Market Bloodbath – Recession Impending or Regularly Scheduled Programming?

Everything, almost literally everything, is down this year just in time for Christmas. The DOW, NASDAQ, S&P 500, and the majority of the crypto markets are all bleeding out day after day, with Bitcoin seeming to be walking down the stairs back to $3,000 and some analysts predicting sub-$2000 levels in the near future.

In technology news, the Huawei Chief Financial Officer Meng Wanzhou was arrested in Canada this week on US charges of possibly violating sanctions on Iran. Huawei stock can’t be found on any market, though – apparently they’re opposed to the idea of publicly issuing shares and are known for a high degree of secrecy, making them one of the largest private firms in history, whose equity is owned by its Chinese employees alone. Employees outside of China are not allowed to own any stake in it.

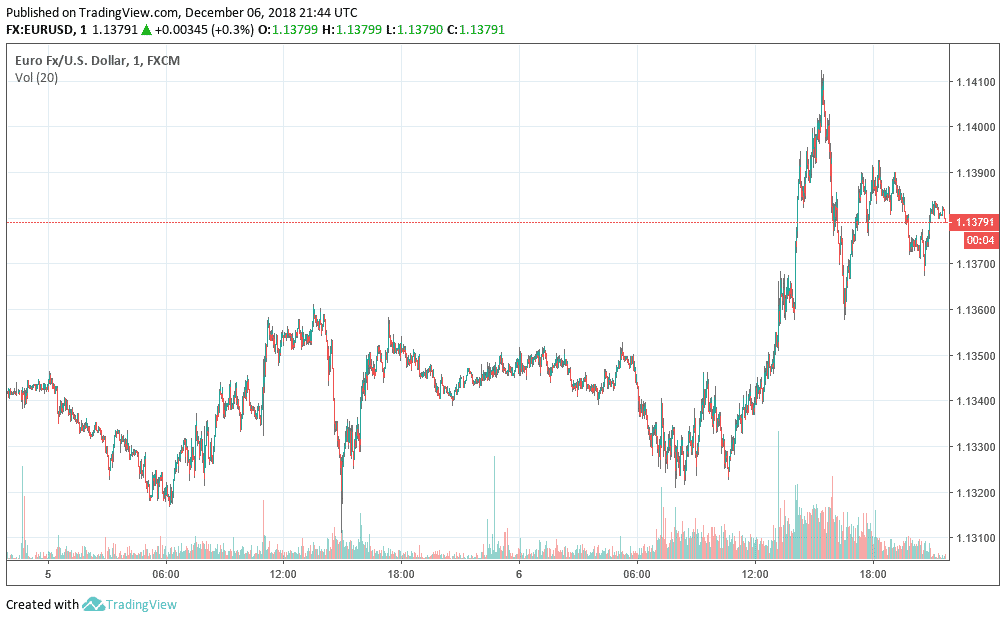

It’s difficult to say what exactly is driving the economic downturn we’re witnessing. We’d love to make guesses, but we’re not here to speculate. The news of the day is bad news, bad news, bad news. If you’re holding anything it’s probably losing value, except the euro, which appears to be experiencing a slight increase against the dollar, as seen here:

The NASDAQ seems to be shedding points like nobody’s business, although a few companies including Stamps.com and MongoDB saw some upward momentum.

But most of the top 100 on NASDAQ saw some form of loss over the past five days.

Over in Dow Jones territory, a 1000 point loss had been experienced over the past three days at time of writing. It’s notable that a mild resurgence occurred over the morning, but that accounts for the previous statement. Previous to that the market had shed as much as 1700 points overall in the same period.

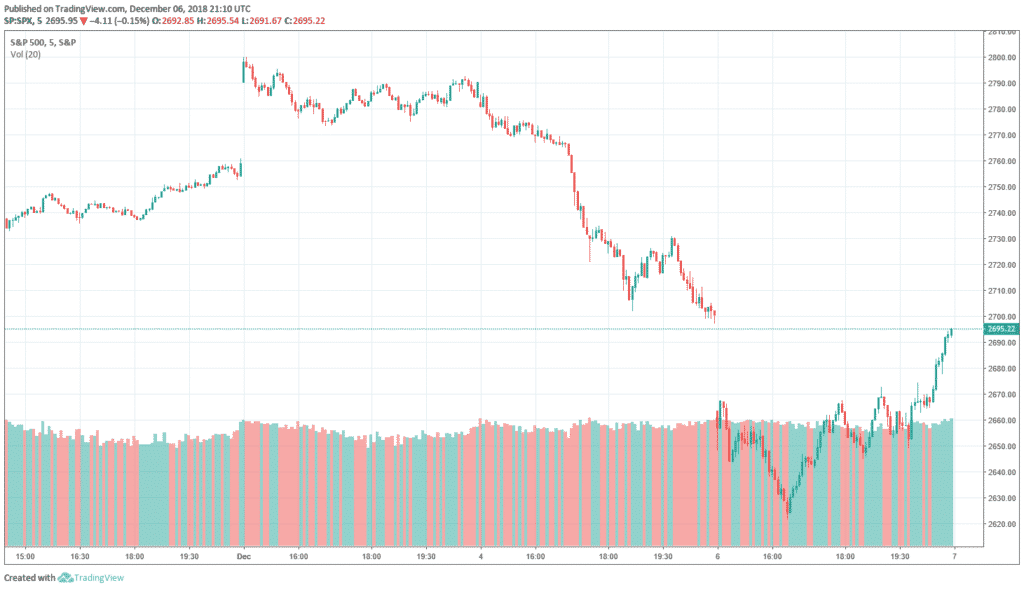

The S&P 500 hasn’t fared much better than the others, seeing a 5-day high of just 2760 and a pullback earlier today and yesterday afternoon to around 2600.

Oil futures aren’t looking bright either. There is some economic theory around the idea that high oil prices combined with Federal Reserve rate hikes will lead to a recession, but theories don’t provide much relief to traders in the trenches, who are currently holding the bag on barrels speculated on at much higher prices just a few months back when the price peaked at over $76.

In the past five days it’s been peaks and valleys, peaks and valleys, and then deeper valleys, currently sitting at just over $51 and momentum seeming to trend toward pushing it lower.

CCN.com has often tried to draw a correlation between market activity and crypto prices, but it seems that there’s still too much disconnect between old finance and smart finance for them to be too closely intertwined. Frequently, stocks can go down while cryptos go up, with plenty of traders viewing cryptos as a safe haven in a storm.

However, this week there’s been no shelter, no quarter given to bulls anywhere they run, as demonstrated by the 7-day chart on the crypto market. As we reported elsewhere, BSV seems to be making a comeback, but overall the Bitcoin Cash market is suffering losses just like the rest of crypto. Where all the money is going would be a good question, but a steady growth of stablecoin markets seems to be playing a minor role.

Although there is growing sentiment that the West is in a state of rapid decline and at risk of collapse, the author errs on the side of this being regular market activity. No booms without an occasional bust, and sunshine doesn’t feel so good without occasional rain.

Featured Image from Shutterstock. Charts from TradingView.