‘Level 1’ Stock Market Shut Down Barely Scratches 1987’s Black Monday

Trading stopped for a full 15-minute period on Monday morning but it hardly compares to the full meltdown of 'Black Monday' in 1987. | Source: AP Photo/Michael Probst

- The initial circuit breaker threshold was breached after stocks fell drastically.

- The system is designed to pause trading in times of extreme stock market volatility.

- Comparatively, there have been worse days in the U.S. equity markets.

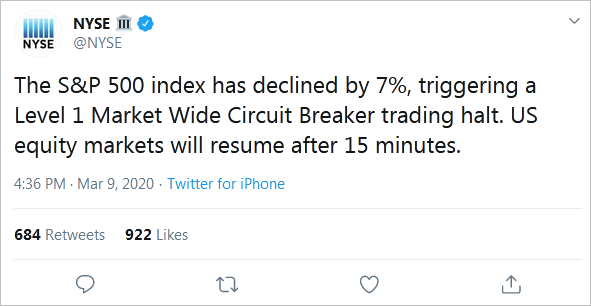

After the S&P 500 nosedived by over 7% Monday, the initial market-wide circuit breaker threshold was breached leading to a temporary halt in trading . Market activity was suspended for 15 minutes in the U.S. equity markets in line with the rules.

Market volatility thresholds

Per the rules, circuit breakers are triggered after a drastic drop in the S&P 500 index. A decline of 7% from the prior trading sessions’ close activates the Level 1 circuit breaker threshold. This pauses trading for 15 minutes.

If the index falls by 13% from the prior trading session’s close after the resumption of trading, trading is paused for another 15 minutes. The decline must occur before 3:25 p.m. ET for the second circuit breaker threshold to be triggered though.

A fall of 20% from the prior trading session’s close in the S&P 500 triggers the Level 3 circuit breaker.

History of the market-wide circuit breakers

Despite the existence of market-wide circuit breakers for decades, the system failed to prevent the May 10th, 2010 flash crash when the Dow declined by over 1,000 points. At the time it was the biggest drop in the Dow’s history.

This failure resulted in the Limit Up/Limit Down (LULD) Plan which was approved on May 31st, 2012 by the Securities and Exchange Commission. The plan was made permanent last year on April 11th.

The events of today pale in comparison to the Black Monday market crash of three decades ago. So far the stock market circuit breaker has only been triggered once. On October 19th, 1987 all three levels were activated after the S&P 500 fell by 20% . The Dow, on the other hand, fell by 22.6% on the same day. The day is popularly referred to as the Black Monday crash.

What caused the Black Monday stock market crash?

The market crash was blamed on among others falling crude oil prices, geopolitical tensions and an ailing U.S. economy. Computerized trading, which was still at its infancy, is also thought to have contributed to the market crash.

Currently, the S&P 500 index is down less than 6% from Friday’s close. While the decline is significant, if the drop does not escalate further, it will not only pale in comparison to the Black Monday crash but the 20 worst days in the index’s history.

The next five worst drops in the index’s history, with declines ranging between 9.1% and 12.9%, were all recorded pre-1940. In recent memory, the worst stock market crashes were recorded in 2008 at the height of the global financial crisis.