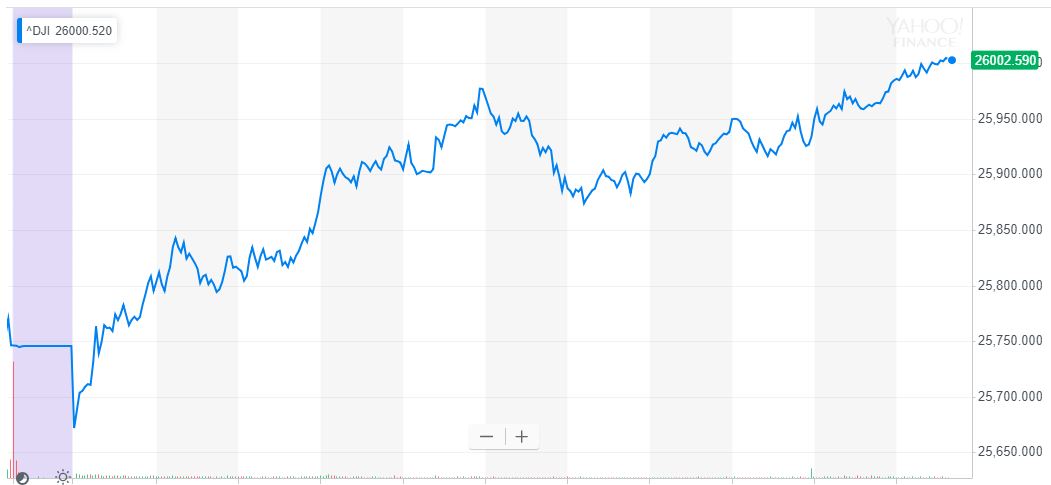

Newsflash: Dow Surges 250 Points to Race Past 26,000

The Dow should vault to a new all-time high within the very near future. | Source: AP Photo / Richard Drew

The Dow Jones Industrial Average opened to sharp losses on Thursday and then promptly began a massive recovery that achieved what few on Wall Street thought it would today: cross the 26,000 mark on the back of a blockbuster rally.

Dow Reverses Early Losses to Jump Past 26,000

As of 2:53 pm ET, the Dow stood at 26,001.05, representing a gain of 255 points or 0.99 percent. The S&P 500 and Nasdaq posted even larger gains, with the former jumping 1.12 percent to 2,855.97 and the latter adding 1.44 percent to reach 7,838.44.

As CCN.com reported, Dow futures traded as far as 100 points in the red before the opening bell, with many analysts blaming US President Donald Trump’s bombshell revelation that he does not foresee eliminating tariffs on Chinese imports, even as part of a comprehensive trade deal.

“We’re not talking about removing [tariffs], we’re talking about leaving them for a substantial period of time, because we have to make sure that if we do the deal with China that China lives by the deal,” Trump said.

He added that Chinese President Xi Jinping was his “friend,” so he didn’t expect the tariff issue to prevent the two economic superpowers from reaching a new trade agreement.

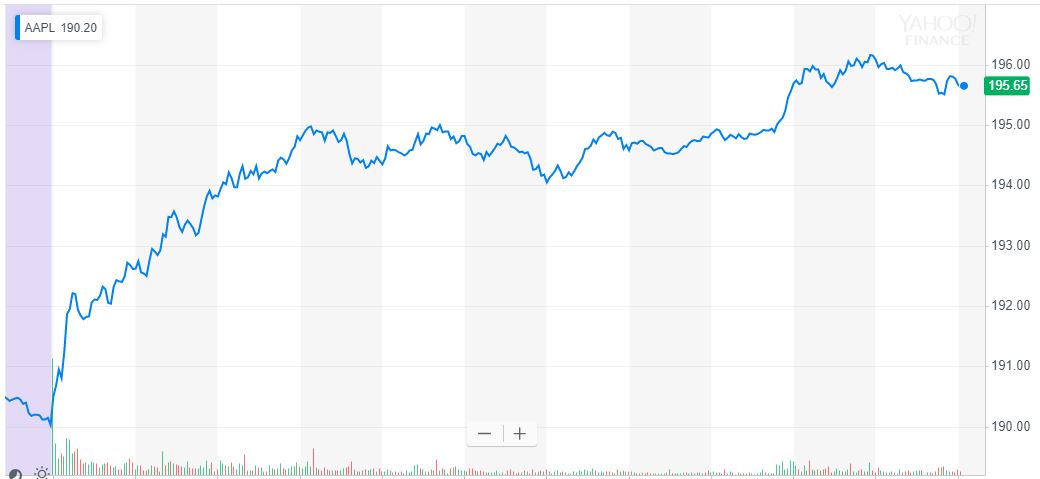

Apple Stock Climbs 4 Percent

However, tech stocks led a rapid stock market recovery, with Apple rising a full 4.03 percent to buttress the Dow, even as fellow components Boeing and JPMorgan dropped 0.86 percent and 1.69 percent, respectively. Other top performers included DowDuPont, which was up 2.16 percent, and Intel, which rose 1.95 percent.

