Dow Carnage: US Stock Market Plunges as Recession Warnings Intensify

The Dow imploded more than 400 points on Tuesday, and the bleeding might be just beginning. | Source: REUTERS / Brendan McDermid

The Dow’s disastrous week took an even darker turn on Friday after dismal economic data from China intensified fears of a looming recession – and caused U.S. stock market futures to point toward a fifth consecutive day of losses.

Dow Futures Plunge after SSE Composite Implodes on Friday

As of 8:48 am ET on Friday, Dow Jones Industrial Average Futures had fallen by 203 points or 0.8%. S&P 500 futures lost 0.8%, and Nasdaq futures dropped by 1%.

The U.S. stock market’s pre-bell sell-off followed one of the worst days for Chinese stocks in recent memory. The red-hot Shanghai Composite Index (SSE) plummeted by 4.4% during the week’s final trading session, causing the index to crash below the crucial 3,000 level it had only recently achieved. Altogether, the SSE Composite lost a breathtaking $345 billion.

The SSE plunge followed the publication of trade data that was dramatically worse than expected. According to CNBC , dollar-denominated Chinese exports fell by 20.7% in February versus last year, while the country’s trade balance was more than $22 billion lower than expected.

Commenting on the data, ANZ published a note declaring that “China’s trade recession has started to emerge.”

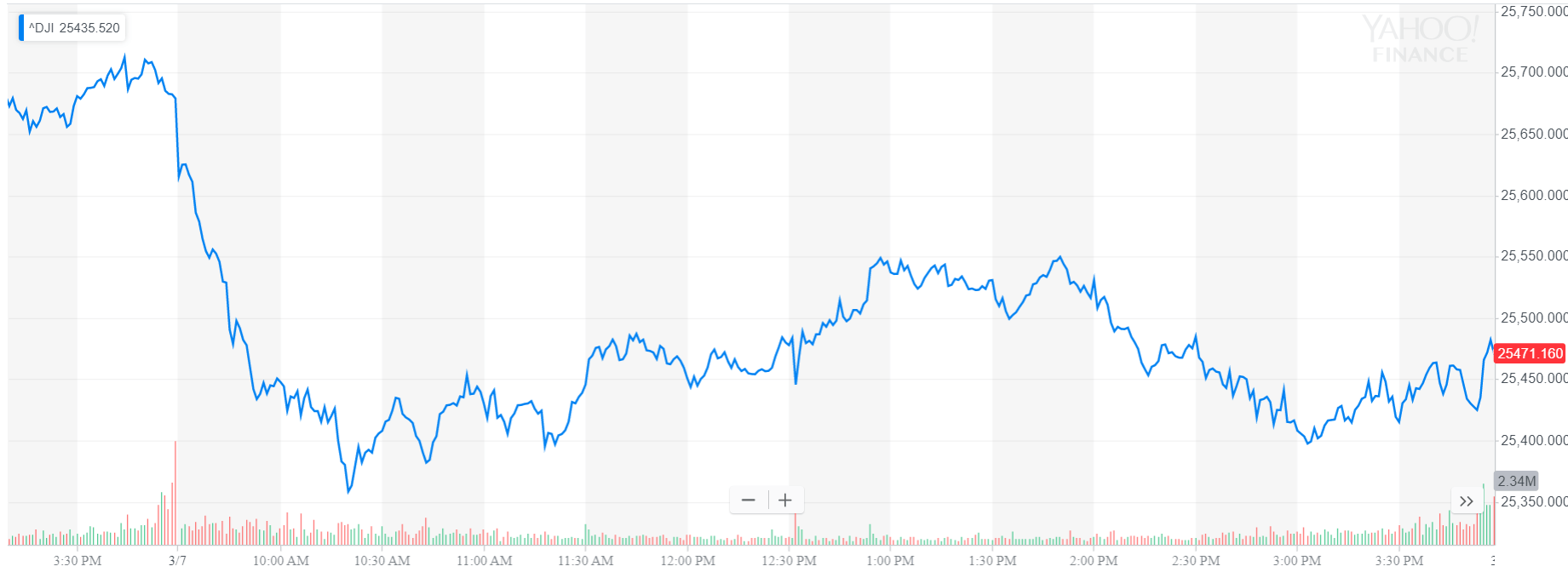

Dow Plunges 200 Points on Thursday; S&P 500, Nasdaq Follow

The Dow and broader U.S. stock market had already plunged anew on Thursday after the European Central Bank (ECB) launched fresh stimulus measures to combat a slowing regional economy. The shocking announcement brought recession fears back to the fore as investors continue to navigate a synchronized slowdown in global growth.

All of Wall Street’s major indexes declined sharply through the morning, reflecting a volatile pre-market session for U.S. stock futures. By the end of trading, the Dow Jones Industrial Average fell 200.23 points, or 0.8%, to close at 25,473.23. That was its fourth consecutive drop. The Dow was off more than 300 points at its lowest point during the day.

Twenty-six of 30 Dow members recorded declines, with Walgreens Boots Alliance Inc. (WBA) leading the declines.

The broad S&P 500 Index declined 0.8% to settle at 2,748.93. Ten of 11 primary sectors recorded losses, with consumer discretionary shares falling 1.4% on averages. Financials stocks declined 1.1% while information technology and materials each fell 0.9%. Utilities, long considered a defensive play, was the lone bright spot, gaining 0.3%.

The technology-focused Nasdaq Composite Index settled down 1.1% at 7,421.47.

A measure of implied volatility known as the CBOE VIX rose for a fourth consecutive session and settled at its highest level since late January. After peaking at 17.81, the so-called “fear index” settled at 16.59, having gained 5.4%. VIX is inversely correlated with the S&P 500 Index at least 75% of the time.

ECB Reignites Debate Over Global Economic Health

Less than three months after phasing out its massive bond-buying program, the European Central Bank on Thursday announced a new batch of stimulus measures designed to combat a slowing Eurozone economy. The central bank said it would hold interest rates at their current levels through the end of 2019, months longer than previously expected. Beginning in September, the ECB will offer banks cheap long-term loans with a maturity of two years.

The new measures follow a sharp slowdown in euro area growth over the past two quarters that has investors concerned about a full-blown recession. Eurozone gross domestic product (GDP) expanded just 0.2% in the fourth quarter, up slightly from 0.1% in Q3. The economy expanded 0.4% in the two quarters before that, a marked slowdown from 2017 levels.

Earlier in the day, the Organization for Economic Cooperation and Development (OECD) slashed its forecast for global growth even more drastically than the International Monetary Fund. The Paris-based organization now expects the world economy to grow just 3.3% this year compared with 3.5% previously.

“The global expansion continues to lose momentum,’’ the OECD said as it downgraded almost every country in the Group of 20. “Growth outcomes could be weaker still if downside risks materialize or interact.”

Italy, Germany and the euro area as a whole saw the most dramatic cuts.

With additional reporting by Josiah Wilmoth