Forget Jobs Data: Far Greater Pressures Threaten the Dow Recovery

And just like that, the bears seem to have regained their stranglehold on the Dow and broader US stock market. | Source: Shutterstock

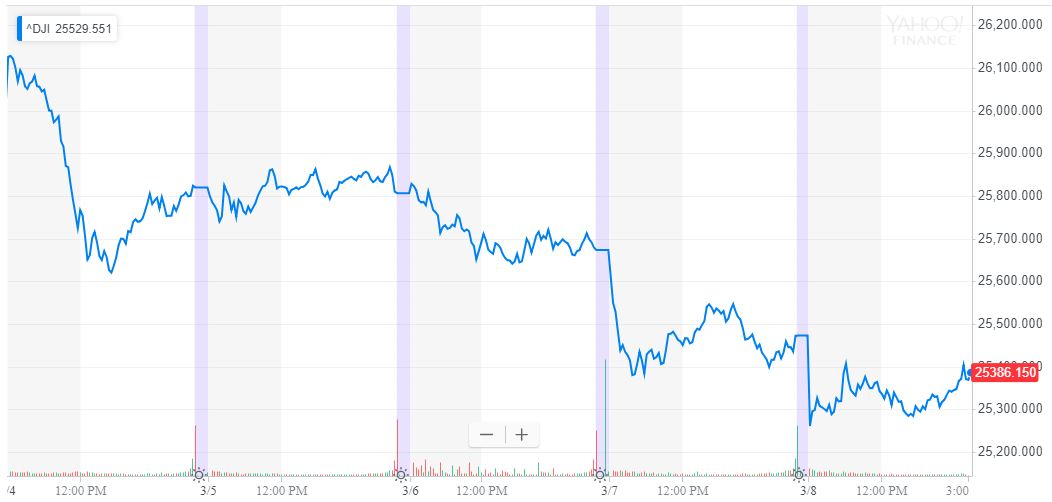

The US jobs data is in, and boy oh boy, what a disaster in Non-Farm Payrolls . The most closely watched metric in today’s report came in at 20,000 jobs created. (I know what you’re thinking, and no, there isn’t a zero missing.) The job creation statistic is the worst reading in over a year and down a staggering 291,000 jobs from last month’s revised figure. Naturally, this prompted a sell-off in stocks that were already under pressure, with the S&P 500, Nasdaq, and Dow Jones posting sharp losses.

Dismal Jobs Data Batters US Stock Market

The report was definitely not all bad, as the unemployment rate improved to 3.8% from 4.0% (projected 3.9%). There was also a bounce in wages, with average hourly earnings up to 0.4% last month from 0.1% (anticipated 0.3%).

Housing starts even beat estimates. Be careful about getting too excited about the employment rate, however, as it may have been due mostly to a technical difference in the wage force this month.

Donald Trump dove into the numbers and came up with this gem:

Macro Perspective Darkens Despite Analyst Optimism

The markets had additional reasons to show restraint in their reaction to the horrific payrolls figure. Firstly, there was a lot of severe weather in the US last month, with snowstorms on the east coast. Snowstorms and excessively cold weather usually dampen economic activity. Secondly, we have been approaching full-employment for some time, and there was only ever going to be so many more jobs the economy could support.

Speaking to Reuters, BMO US rate strategist Jonathan Hill embodied this perspective:

“Treasury yield moves speak to (the market’s) willingness to look through this. We’ve seen similarly low levels before. May 2016 was 15,000. September 2017 was 18,000. So if it’s a one-off month of weak job growth and we return to that 200,000 level, there will be a willingness to look through this read.”

Trump adviser Larry Kudlow, for his part, said that the jobs numbers were “fluky.”

Unfortunately, a more macro perspective makes these points of view look like excuses in the face of gathering bearish momentum around the globe.

Dow Can’t Outrun China’s Dismal Economic Data

The US is the world’s largest economy, and the global financial system is interlinked. A significant slowdown in China would have a pronounced impact on US productivity.

Well, it appears that is precisely what we are getting, as the most recent data from China showed both exports and imports collapsing — suggesting that the trade war has been begun to bite. Many US companies rely on foreign investment, and China is also very influential on home prices . Add to this bearish mix that Europe is pushing back a rate hike and slashing growth prospects and we have a problem.

Even if the US economy continues to outperform its global peers, it cannot burn red-hot indefinitely while the rest of the world enters a recession.

“Transitory weakness” is what the Federal Reserve is probably going to allege , but it’s not quite that simple.

Glass half-full: this is just a blip in a long run of strong employment data.

Glass-half-empty: this is a shocking indicator of private sector confidence. Let’s not forget that December 2018 was the stock market’s worst month since the Great Depression, even if 2019 has brought a phenomenal rally to the Dow and its sister indices.

Fed Shift Opens the Door for Inflation

One can probably forgive businesses for slowing hiring, at least for one “fluky” month. Perhaps the biggest thing to take away from this jobs report is inflationary pressures .

The Consumer Price Index is a definite danger to the Dow Jones and other major indices, particularly as the Fed appears to be bowing to pressure to stop tightening and could let the economy run hot to reboot investment confidence.

While good for the DJIA in the short-term, the rising deficit cannot be ignored forever. Even Fed Chair Powell has acknowledged this.

In short, today’s 20,000 Non-Farm Payrolls figure shouldn’t be enough to make you start boarding up your windows, but if the next few months are similarly poor, then maybe it’s time to start buying some nails.