economy.

U.S. Budget Deficit Looks Like Trump and Congress Are Fighting Off A Recession

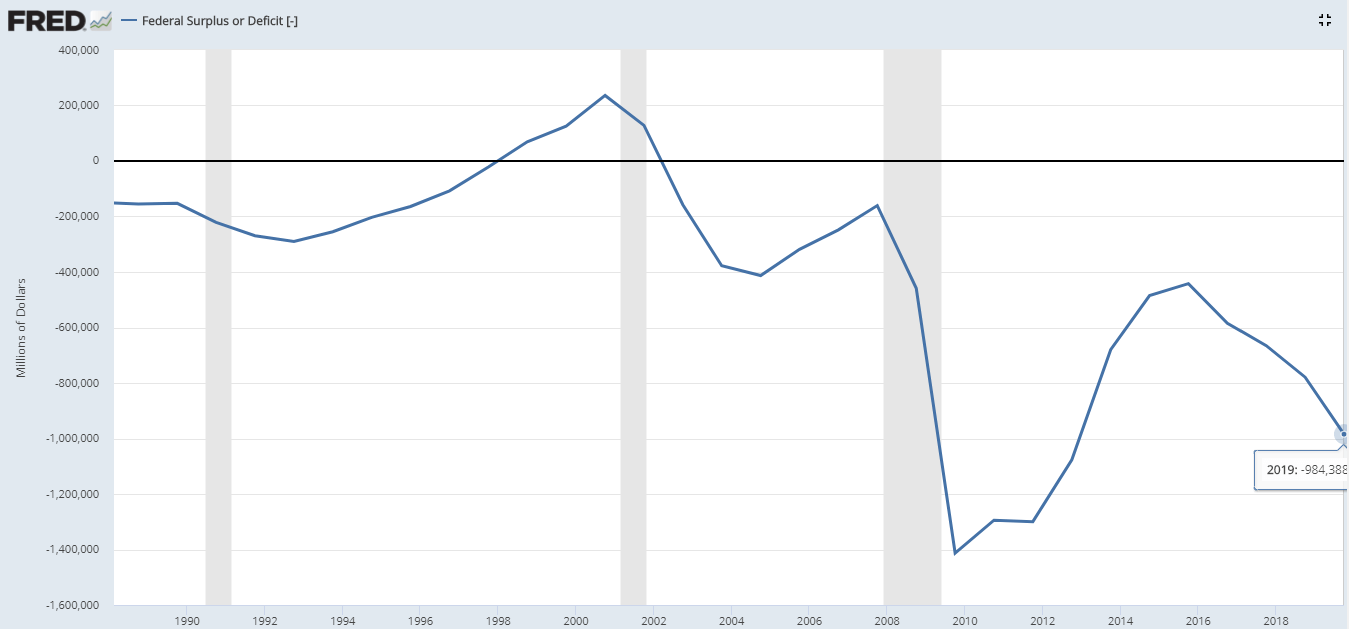

The skyrocketing federal deficit under Trump is very unusual . The government typically runs large deficits during recessions because of lower tax receipts. And Washington boosts spending during economic downturns for fiscal stimulus to spur recovery.

But when the economy is growing, deficits are supposed to shrink.

The last time the national deficit grew this quickly , we were battling our way out of the Great Recession. The time before that, Washington was simultaneously dealing with the Early 2000s Recession and fighting the Global War on Terror.

The Peter G. Peterson Foundation says the Trump deficits are dangerous :

Despite the dangers of procyclical fiscal policies during an economic expansion, deficits are expected to remain large in the future, leaving us with less room to maneuver if there is an economic downturn.

Peterson was an American investment banker and Commerce Secretary under Nixon. His foundation assesses the deficit as risky in case of recession. Peter Schiff’s assessment is more bearish. He thinks the deficit is proof that a recession is already underway.

Disclaimer: The opinions in this article do not represent investment or trading advice from CCN.com.