Coinbase Adds Ethereum

Coinbase Adds Ethereum

Coinbase adds Ethereum just a day after a historical and highly successful hardfork.

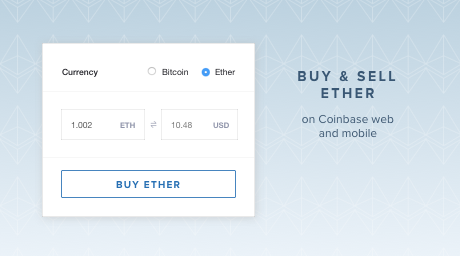

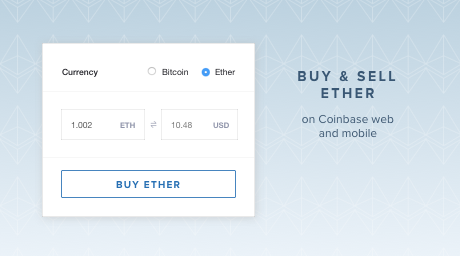

Coinbase customers in 32 countries can now easily directly buy, sell store and send eth from their Coinbase account, making a conversion from btc to eth unnecessary, saving money in conversion fees.

The ability to buy eth further extends to a new widget recently announced by Coinbase – Coinbase Buy Widget – which in partnership with other platforms, such as Brave Browser, allows users to buy Eth directly from the browser or website.

The service will further expand to Australia in the coming weeks. Likewise, in a few weeks, Coinbase customers in Canada and Singapore will be able to instantly buy eth using a credit or debit card.

https://twitter.com/brian_armstrong/status/756158520987353088

https://twitter.com/brian_armstrong/status/756167970364108800

Coinbase was one of the first major service providers to add ethereum to their exchange – GDAX – which has seen an increase of 350% on average daily trading volume since adding ethereum. In a public statement, a Coinbase representative stated:

“Ethereum is pushing the digital currency ecosystem forward and we are excited to support it as part of our mission to create an open financial system for the world.”

Coinbase was one of the most vocal proponents of bitcoin on-chain scaling together with almost all of bitcoin’s businesses, including Blockchain.info, Bitgo, OKCoin, Xapo, Bitstamp, Coinify, Lamassu, itBit, and others. Bitcoin’s failure to scale, however, led to increased attention for alternatives, with the market judging Ethereum as the most promising due to its impeccable and highly professional development team.

Starting around February this year, just when miners rejected a last-ditch attempt to scale bitcoin to a mere 2MB, Ethereum’s price skyrocketed, from pennies to more than $20. Attention continued to increase due to an attempt to implement a new concept called Decentralized Autonomous Organizations which led to mainstream coverage, with one news outlet proclaiming that all the cool kids were now on Ethereum. The somewhat amateurish slock.it team however almost led to tragedy, but, ethereum’s developers, aided by the Cornell team, took over, saving the day and averting a disaster with a smooth and very successful hard fork.

The biggest non-event, perhaps in digital currencies’ entire existence, impressed many, including David Baily, CEO of Bitcoin Magazine, a media outlet that has been strongly in favor of retaining the 1MB limit. In a public statement, he congratulated Ethereum and added:

“[F]or once I’ve seen something totally new… [y]ou’ve really done a service to the entire crypto community.”

Coinbase may now be joined by other businesses which share a more practical approach to this new invention and wish to benefit from Ethereum’s plans for unlimited scalability, added security by employing fail-safe mechanisms in smart contracts and higher flexibility, leading to a greater ability to innovate and adapt in the fastest moving space on earth where sectors and players are having races within races, from Silicon Valley to London to Shanghai and Zug, from public blockchains to private blockchains, from giant tech companies to banks and financial institutions, but the most exciting of them all, right now, is the race between Ethereum and Bitcoin.

Featured image from Coinbase.