Bloody Wednesday: Bitcoin Price Headlines Crypto Sell-Off, But One Coin Emerges Unscathed

Wednesday brought more pain to the Bitcoin price and wider crypto market. | Source: Shutterstock

The Bitcoin price took a sharp drop and the rest of the crypto market went with it. The rest of the market, that is, except for Binance Coin, which resisted the bearish tilt and climbed into the 10th spot in the market cap rankings.

Outside of the top 10, nearly everything was red. Bitcoin itself was barely flirting with a global average just over $3,400, while Ethereum dropped a few dollars to $104 and XRP finally dipped under $0.30.

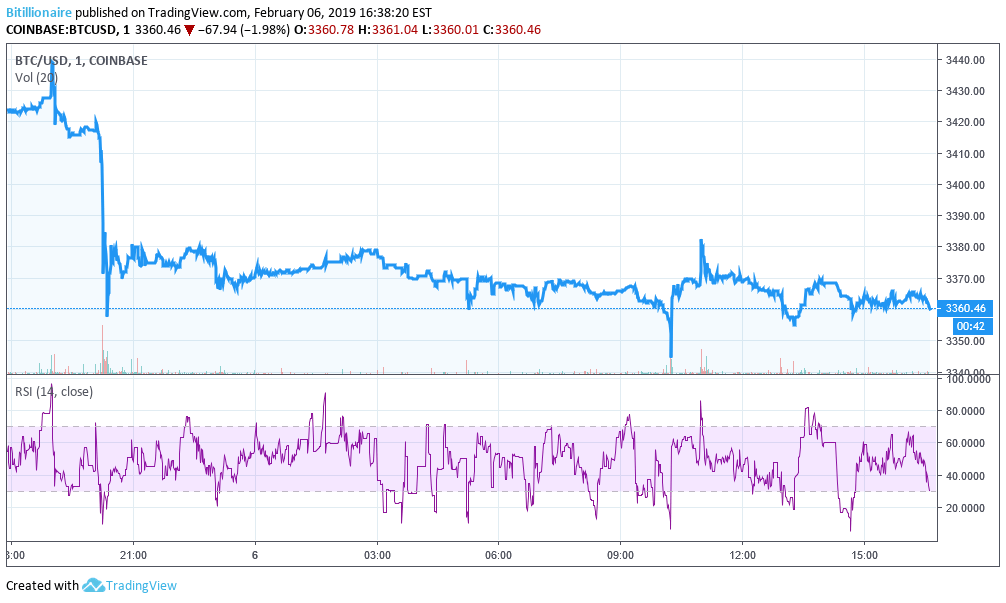

Bears Deal Bitcoin another Blow

As noted above, the global average for Bitcoin is still clinging to $3,400. But plenty of exchanges, including Coinbase, have it in the $3,300 range.

Late trading last night saw a dip of over $65 from whence Bitcoin has not recovered. For reference, the loss on every BTC on Coinbase was enough to buy a whole Bitcoin SV. Bears fought all morning to drag it down, eventually reaching a low of around $3,345. By press time it was selling for $3,360.

Definitely not the “big shakeout” we were told to expect yesterday, but it’ll take some significant buy pressure in the $5 billion volume market to raise it back above $3,400 and head toward the previously understood “support” of $3,500.

