FOMC Minutes Say the Fed Will Pause on Interest Rates, But Economic Data Suggest Further Cuts Likely

U.S. Federal Reserve Chairman Jerome Powell has presided over three interest rate cuts. A fourth could be on the way if the latest GDP projections hold. | Image: REUTERS/Jonathan Ernst

- The Federal Open Market Committee (FOMC) voted to lower interest rates last month for the third time in as many meetings.

- Most FOMC members see no need for further rate cuts.

- Calls for looser monetary policy could grow as the U.S. economy grinds to a halt.

“Most” Federal Reserve members believe they are done lowering interest rates, provided that the economy continues to progress toward broadly stated targets, the minutes of the latest meeting revealed on Wednesday.

Although the Fed is rarely accurate in its forecasts, policymakers may need to adjust their view more quickly than usual as the U.S. economy shows signs of stagnating.

FOMC Minutes Suggest Fed Is Done Cutting Rates

The likelihood of a fourth interest rate cut in 2019 diminished on Wednesday after the minutes of last month’s FOMC meeting revealed that “most” officials are satisfied with the current target of the federal funds rate.

On Oct. 30, central bankers cut their benchmark lending rate by 25 basis points to a range of 1.5% to 1.75%. The move followed two similar downward adjustments in July and September.

Combined with the ongoing intervention in the overnight repo market, the rate cut should be enough “to support the outlook for moderate growth, a strong labor market, and inflation near the Committee’s symmetric 2% objective,” the official transcript said.

FOMC members added that the stance of monetary policy will likely remain where it is “as long as incoming information about the economy did not result in a material reassessment of the economic outlook.”

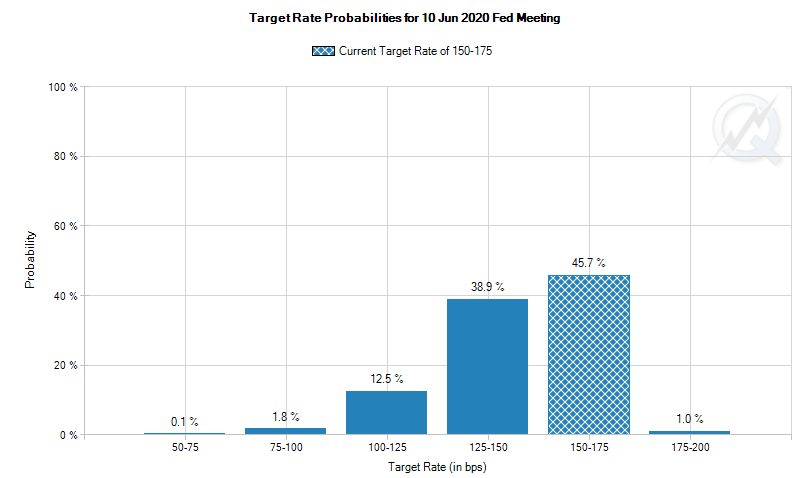

Rate-watchers in recent weeks have been downgrading their expectations for looser monetary policy. CME Group’s Fed Fund futures prices imply that interest rates will remain on hold until at least June of next year. Only then do the odds of a rate cut climb back above 50%.

U.S. GDP Begins to Flat-Line

If the Federal Reserve is as data-dependent as it says, policymakers may resort to cutting rates much sooner. That’s because the U.S. economy is heading for its worst quarter under President Trump, according to the latest GDP forecast from the Atlanta Federal Reserve.

The Atlanta Fed’s GDP tracker suggests the world’s largest economy will grow just 0.4% this quarter. That’s only slightly better than last week’s grim 0.3% outlook.

Although inflation is showing signs of picking up, producer prices increased just 1.1% in October compared with a year earlier. PPI measures price changes at the factory-gate level.

Industrial production – the broadest measure of factory output – plunged 0.8% in October. The worst monthly slide in a year-and-a-half was exacerbated by a six-week labor dispute at General Motors.

Retail sales bounced back at the start of the fourth quarter, but when you strip away auto sales, they grew less than expected.

All said, it looks like the U.S. economy is headed for a soft landing. If GDP growth turns negative, the Fed will have little recourse but to cut rates further. The only problem is it lacks the 500-basis point cushion it needs to kick-start the economy. A reduction of the same magnitude would put the federal funds rate well below zero and into uncharted territory.