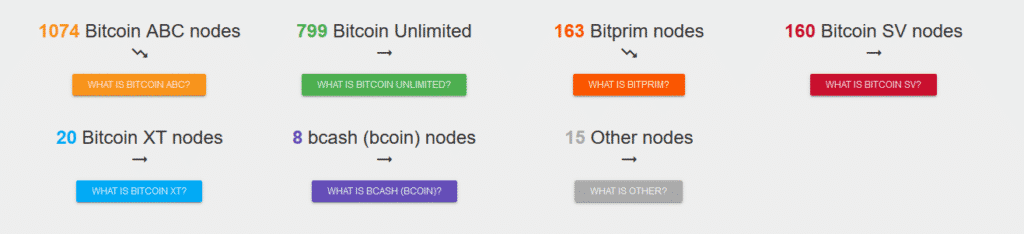

Bitcoin ABC Has 600% More Nodes than Bitcoin SV

Editor’s note: The article’s headline has been amended to clarity.

According to Coin.Dance , a reputable Bitcoin network data provider, there are about 600% more Bitcoin Cash ABC nodes than Bitcoin SV (“Satoshi Vision”) nodes. Bitcoin Cash ABC enjoys the support of three major exchanges: Bitpay, Binance, and Coinbase, while Bitcion Cash SV has the backing and blessing of the largest Bitcoin Cash mining pool, Coingeek.

The keyword in the last sentence there is “pool.” Individual miners are free to mine whatever their hardware will allow them to, and membership in a given pool is voluntary and sometimes fleeting. At time of writing, BCHABC was trading noticeably higher on the only reputable exchange listing it along with BCHSV and BCH, Poloniex.

An “ABC Coin” was worth $414 while an “SV Coin” was worth $113. Having one of each would be about $2 less than simply having a Bitcoin Cash coin, at this point, but this can be attributed to the fact that actual trading still hasn’t really opened up – trades at this point can be called cautious at best.

Node Count Isn’t Everything

It is relatively cheap to launch a Bitcoin node. While it would be theoretically more expensive to run a Bitcoin Cash node of any sort long-term, due to allegedly larger hard drive requirements, the overwhelming majority of blocks in the Bitcoin Cash chain have been far less than their limit of 32MB.

It should be noted here that the Bitcoin Cash SV fork will immediately increase blocksize ot 128MB. In any case, a single user with an account somewhere like Digital Ocean or Linnode could conceivably launch dozens of nodes for a few hundred dollars. This is to say that node count isn’t everything – in proof-of-work economies, hash is what counts, and we will not know where the hash is actually pointing until the hard fork actually takes place.

Importantly, Coingeek and SVPool were collectively mining most of the blocks at time of writing.

Hash isn’t everything, either. All the hash in the world could point at a token that wasn’t widely accepted by exchanges or merchants, and it would essentially be wasted hash. This is to say that the market situation for Bitcoin SV is very relevant to the mining situation. If Bitcoin Cash miners mining through CoinGecko find themselves mining coins that are effectively worth 1/3rd or less the value of Bitcoin ABC tokens, well, they can only do that for so long before it stops making sense, barring the overarching market value of all BCH skyrocketing by 100s of percent.

The Mining Hardware Factor

One factor that is occasionally overlooked with SHA256 Bitcoin forks is the fact that a massive amount of old Bitcoin mining hardware exists in the world, hardware that is essentially unprofitable on the modern Bitcoin chain, which has an astronomical hashrate of many petahashes. To compete on this network, especially when new hardware is released, miners must offload their old hardware. This presents an opportunity for chains with lower hashrates, like the upcoming forked chains and Bitcoin Cash in general.

One thing we didn’t note previously in this article is that Bitcoin Unlimited, which allows for the rules of both forks to go through it and also overwhelmingly supports the status quo of Bitcoin Cash, has almost 800 nodes running.

All of which is to say it is entirely conceivable that Bitcoin Cash could be running as many as three chains in after November 15th.

Featured image from Shutterstock.