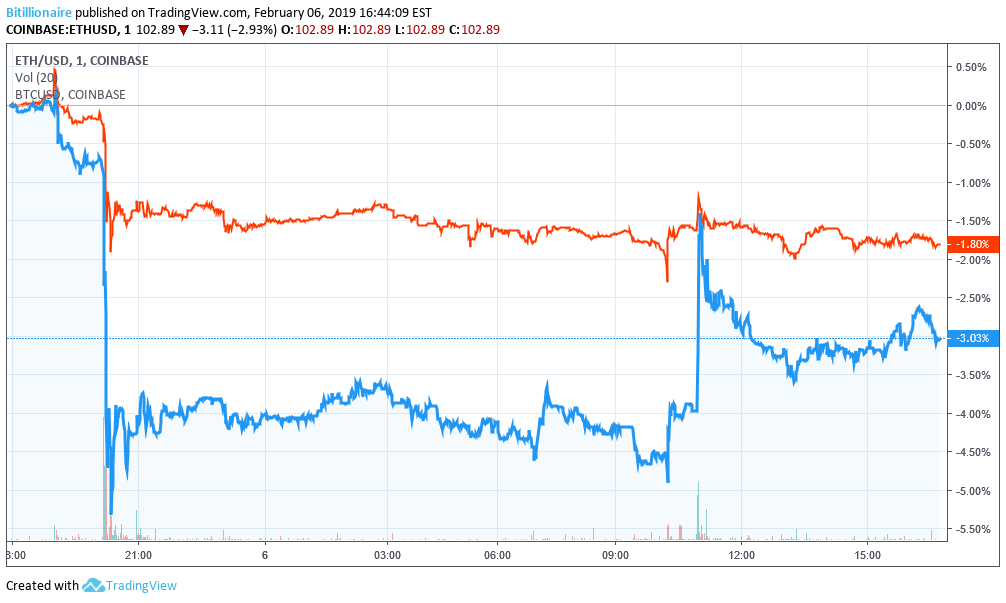

Ethereum Follows Bitcoin into Decline

The drop in Ethereum was mostly commensurate with the drop in Bitcoin, only worse. A dollar or two is a lot more to a token struggling to stay above $100 than it is to one resting comfortably above $3,000.

Likewise, Ethereum did about half the volume of Bitcoin today, at over $2.5 billion. The state of the dApp industry isn’t helping matters much. However, any way you slice it, it’s hard to complain about being able to buy Ether this cheaply. Long-term, philosophically-inclined traders understand that crypto assets have only begun their value cycle.

Binance Coin Resists Market Gravity

About the same time that Bitcoin and Ethereum started losing last night, Binance Coin (BNB), a token used primarily for paying fees on the world’s largest crypto exchange, started gaining.

With a 24-hour volume of over $120 million, the token reached $8.00 globally by price time, overtaking Bitcoin SV. At the time of writing, BNB is the 10th largest cryptocurrency by market capitalization. It has a supply of nearly 142 million and a per-token price of $8.00.

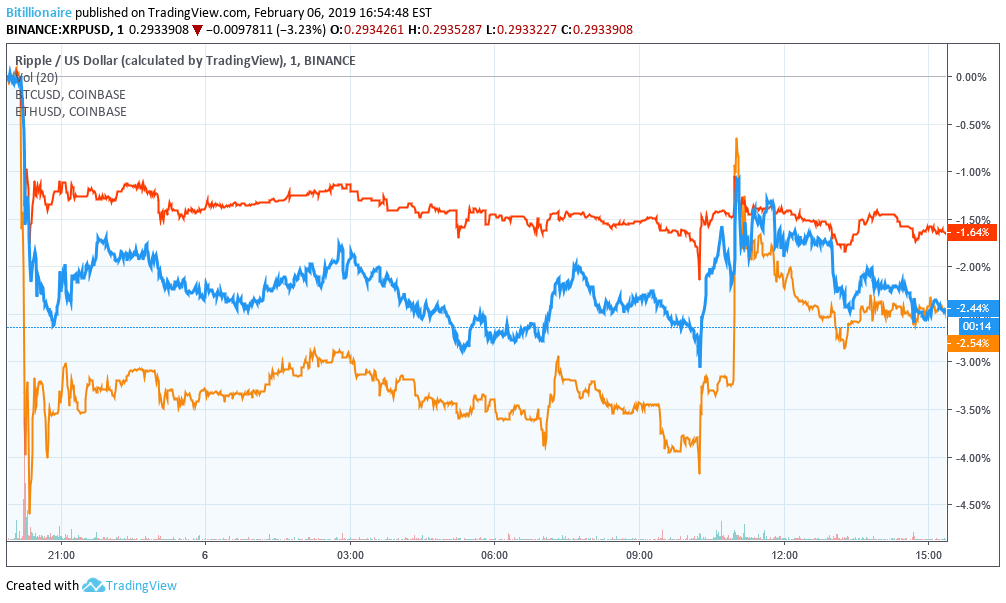

Ripple Price (XRP) Among Hardest Hit

Percentage-wise, Ripple (XRP) suffered a bit more than Ethereum or Bitcoin. As you can see in the chart below, which includes BTC and ETH, the losses began around the same time. The primary factor in this is that XRP is often traded against BTC or ETH.

In any case, the overall price for Ripple is now officially below $0.30. Barring some news or other great sentiment from Ripple Labs, we can expect this downtrend to continue for XRP as long as Bitcoin and Ether suffer losses. What we’ll want to check on is whether or not the bank-friendly token gains along with them, or continues losing, on the next bounce.

Disclaimer: Always keep in mind that you’re on your own when trading crypto. This isn’t trading advice. As a rule, this reporter advises anyone to avoid storing coins on exchanges.

Featured Image from Shutterstock. Price Charts from TradingView .