Dow Plummets at the End of Trading as Fed’s Powell Stokes Rate-Hike Jitters

The Dow is having a stellar year and could push beyond all-time highs. | Source: REUTERS/Lucas Jackson

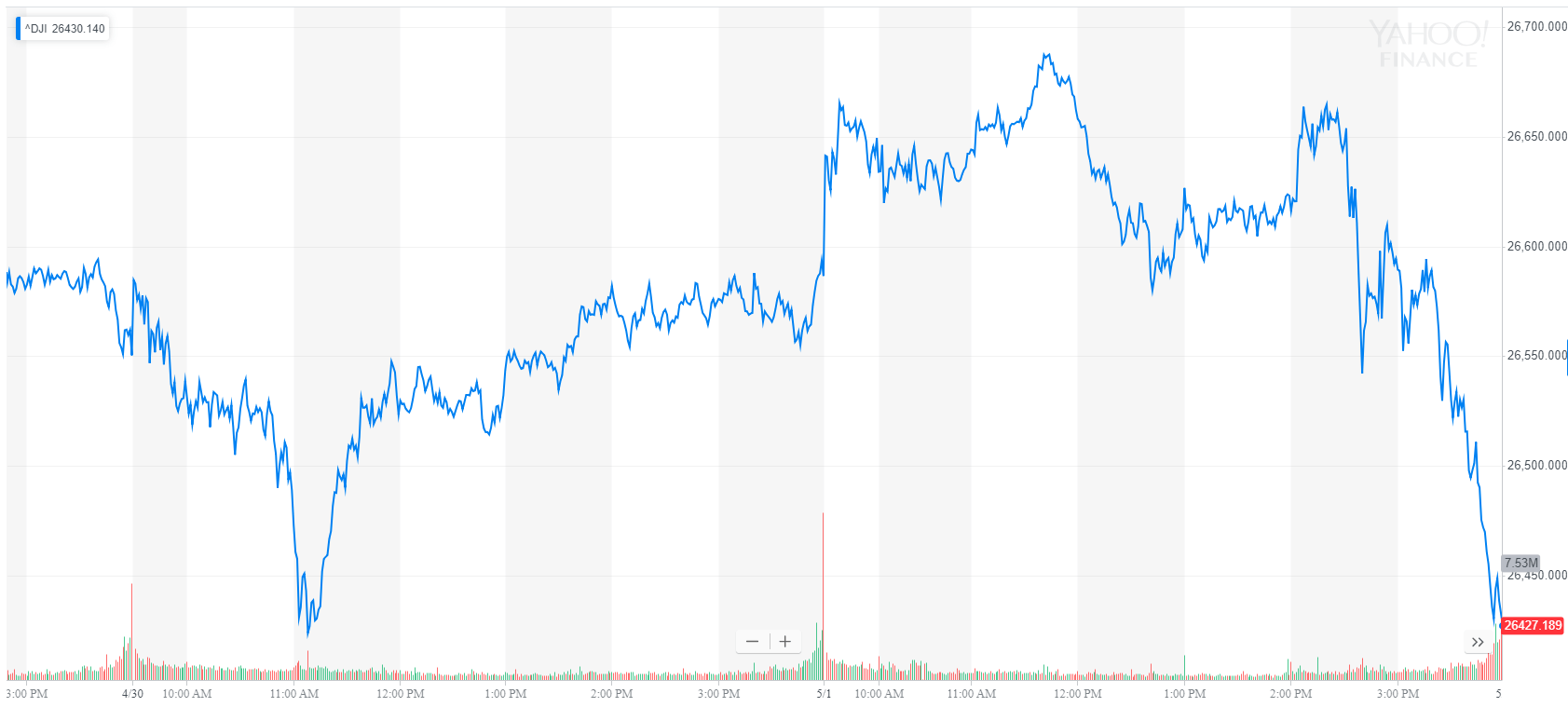

By CCN.com: The Dow and broader U.S. stock gave up gains in the final hour of trading Wednesday, as investors dissected a statement from the Federal Reserve that seemed to imply the door was still open to future rate rises.

Dow Gives Up Gains

All of Wall Street’s major indexes opened higher, reflecting a strong pre-market for Dow futures. However, the gains began to erode by the afternoon session and completely reversed in the final hour of trading.

The Dow Jones Industrial Average plunged 162.77 points, or 0.6%, to close at 26,430.14.

After trading at record highs, the S&P 500 Index of large-cap stocks closed down 0.8% at 2,923.73. Ten of 11 primary sectors recorded losses.

Meanwhile, the technology-focused Nasdaq Composite Index closed down 0.6% at 8,049.64.

Stocks came under pressure late in the afternoon as the Federal Reserve concluded its two-day policy meeting in Washington. The Fed kept its benchmark interest rate unchanged but did reiterate patience in deciding on the future path of monetary policy.

In a press conference after the meeting, Fed Chair Jerome Powell said monetary policy is “appropriate for now” and that there wasn’t a “strong case for moving in either direction.”

U.S. Job Engine Hums Along

U.S. businesses added a whopping 275,000 workers to payrolls last month, the most since last July, according to payrolls processor ADP. The figure blew past forecasts calling for 180,000, adding to growing evidence that President Trump’s economic recovery was still on track.

April hiring was led by mid-sized companies operating in the services sector. The goods producing sector also saw big gains led by construction.

“The job market is holding firm, as businesses work hard to fill open positions. The economic soft patch at the start of the year has not materially impacted hiring,” Mark Zandi of Moody’s Analytics said in the official press release . “April’s job gains overstate the economy’s strength, but they make the case that expansion continues on.”

ADP payroll data are considered a good proxy for the official nonfarm payrolls report that is due two days later. On Friday, the U.S. Department of Labor is expected to show the creation of 180,000 nonfarm jobs in April. The economy added 196,000 workers in March.

The U.S. economy got off to a strong start in the first quarter, growing at an annualized pace of 3.2%, the Commerce Department reported Friday. That marked the best start to a year since 2015.