Coinbase Trading Drops 83% Since January, Offshore Cryptocurrency Exchanges Make Gains

Cryptocurrency exchange giant Coinbase might, as market research firm Bernstein recently said, be on the cusp of assembling an “unassailable” market share in the U.S., but that doesn’t mean that the San Francisco-based firm isn’t struggling to maintain consumer activity during the current downturn.

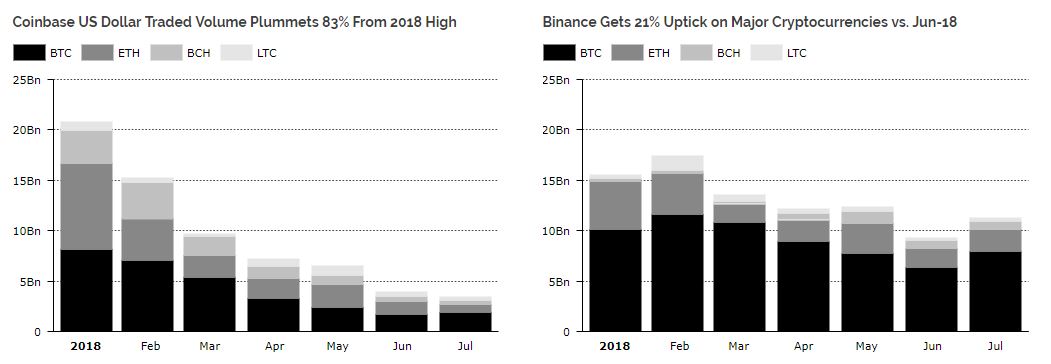

Citing data from CoinApi, cryptoasset research firm Diar reports that USD-denominated cryptocurrency trading has plunged in 2018, even as large cryptocurrency-to-cryptocurrency exchanges headquartered in other parts of the world have seen stable or even rising volumes.

According to the publication, Coinbase — the most well-known cryptocurrency trading platform in the U.S. — has seen volumes plunge by 83 percent from their all-time high in January. In July, Coinbase processed an estimated $3.9 billion worth of trades, down from a peak of nearly $21 billion. Bitstamp and Kraken, both of whom offer USD trading pairs, have also experienced significant declines, though they have been less pronounced than those seen on Coinbase.

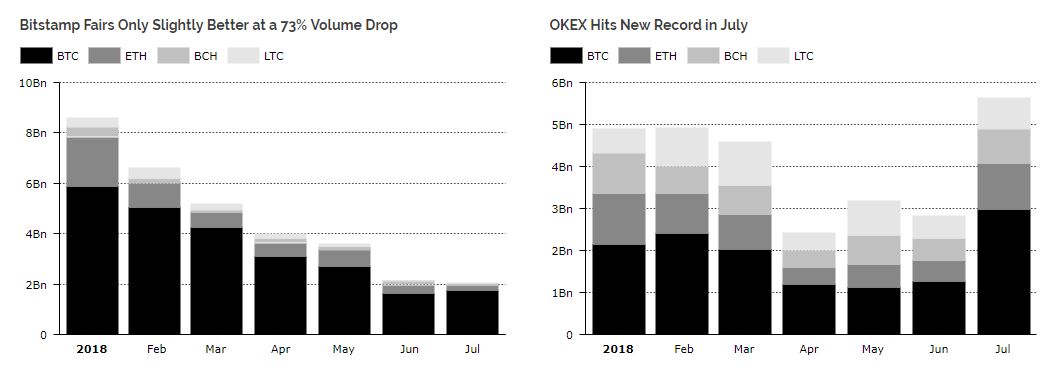

Binance, the world’s largest order-book cryptocurrency exchange, has also seen a moderate decline in volumes in its BTC, ETH, BCH, and LTC markets (the four cryptocurrencies that have been available on Coinbase throughout 2018), from $17.5 billion in February to a low of $9.4 billion in June. However, Binance volume jumped 21 percent the next month, reaching $11.3 billion in July.

Meanwhile, OKEx, generally the second-largest cryptocurrency exchange, attracted a surge in trading volume among these four-large cap coins between June and July, from to $5.7 billion from $2.9 billion. That not only signifies a month-over-month increase of 97 percent but also, Diar reports, represents a new monthly record for OKEx.

That’s particularly notable since volume on Coinbase and Bitstamp decreased between June and July, albeit slightly. Incidentally, neither Coinbase nor Bitstamp supports USD-pegged stablecoin Tether (USDT), while both OKEx and Binance do. Tether, whose solvency and credibility have been the subject of much debate within the cryptocurrency community, has issued hundreds of millions of dollars worth of new tokens over the past few weeks, which could help explain the discrepancy in volume between exchanges that support USDT and those that do not.

Additionally, both Binance and OKEx, as CCN.com reported, are planning to set up shop in Malta after pro-industry regulations go into effect in the self-described “Blockchain Island” later this year. Binance, which heretofore has only offered crypto-to-crypto trading, has also unveiled plans to partner with a Liechtenstein-based company to begin offering its first fiat trading pairs.

Featured Image from Shutterstock