Don’t Trust the Bounce: Brutal S&P 500 Selloff Will Continue, Says Popular Trader

The S&P 500's large rally on Tuesday is more of a dead-cat bounce, a popular trader argues. This means investors should brace for more volatility in the short term. | Image: AP Photo / Richard Drew, File

- The S&P 500 posted its biggest rally since October 2019.

- A widely-followed trader is shorting this rally.

- Selloffs in the oil and copper markets suggest that the stock market is due for more pain.

On Tuesday, investors’ nerves were calmed amid the coronavirus threat as the S&P 500 Index jumped 1%. That was the index’s best day since Oct. 4.

While the rally is giving investors reasons to cheer, one popular trader believes that it is not yet time to buy the dip. He says that the bounce will likely lose momentum soon.

The Rally Is a Setup for Shorting the Market

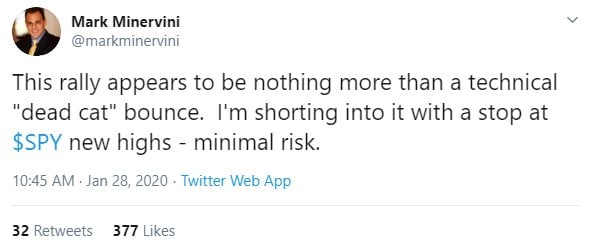

The widely-followed trader and author Mark Minervini took to Twitter to share his short-term view on the S&P 500 through the SPY. The technical analyst wrote:

In technical analysis, a dead-cat bounce is a brief recovery in the price of an asset in decline. Eventually, the correction will rear its ugly head.

This is bad news for investors who saw the correction as a chance to buy the dip. It seems that the stock market is not yet done retracing.

Billion-dollar hedge fund manager Will Meade shares Minervini’s bearish outlook. The former Goldman Sachs analyst recently said that big institutions don’t dump their positions in the course of one day. They take their sweet time distributing their shares in a span of weeks or even months.

Selloff in Commodities Hints at a Deeper Correction in Equities

Oil and copper are two key commodities that are languishing in bear territory. According to Otavio Costa, Crescat Capital portfolio manager, this is an ominous signal for the stock market. Costa told CCN.com,

Commodities are now acting like it’s in the middle of the Great Recession or weeks prior to a meltdown in emerging markets. The last two instances when oil and copper prices plunged while gold rallied as much as they did this month were in mid-2008 and mid-2015.

The portfolio manager added,

All eyes on the Fed [today]. Depending on how dovish their message comes across, we could easily see another surge on the percentage of inversions in the US yield curve. We are now at 50%. However, we are seven spreads and only ten basis points away from turning negative. If they invert, this indicator would approach 70% and could add further pressure on stocks to selloff.

With the acceleration of the coronavirus and the downtrends in oil and copper, the Fed has a lot of heavy lifting to do to keep the longest bull market in history alive. We’ll know more once the two-day Federal Open Market Committee (FOMC) wraps up on Wednesday.

Disclaimer: The above should not be considered trading advice from CCN.com. The writer does not own any shares of the companies, ETFs or markets mentioned.