Nouriel Roubini Out of Hiding Provokes BitMEX CEO Arthur Hayes

NYU economics professor Nouriel Roubini has ended a months-long silent streak after BitMEX's bitcoin derivatives volume reached $1 billion in open interest. | Source: (i) Shutterstock (ii) Distributed/YouTube; Edited by CCN.com

New York University economist and bitcoin-hater Nouriel Roubini has come out of hiding to take a swipe at crypto exchanges. It’s been a while since the notorious bitcoin basher has taken to Twitter to flame bitcoin. Something about a tweet by the BitMEX exchange raised Roubini’s ire. When BitMEX announced its bitcoin derivatives volume had reached $1 billion in open interest, the professor unleashed one of his characteristically scathing polemics:

There have been many legitimate criticisms of purported volumes on exchanges. Roubini is not, however, giving the devil his due. As Joseph Young reported on Forbes Wednesday:

“The ‘Real 10’ volume of bitcoin, which refers to the verifiable daily volume of bitcoin coming from exchanges regarded by Bitwise Asset Management for having a legitimate daily volume of over $1 million, is also nearing $5 billion for the first time in 2019. At its low point in March, the Real 10 volume of bitcoin hovered at around $500 million.”

BitMEX Strikes Back

But BitMEX didn’t take the social media flaming lying down.

The crypto margin-trading exchange’s CEO, Arthur Hayes, hit back hard. He tweeted back a flex about his company’s profits and a taunt about an upcoming debate in Taipei.

Hayes vs. Roubini Bitcoin Debate

The debate between Hayes vs. Roubini will be held next month on July 3 – a day before America’s Independence Day. It will be hosted by the 2019 Asia Blockchain Summit .

Event organizers are pumping the face-off as though it’s the biggest cryptocurrency debate in the history of the fledgling industry, calling it a “cryptocurrency duel.”

In a now-deleted tweet , Hayes reportedly taunted:

“I’m going to wipe the floor with that chump.”

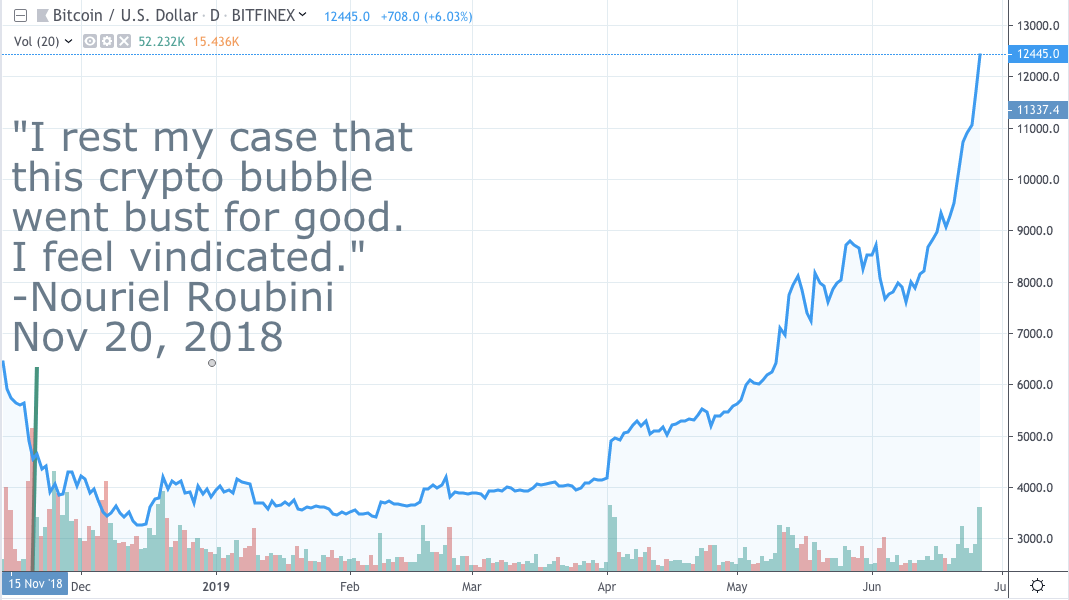

Nouriel Roubini has been very quiet since pronouncing bitcoin dead in a tweet last November, saying at the time:

“With BTC down almost 80% from peak (from 20K to ~4K) and all other cryptocurrencies down 80% to 99% I rest my case that this crypto bubble went bust for good. I feel vindicated. So I will take a break for a few days from this toxic Crypto Twitter.”

He ended up taking a break for a few months as the crypto winter thawed out.

Bitcoin a “Right-Wing Nightmare”

Then as the bitcoin price began its parabolic ascent in mid-June, the perma-bear aroused and went on a tirade against the cryptocurrency as a “right-wing nightmare” that facilitates tax evasion, money laundering, and environmental degradation.

All of Nouriel Roubini’s hysterically written charges against cryptocurrencies like bitcoin are as true or even more true of institutional finance. This is a common thread that runs through criticisms of bitcoin. It’s as if the traditional banking system’s white knights aren’t earnestly policing financial corruption so much as they are defending their gang’s turf.

Traditional banking engages in tax evasion.

In 2018, top EU banks were found guilty of €55.2 billion in tax fraud. That was the same month JPMorgan got slapped with a $5.3 billion U.S. Treasury fine for money laundering. And institutional finance uses 3 times the amount of electricity that bitcoin uses.

As for Roubini’s Wednesday morning tweet at BitMEX – traditional banking invented fake coins with paper notes backed by nothing instead of gold reserves.

And don’t talk to the crypto industry about fake transactions unless you’ve also called out Wells Fargo on their massive, company-wide account fraud scandal that has cost investors $2.7 billion in fines and damages. (The only mention Roubini has ever made of Wells on Twitter is a tweet from April about Wells’ CEO saying blockchain “is oversold.”)

Regarding “manipulation, pump-n-dump, front-running, wash trading” – these financial shenanigans were all invented by Wall Street. Take the telephone pole out of your own eye before you call out the mote of dust in the crypto industry’s eye.