Boston University Economist Mark T. Williams’ Bitcoin Price Prediction Will Be Proven Ridiculously Wrong

As Bitcoin has entered mainstream economic discussions, several notable economists have endorsed it. However, others, such as Yale University Robert Schiller, have attacked it viciously. Thus far, the Bitcoin naysayers have all been proven wrong, and the list containing their names continues to grow at a rapid pace. Nevertheless, this does not deter those negative about Bitcoin’s price from continuing publicly to declare Bitcoin’s insolvency. Today, Bitcoin backers get to gloat once more as yet another negative prediction about Bitcoin’s price starts to tumble. With exactly one month to go the Bitcoin price is rising, not falling to single-digit numbers.

Boston University Economist Mark T. Williams’ Infamous Bitcoin Price Prediction

[dropcap size=small]I[/dropcap]n December 2013, Bitcoin was taking the world–and the news media–by storm, and economists worked their way into the story by making bold and often ill-informed Bitcoin price predictions.

One of these ill-conceived Bitcoin price predictions came from Boston University finance Professor Mark T. Williams, who vociferously declared that Bitcoin’s price would careen downwards throughout 2014 until it reached a mean price of $10 in “by the first half of 2014.” He argued that Bitcoin is not a viable medium of exchange because it is:

“steep in Libertarian and anti-Fed dogma but weak in the understanding of how global economics, central banking policies, and financial markets function.”

He continued:

“To assume currency can be computer-generated, run in a decentralized manner and outside of the central banking system and controls is farcical and economically dangerous.”

The mainstream media had a heyday with the prominent economist’s gloomy Bitcoin prediction, and he smugly reiterated his prediction as the price fell during the early part of 2014. In January, Williams composed a Business Insider article where he again argued that Bitcoin’s price would plummet to $10 by June. This article generated more than 140,000 views, in addition to the hundreds of thousands of people who learned about Williams’ prediction from other news sources, whether in print or on television.

Williams’ Bitcoin Price Prediction Proven Ridiculously Wrong

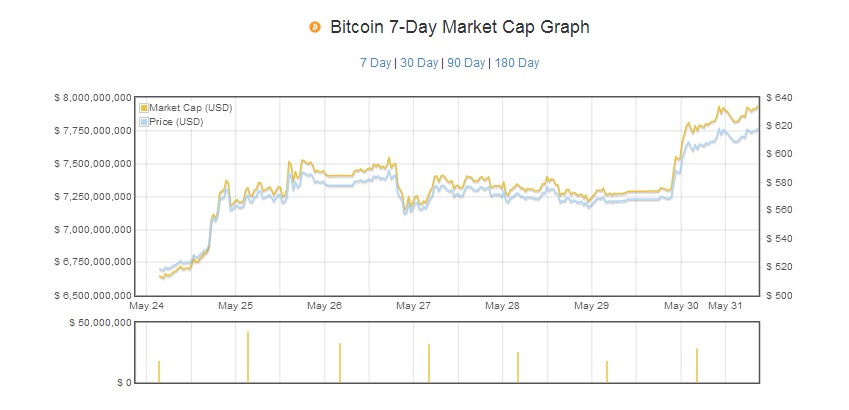

Despite Williams’ best efforts at pontificating about Bitcoin’s imminent demise, Bitcoin’s price has proven resilient, even amid the rocky waters of the Mt. Gox debacle and regulatory uncertainty. A quick look at the latest info from CoinMarketCap reveals that Bitcoin’s price sits at $630, or 6,300% higher than what Williams had predicted. In fact, in the several days prior to what should have been Bitcoin Armageddon, the price rose about $40. Williams’ Bitcoin price prediction was so far off the mark that his statements proved not only wrong but laughably ridiculous.

Williams Doubles Down With Further Useless Bitcoin Price Prediction

Professor Williams has not learned much from his mistake. In a recent interview with CoinDesk , Williams doubled down on his Bitcoin price prediction, stating that time would vindicate him because “bitcoin is grossly overpriced and the price will eventually adjust dramatically downward as the priced-for-perfection expectations set by bitcoin promoters cannot be met.” However, it does appear that Mark T. Williams learned something this time around because he was wise enough to not give his revised Bitcoin price prediction a specific timetable to be proven wrong.

One must wonder how such a noted intellectual could be so off-the-mark about Bitcoin. However, as CCN.com demonstrated, Williams possesses a flawed understanding of how Bitcoin and its network function. As a respected professor, Williams should recognize that when you discuss what you do not understand, you inevitably end up looking like a fool. However, he did not, and his folly should hopefully warn other economists to closely analyze Bitcoin before making bold claims about its future. If not, that’s okay too, because /r/Bitcoin can always use some more comedic fodder.