How Every Fed Member Voted on Today’s Interest Rate Cut

The Federal Reserve voted to reduce interest rates at today's policy meeting. Here's how every FOMC member voted - and what it means. | Source: REUTERS / Leah Millis

As expected, the Federal Reserve voted to reduce its interest rate target to 1.75% to 2.00% at its September policy meeting.

The US central bank has now cut interest rates at two consecutive FOMC meetings, after not cutting rates for more than ten years amid the US economy’s longest-ever expansion.

How Each Fed Member Voted at Today’s FOMC Meeting

The Fed’s interest rate decision was not surprising. However, the decision was far from unanimous. In fact, three voters dissented from the 25 basis point cut.

Here’s how every Fed member voted at today’s FOMC meeting:

Fed Members Who Voted for 25 Basis Point Interest Rate Cut

There were seven votes in favor of the 25 basis point cut.

- Jerome Powell, Federal Reserve Chair

- John Williams, New York Federal Reserve President

- Michelle Bowman, Federal Reserve Board of Governors

- Lael Brainard, Federal Reserve Board of Governors

- Richard Clarida, Federal Reserve Board of Governors

- Charles Evans, Chicago Federal Reserve President

- Randal Quarles, Federal Reserve Board of Governors

Fed Members Who Voted to Maintain the 2.00% to 2.25% Target Range

Two FOMC members voted to maintain the bank’s previous target.

- Esther George, Kansas City Federal Reserve President

- Eric Rosengren, Boston Federal Reserve President

Fed Member Who Voted for a 50 Basis Point Interest Rate Cut

One FOMC member advocated for a 50 basis point reduction.

- James Bullard, St. Louis Federal Reserve President

Today’s vote shows that the FOMC remains deeply divided on the state of the US economy, which continues to serve up conflicting data as geopolitical risks mount – and the stock market trades near all-time highs.

The Dow Jones Industrial Average slid more than 175 points after the Fed published its decision, indicating that investors were disappointed that the bank did not preview a more deliberate easing policy.

One More Rate Cut – But Maybe Not in 2019

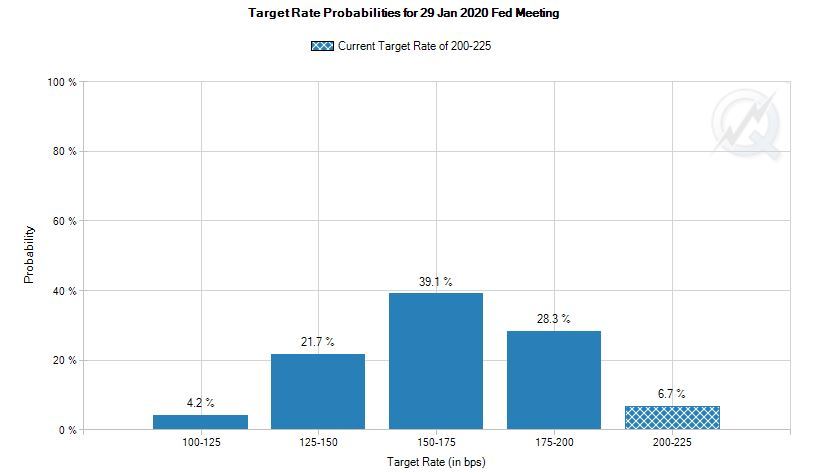

Right now, Fed funds futures indicate that traders do not expect a third straight interest rate cut at the next FOMC meeting at the end of October.

According to CME’s FedWatch Tool, there’s a 32% probability that the Fed will reduce its target range to 1.5% to 1.75%. However, that doesn’t mean Wall Street believes the central bank is done cutting rates.

There are roughly even odds for an interest rate cut in December, and the probability ticks up to 65% for the January 2020 FOMC meeting.