What Peter Schiff Gets Half-Right About Bitcoin

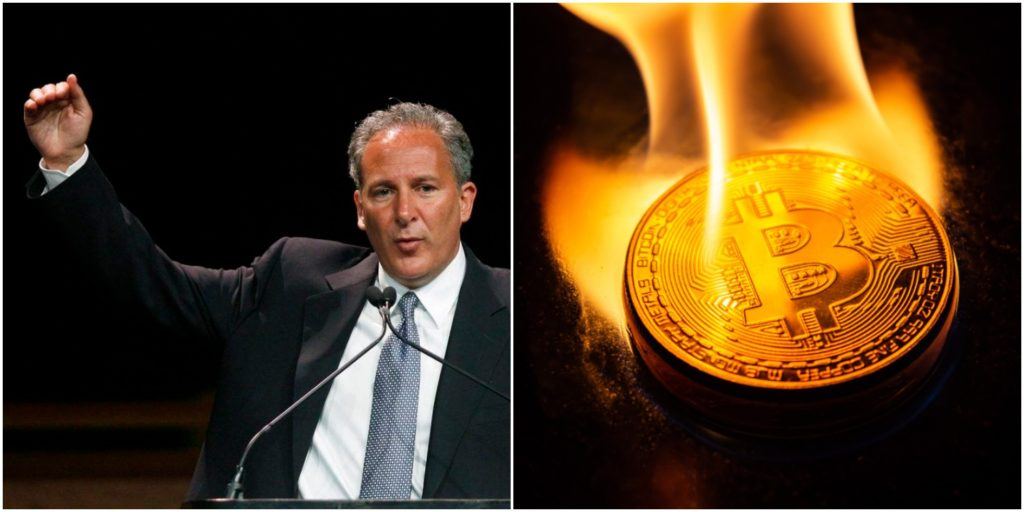

Bitcoin bear and gold bug Peter Schiff tweeted that bitcoin is more dangerous than fiat can ever be, and he's right. Well, half-right, anyway. | Source: Lucas Jackson / Reuters (i), Shutterstock (ii). Image Edited by CCN.com.

Bitcoin hater and gold bug Peter Schiff took to Twitter on Thursday with an interesting piece of history that he believes proves that bitcoin is even worse than fiat currency.

He said:

“At one time all fiat currencies were backed by gold. They only became fiat after the gold backing was removed. But it was the original gold backing that gave currencies their value. Bitcoin has never been backed by gold, so confidence in its future value will be lost much faster!”

The Gold Standard Was Standard for a Reason

Schiff correctly points out that certain currencies were originally supported by gold.

In order to establish and maintain the people’s trust in pieces of paper issued by the central bank, the federal government held vast stores of gold that could be redeemed with currency.

As other countries around the world adopted the gold standard, carrying around hefty gold coins was no longer necessary. More importantly, it established a system of trust in global trade.

As long as everyone was on the same page, paper currency could be exchanged for gold in many countries, commerce would become easier, and benefit everyone.

Where Peter Schiff has a valid point is that the US government didn’t just create the currency known as the dollar out of thin air. There was an intermediary asset which was used to gain the trust of everyone involved and establish confidence in the entire system.

That is not the case with bitcoin and cryptocurrency.

Trust Inspires Confidence

This raises the question as to whether Peter Schiff’s thesis has any merit or relevance in regards to bitcoin. On its own, it’s a pretty thin strand on which to hang a bearish bitcoin argument.

Yet, Schiff’s real point is that any item that holds value comes as the result of decades or even thousands of years in which that asset has had the confidence of everyone in the world.

Why was the US dollar originally pegged to gold in the first place? Because gold had thousands of years of confidence behind it, in that it was a valuable and useful asset that also happened to be precious.

While the gold standard has now officially been out of use for almost 50 years, it has effectively been tossed aside for almost 100 years. During World War I, most countries suspended the gold standard so that they could print enough money to finance the war.

Fiat Currency Rarely Fails

In the interim, fiat currency is no longer backed by anything but – and here’s the central point – confidence in the entire system.

That confidence can disappear, but it only fails in extreme circumstances, and most often in socialist or communist countries.

It is possible, but extremely unlikely to the point of absurdity, that the US dollar will become completely valueless. Bitcoin certainly won’t replace it.

Ed Butowsky of Chapwood Capital Investment Management tells CCN.com:

“[Bitcoin] is literally backed by nothing and never has been. The only confidence it has is generated by relatively small number of people who use it in transactions. Yet that number of people remains so comparatively small that bitcoin remains subject to extreme volatility. Volatility is equivalent to risk. Risk does not inspire confidence.”

That is precisely why Schiff has it half-right.

Bitcoin won’t replace the dollar. But gold won’t either.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.