Recession No More? Bond-Market Selloff Pushes Treasury Yields to Six-Week High

U.S. bond markets extended their slide on Friday, as investors continued to reevaluate the recession risk. | Image: AFP PHOTO / Stan HONDA

U.S. government debt yields continued to rise on Friday, booking their biggest weekly gain in three years on better than expected data, China trade progress and looser monetary policy.

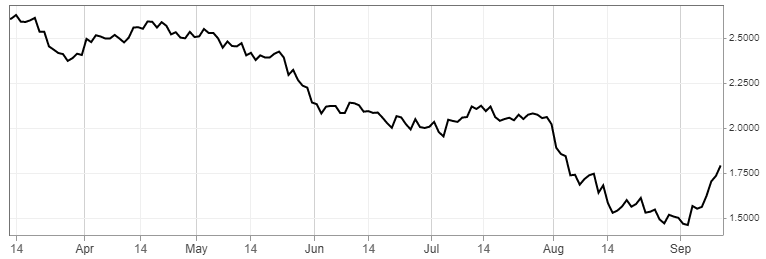

Treasury Yields Extend Rally

Government bond yields were higher across the board, extending a rally that began at the start of September. The benchmark 10-year Treasury note peaked at 1.91%, the highest since late July, according to CNBC data .

The 10-year yield has gained over 40 basis points since the month began.

The 2-year Treasury note jumped around 8 basis points on Friday to 1.81%. The yield on the 30-year bond added 11 basis points to 2.38%.

Investors Reassess Economic Outlook

Investors piled up government debt last month over concerns that the U.S. and global economies were heading toward recession. The latest thawing in U.S.-China trade tensions, combined with better than expected economic reports and looser monetary policy from the European Central Bank (ECB), have abated those fears for now.

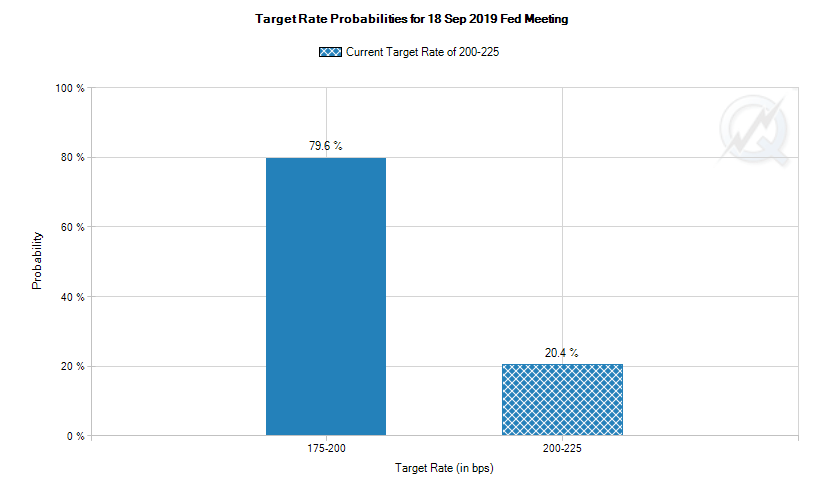

Like the ECB, the Federal Reserve is widely expected to cut interest rates next week. Fed Fund futures prices courtesy of CME Group imply a nearly 80% chance of a rate cut following the Sept. 17-18 Federal Open Market Committee (FOMC) meeting.

The September rate announcement will be accompanied by a revised summary of economic projections covering GDP, unemployment and inflation. Central bankers are notoriously bad at forecasting the future, with no Fed administration ever predicting recession .

The consumption component of the U.S. economy remained firm in August, according to the latest retail sales report. The Commerce Department reported Friday that retail sales rose 0.4% in August following an upwardly revised gain of 0.8% the month before.

Separately, the University of Michigan’s consumer sentiment index improved to 92.0 in September from 89.8 the month before.