Investors Flee Stocks as S&P 500, Dow Smash Records

The Dow Jones and S&P 500 are smashing records, but ordinary investors are fleeing the stock market at an alarming pace not seen since 2014. | Source: REUTERS/Brendan McDermid

The Dow Jones Industrial Average and S&P 500 each set new records this week, barreling past 27,000 and 3,000, respectively, for the first time in the stock market’s history.

But as rate-cut fever rampages across Wall Street, the market’s historic rally is increasingly proceeding without one key demographic: investors.

Investors Pulled $25 Billion Out of Stocks Last Week

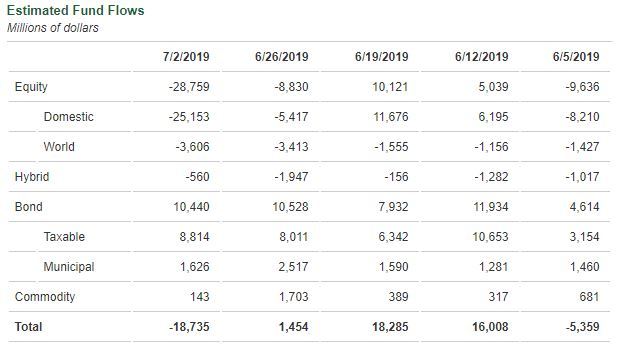

According to data published by the Investment Company Institute, US stock funds experienced a staggering $25.2 billion in net outflows during the week ended July 2.

That’s right: As stocks raced toward all-time highs, investors were actually taking money out of equities. A lot of money.

Investors haven’t yanked that much cash out of domestic stock market funds in a single week since February 2014.

“It’s surprising to see outflows accelerate because we had a very strong U.S. equities market in the first half of the year and investors have historically put money to work when markets have rallied,” said Todd Rosenbluth, director of ETF and mutual fund research at New York-based research firm CFRA, in remarks cited by Reuters .

Nor is it an isolated occurrence.

Dow, S&P 500 Race Higher Despite Sustained Fund Outflows

US stock funds have experienced net outflows in three of the past five weeks, leaving a cumulative $21 billion flowing out of the domestic equities market.

Altogether, long-term mutual funds and exchange-traded funds (ETFs) have experienced around $32 billion in net outflows for the five-week period chronicled in the ICI report.

Bonds, meanwhile, recorded net inflows in each of the past five weeks for a cumulative gain of more than $45 billion.

And no, investors aren’t rotating this capital into world stock funds, which have experienced net cash outflows in each of the past five weeks.

So if investors have already taken their ball and gone home, who’s left in the game to keep driving stock prices higher?

The working theory is that it’s cash-flush companies themselves, buying back their own shares with the windfall from last year’s corporate tax cuts.

Stock Buybacks Mask Investor Exodus

Loathed by politicians such as Bernie Sanders as naked “greed ,” defenders say that stock buybacks are just “tax-efficient dividends” that return cash to shareholders.

Critics note that they also reduce a company’s supply of outstanding shares, propping up their earnings-per-share (EPS) ratio.

Regardless, analysts have been monitoring this trend for months.

Here’s a New York Times headline from February:

In May, Hacked reported that the S&P 500 would have closed the first quarter 19% lower without the near-endless supply of stock buybacks.

The percentage is likely much higher now, and it’s only going to grow larger. The New York Times cites a Goldman Sachs estimate indicating that corporations will likely spend $700 billion on stock buybacks this year while traditional investors divest themselves of $400 billion worth of shares.

Buybacks are clearly a boon to current shareholders – call them a reward for hanging on during last year’s brutal market downturn. Still, you have to wonder whether the market’s rapid recovery has spooked would-be investors who are sitting on the sidelines.

And maybe that’s their fault for ignoring historical trends and common sense advice .

But as Wall Street continues to enjoy a non-stop party, it’s more than a bit disconcerting that so many investors believe they’ve been left off the guest list.