Jinx: Fed Chairman’s History of Rate Decisions Looms Over the S&P 500

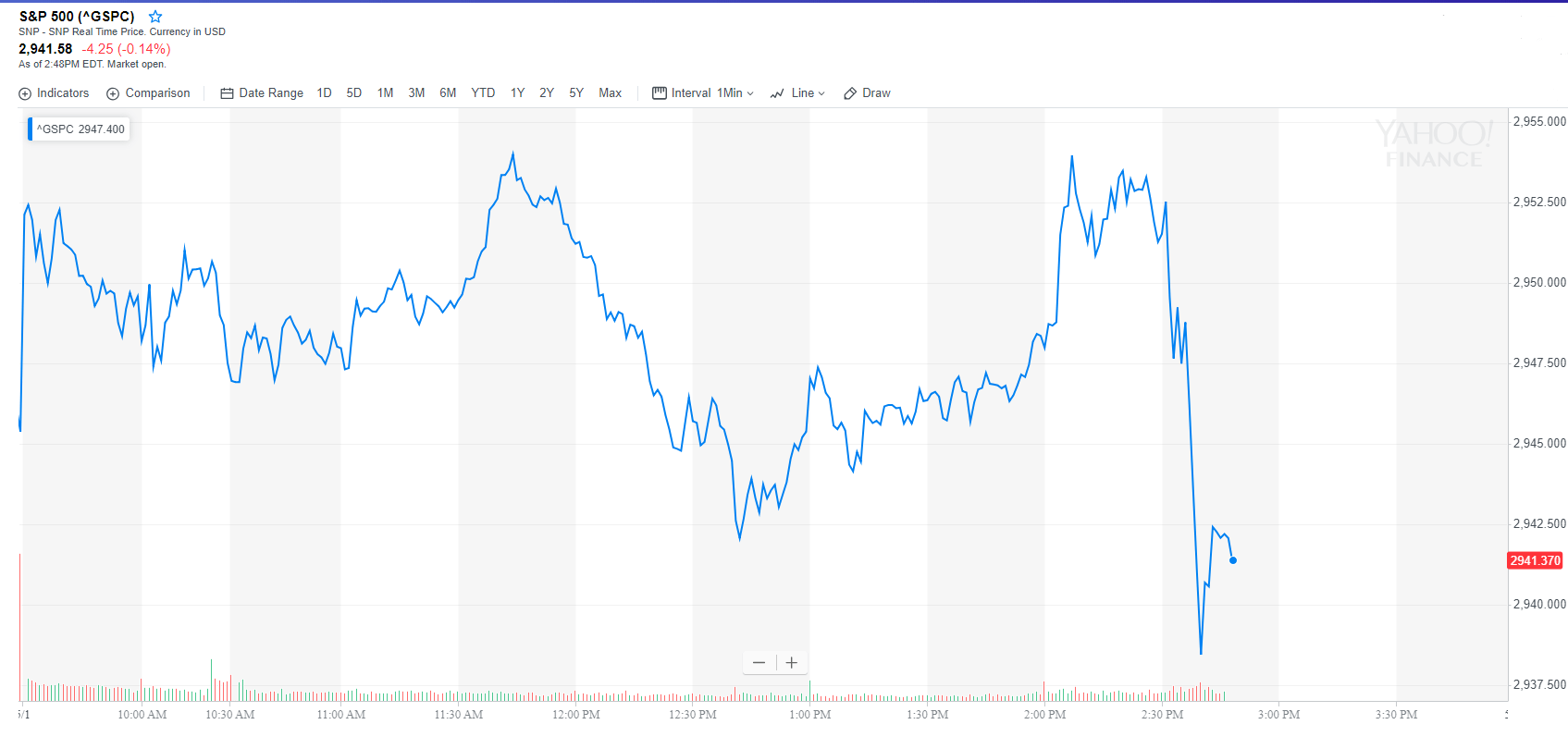

The S&P 500 has fallen after most of Fed Chairman Jerome Powell's rate decisions. Today wasn't any different, though the declines were modest.| Source: Shutterstock

By CCN.com: It’s easy to see why the stock market-obsessed presidency of Donald Trump doesn’t like what Jerome Powell is doing. The Federal Reserve chairman has hurt the performance of the S&P 500 in all but one rate decision, as the following tweet by CNBC’s Bob Pisani demonstrates:

Powell’s Hawkishness Has Mainly Hurt the S&P 500 on Fed Day

Statistics show the S&P 500 has experienced 3.8% in declines and 1.6% in gains on Fed days. Evidently, it’s hard to get too bullish when you know that Jay Powell is heading to the podium. The only positive reaction to a Powell presser was when he announced the “Fed pause.” The dovish move linked to the fact his previous meeting had sent the S&P 500 and Dow Jones Industrial Average into a tailspin. Today proved to be no different, though losses were not significant.

Donald Trump has been pressuring the FOMC again lately, calling for as much as a 1% rate cut to help boost stocks. Clearly, he is not thinking about the long-term stability of financial markets; he wants to pad voters’ 401k plans and get reelected in 2020.

FOMC Must Balance Sentiment Against Robust Economic Fundamentals

The Federal Reserve will undoubtedly be pleased to see the S&P 500 touching record highs. Realistically, they are going to have to perform a tough balancing act. With jobs data surging and oil prices firm, inflationary pressures are inevitable. It’s not Powell’s job to be reactive, but proactive. If the markets are blind to the risks of higher rates this year, then they aren’t looking at the facts.

CNBC Analysts Believe Stock Markets Are Underestimating Risks of a Rate Hike This Year

Talking to CNBC , Art Hogan, chief strategist at National Securities, highlights how stock market players may have misinterpreted the meaning of patient, saying:

“The Fed has clearly pivoted from being autopilot hawkish to ‘The Year of Living Patiently, think one of the biggest surprises for 2019 may well be stabilizing economic growth globally and a fourth-quarter rate hike by the U.S. Federal Reserve.”

FOMC Chair Powell Makes It Nine-out-of-10 Hits To the S&P 500 Today

The disconnect between economic reality and prudent policy is obvious. Markets give an overweight amount of influence to President Trump’s view despite Powell’s independence. The pause was merely to ensure that the stock market collapse in late 2018 did not continue and to ensure the payrolls numbers stabilized. We saw a relatively dovish Powell today. Yet, the S&P 500 turned fractionally lower as he took the podium to speak. Looks like we will get a chance to see whether or not this broader rally in the S&P 500 has legs.