BitMEX: Bitcoin Cash Hash War Costing Miners Millions in Lost Revenue

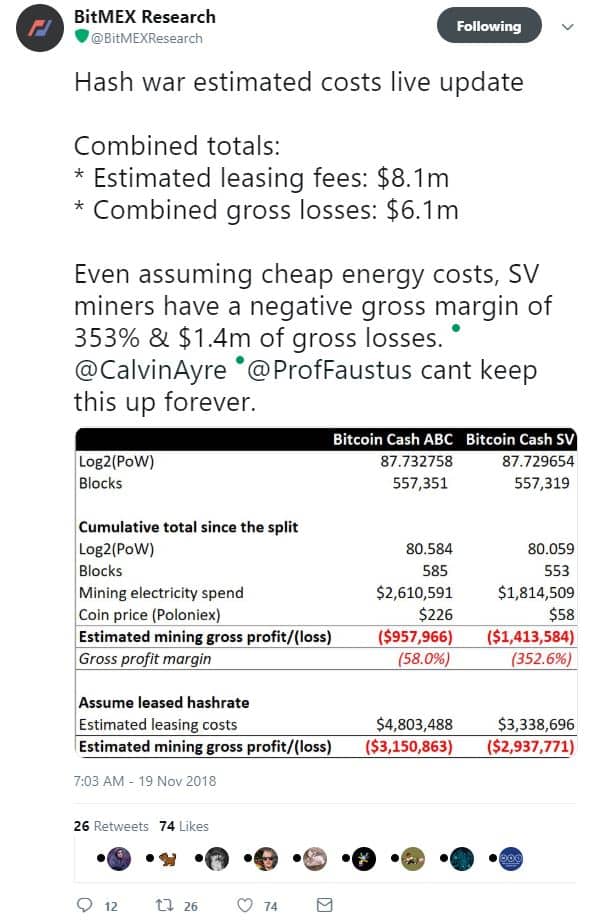

According to BitMEX Research, going under the assumption that much of the hash rate on both sides of the Bitcoin Cash “hash war” has been leased since the fork, says that BCH miners have collectively lost as much as $6.1 million in gross revenue since last week’s blockchain split — but that one side, Bitcoin SV, can’t “keep this up forever.”

Something which has to be noted in any such discussion is that the profits gained from such mining — or loss thereof — would at present be on paper only, as neither BCH nor BSV has exactly the most liquid market at this time. This is to say that losses would cascade if the lessees actually attempted to realize them in Bitcoin or fiat because the market support of the prices used in the estimation would quickly vanish, replaced by lower rates, as the forces of supply and demand dictate.

The figure also assumes that everyone renting hash is actually finding blocks, or that most or all of the hash being used to win blocks in either chain, at present, is rented. This is decidedly not the case, with plenty of Bitcoin Cash miners owning their hardware and choosing to mine on BCH chains for various reasons.

The figures seem intended to provide a minimum gain/maximum loss worst-case scenario, but they do illustrate an important and perhaps disheartening fact of the ongoing “hash war”: there are definitive losers.

Mining is no longer a hobbyist game. The vast majority of participants run on tight margins. Virtually every decision made by a miner is important — where they choose to operate, what they choose to mine, and which pool they decide on all play a role in the profitability of their operation. Hardware expenses are at least as important as the cost of electricity, which varies, and returns on investment sometimes take several months to realize.

As such, it can be expected that a significant amount of new BCH will continue to be sold regardless of how the markets treat either token, putting increased pressure on a market that was already notably smaller than Bitcoin, during a time of massive losses across the crypto markets.

Featured Image from Shutterstock