Apple’s rally followed multiple analyst upgrades. Wedbush raised its target by 7.5 percent to $215, while Citigroup and Needham hiked their targets by $50 to $220 and $45 to $225, respectively. All three firms pointed to next week’s launch event in Cupertino as the trigger for their bullish pivots.

“There’s been a lot of buying in the tech sector after some good news,” added Ilya Feygin, senior strategist at WallachBeth Capital. “Tech has definitely been the leader. There’s been a lot of strength coming from there; I think a lot of that is deployment of cash.”

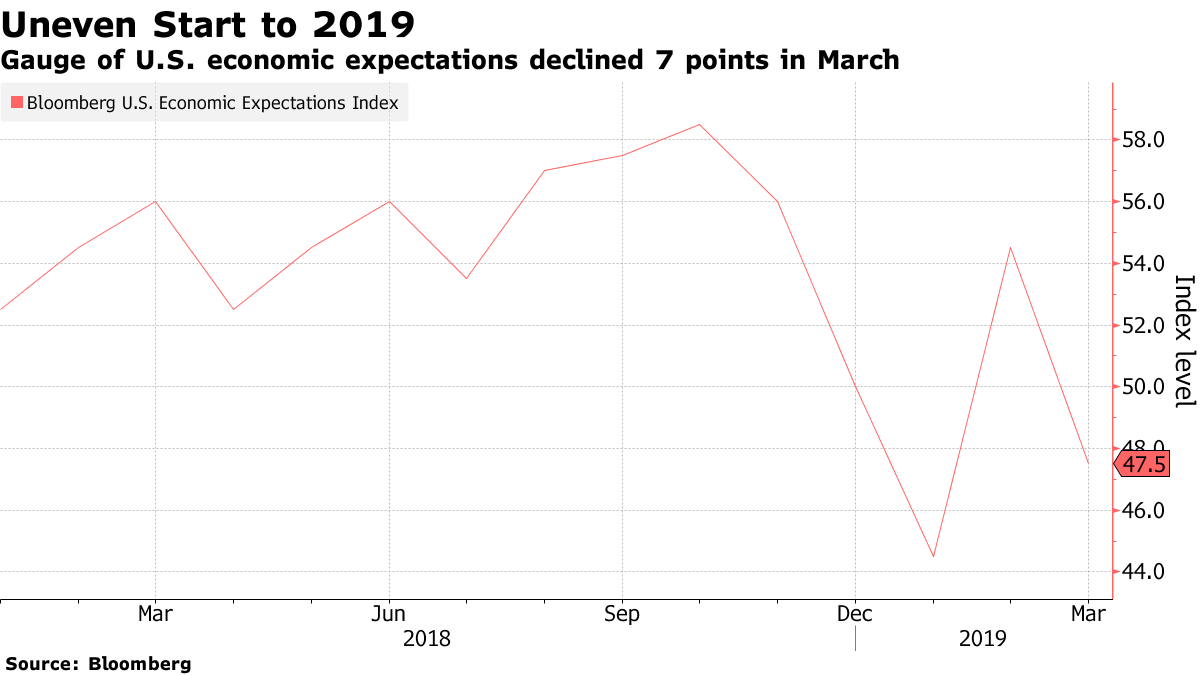

Consumer Comfort Falls Toward December 2018 Lows

Remarkably, today’s stock market rally came even after Bloomberg published its monthly Consumer Comfort survey, which indicated that US consumer expectations for the economy declined for the fourth time in five months. In March, the index sits at 47.5, down from 54.5 in February and just a few points above the low that it hit in December 2018 amid a massive Dow sell-off.

However, according to David Jones, Chief Market Strategist at Capital.com, “bull markets climb a wall of worry.” As a result, maybe the drop in consumer confidence was just the jolt that the Dow needed to push back toward its 2019 highs.

Still, the 26,000 level has proved elusive for the Dow Jones. The index has crossed it during nine different trading sessions in 2019, even peaking as high as 26,241.42 on Feb. 25. Thus far, though, the Dow has failed to close above 26,000 on all but four days in 2019 and has not ended the day above that mark since March 1.

Developing…Check back for updates