Bitcoin Exchange Coinbase Defends Itself on Credit Card Charges, Admits Missteps

Cryptocurrency investors are seeing added fees on their credit card statements, but Coinbase is just the messenger. Leading US cryptocurrency exchange Coinbase in a blog provided an update to investors about the fees, which are being levied immediately following a purchase of a digital coin.

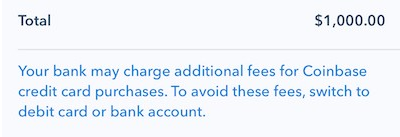

Coinbase said the charges — which have a separate line item and are being listed as “cash advance/cash equivalence on bank statements — weren’t coming from the exchange but instead third parties amid a change in the Merchant Category Code (MCC) code by banks and card issuers. (MCC is a system of categorization for merchants so tax agencies can follow the trail.)

The charges add insult to injury from the banking community, which in the US has taken to banning credit card purchases of digital currencies altogether. While not collecting these added fees, Coinbase did commit a faux pas, pointing to poor communication to its users.

Coinbase defended itself, saying of the fees, “unfortunately we don’t have a way of knowing when they might be charged or how much they might be.” They give a word of advice, which is for buyers to contact their banks and request the fees be waived. If that doesn’t work, change cards to a bank with lower fees.

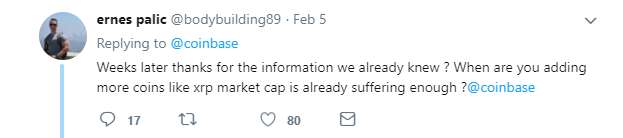

Meanwhile, Coinbase followers on Twitter lamented the exchange’s response –

One-Two Punch

In a one-two punch, Coinbase in addition to the added fees also addressed the ban that US banks — including Chase, Bank of America, Citi and Capital One — banned credit card transactions for digital coins. To troubleshoot the ban and the fees as well as experience higher weekly limits, Coinbase informs investors: “All debit card transactions remain unaffected.”

Limits vary depending on the linked accounts by which investors perform transactions, and there’s a separate “overall limit for your Coinbase account regardless of which payment method is used,” as per Coinbase .

In addition to a subtle warning on its site, Coinbase is urging users via an email sent to switch to debit card payments. You can view a copy of that email in CCN.com’s previous coverage here.

Investors can buy bitcoin, Bitcoin Cash, Ethreum or Litecoin, which are the four digital coins that Coinbase currently accepts, via debit card or bank account. The latter takes about seven days before the coin arrives in your BTC, BCH, ETH or LTC wallet, which is OK for a long-term investment horizon but less so for trading.

Coinbase also touted “record signups … in December,” which while a positive development also placed a burden on its verification systems, triggering delays in the process. The exchange has since bolstered its verification systems and integrated more ID verification providers.

Coinbase will continue to make public announcements about the latest developments on the Coinbase blog and social media accounts.

Featured image from Shutterstock.