Dow Pumps After Fed Capitulation Takes Stock Market Off Life Support

The Dow rallied on Wednesday after the Fed's apparent capitulation to Trump's rate cut demands took the stock market off life support. | Source: REUTERS / Brendan McDermid

By CCN.com: The Dow and broader U.S. stock market extended their relief rally on Wednesday, as traders continued to raise bets that the Federal Reserve will cut interest rates following its July policy meeting.

Markets are now being driven almost entirely by hope even as the Department of Justice and Federal Trade Commission continue to broaden their antitrust probes of Silicon Valley’s largest technology companies.

Dow Extends Relief Rally; S&P 500, Nasdaq Follow

All of Wall Street’s major indexes headed for big gains on Wednesday, extending a strong pre-market session for Dow futures.

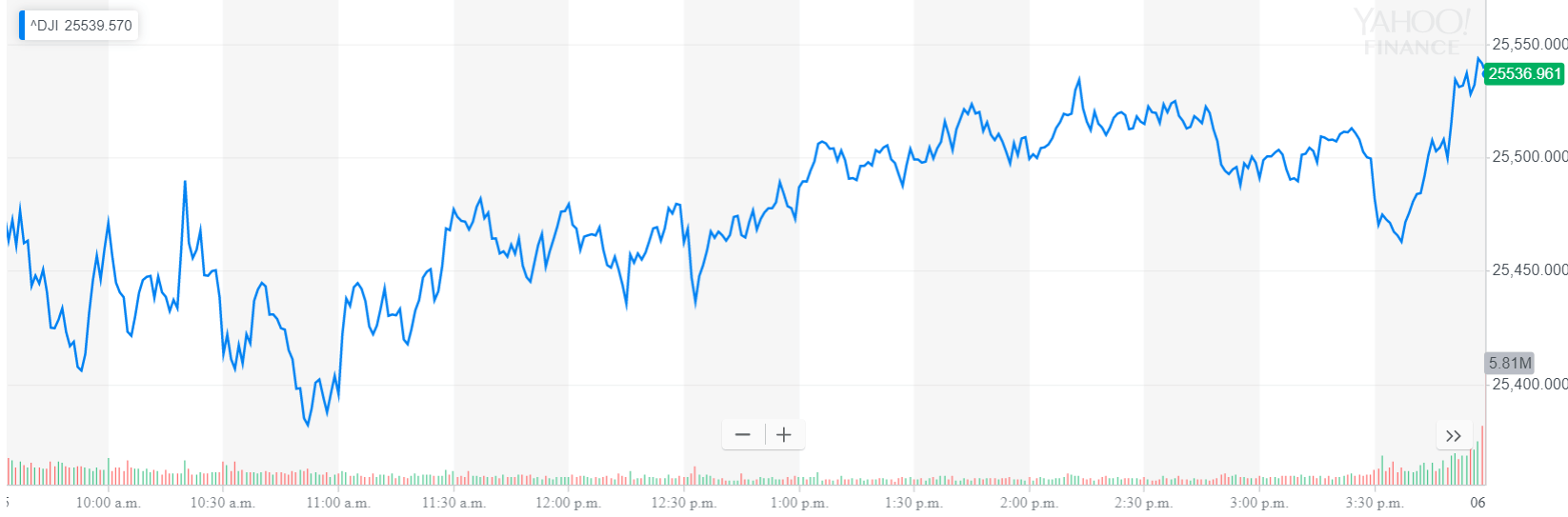

The Dow Jones Industrial Average climbed 207.39 points, or 0.8% to 25,539.57. The blue-chip index is coming off its second-best day of 2019 where it rallied more than 500 points.

The broad S&P 500 Index of large-cap stocks gained 0.8% to 2,826.15. Ten of 11 primary sectors advanced, led by utilities.

Meanwhile, the technology-focused Nasdaq Composite Index rallied 0.6% to finish at 7,575.48.

Fed Fund Futures Show Imminent Rate Cuts on the Horizon

Futures traders are not only confident that the path of interest rates is lower, but they have also priced in a whole extra cut over the past two days, according to BNN Bloomberg . Markets have been long skeptical about the central bank’s policy normalization timeline, but they completely threw it out the window on Tuesday after Chairman Jerome Powell essentially laid the foundation for future cuts.

Central bankers hiked rates aggressively last year as Donald Trump’s presidency kick-started a strong economic recovery and fueled the extension of the longest bull market in Wall Street’s history. A brutal bear-market reversal in the fourth quarter, fueled in part by U.S.-China trade tensions, forced the Fed in January to backtrack on its normalization timeline. Since then, officials have become more dovish in their assessment of interest rates.

In economic data, U.S. private-sector job gains slowed to a crawl in May, painting a bearish picture on the economic recovery.

Employers added just 27,000 jobs last month, well below the median estimate and the smallest gain since 2010, ADP Inc. reported Thursday.

Click here for a real-time Dow Jones Industrial Average price chart.