A Housing Crisis Is Brewing Because 4.3 Million People Can’t Pay Their Mortgages

The pandemic-fueled recession is putting a damper on the U.S. housing market. The latest data prove it. | Image: AP Photo/Paul Sakuma, File

- Over 4 million individuals have not been able to pay their mortgage payments for 30 days or more.

- The housing market may see additional selling pressure as pressure on homeowners mount.

- Renters have also been unable to afford payments, putting additional risks on leasers.

A staggering 4.3 million people have been unable to make their mortgage payments, according to research firm Black Knight. This puts additional selling pressure on the U.S. housing market, on top of a potential drop in foreign buyers.

Data show that over 8% of all U.S. mortgage payments are overdue or now in foreclosure. The number of mortgage holders that are 30 days late increased by 723,000 in the past month.

This is What the Fed Is Scared About

On June 10, the Federal Reserve predicted that 15 million Americans would remain jobless until year’s end. Just ten days after the initial prediction, Boston Fed President Eric Rosengren emphasized that higher unemployment will be hard to avoid.

Rosengren stated the following :

This lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment.

A surge in jobless claims is the main reason behind the rise of late mortgage payments and foreclosures.

Many individuals rely on a stable income source to pay off their mortgages. Due to the pandemic, millions are now struggling to make their mortgage payments. A rise in foreclosures may put additional selling pressure on the housing market.

Renters are affected too; their inability to pay rent could also spill over into the housing market by forcing leasers to unload their property. As the pandemic shows signs of resurgence, the pressure on both renters and leasers will likely increase.

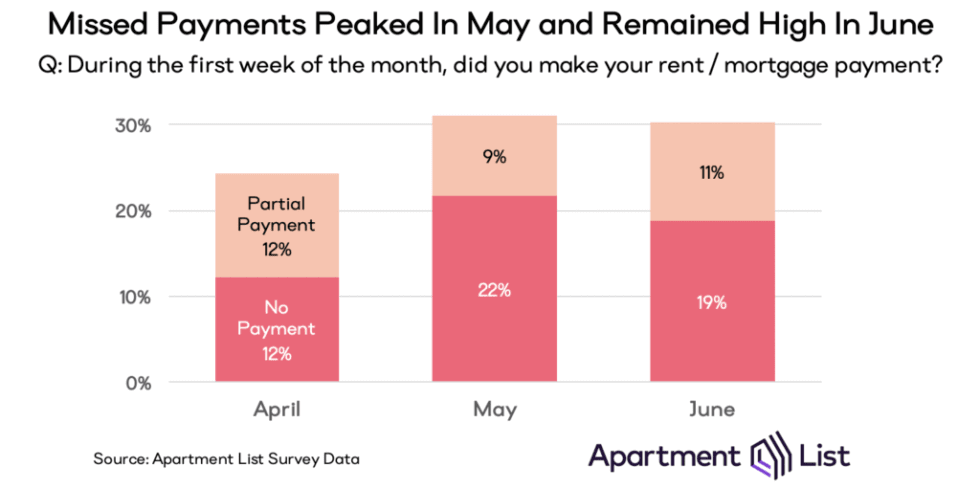

According to the apartment rental company Apartment List, 30% of the American population missed housing payments in June :

In June, 30 percent of Americans missed their housing payments, down slightly from 31 percent in May but still up from 24 percent in April. Missed payments continue to concentrate among renters, younger and poorer Americans, and those who cannot work remotely.

Housing Market at Risk as Homeowners Worry About Losing Property

Data show that foreclosure protections are beginning to expire at a time when the housing market is starting to slump. This means more houses could enter the market very soon, which would boost sell-side volume in the U.S. housing market.

The Apartment List research team said:

Some eviction and foreclosure protections are beginning to expire, creating concern that many Americans will soon lose their housing as a result of missed payments. 37 percent of renters (and 26 percent of homeowners) are at least somewhat concerned that in the next six months they will face an eviction or foreclosure.

The sentiment around the housing market remains cautiously pessimistic. Survey results show homeowners worry about the future of their mortgages in a highly uncertain economy. Their outlook is unlikely to change anytime soon.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.