Bitcoin Price Dives to $3,675 as Fork Concerns Reemerge

Since rising to an all-time high of $4,492 on August 17, the bitcoin price has entered a steady decline. At several points this week, the $4,000 level was tested, but bitcoin managed to hold above that threshold.

Bitcoin Price Drops to $3,675

That threshold was tested again this morning when the bitcoin price dove by more than $300 within a few hours. Bitcoin fell as low as $3,675 during the skid; this was its lowest mark since August 12. The bitcoin price quickly bounced back to $3,800 and has inched back up to a present value of $3,933. This leaves bitcoin with a $65 billion market cap.

Segwit2x Fork Concerns Reemerge

Many factors affect the crypto markets, but it is likely that lingering concerns over Segwit2x are putting some downward pressure on bitcoin. The scaling debate was not solved when bitcoin cash split away to form a new coin, but many casual investors put those concerns on the back-burner during the early August bull run.

The debate reemerged as a major concern over the weekend when BitPay posted a controversial blog post telling their clients they needed to upgrade their nodes from Bitcoin Core (non-Segwit2x) to btc1 (Segwit2x) in preparation for Segwit activation. Segwit2x has widespread support among miners, but it is vociferously opposed by the Bitcoin Core developers, as well as a significant portion of the community at large. The post sparked a social media storm, and btc1 developer Jeff Garzik was removed from the Bitcoin Core repository on Github.

Bitcoin weathered the August 1 bitcoin cash split with little trouble, but the Segwit2x hard fork could be much more contentious. Both Bitcoin Core and Segwit2x developers claim that their version is “Bitcoin” and the other is not. This will almost assuredly create user confusion if the community does not reach consensus by the time Segwit2x deploys. To make matters worse, neither group of developers is eager to implement replay protection, which would prevent attackers from broadcasting a transaction on both network chains.

Core does not want to implement this protection because it would require a hard fork, and–they claim–Segwit2x should be the one to add it because they are the ones breaking away from the main blockchain. Segwit2x developers, on the other hand, want to avoid the appearance that they are creating an altcoin.

Garzik and other Segwit2x proponents say that their proposal has the most support (in the form of hash power), so Core should add replay protection if they want to continue to exist as a “minority chain” after bitcoin implements Segwit2x.

Asian Currency Pairs Give BTC Support

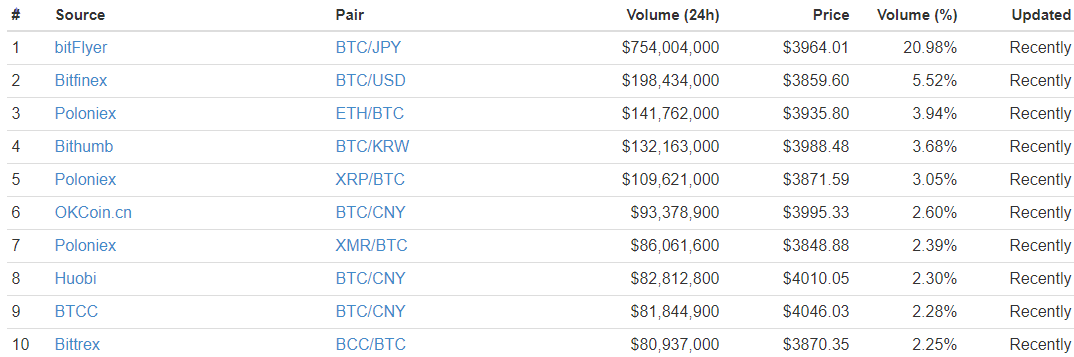

Were it not for bitcoin’s Asian currency pairs, the bitcoin price would likely be significantly lower. BTC is currently trading below $3,900 on Bitfinex, Poloniex, and Bittrex (although ETH/BTC is at $3,936 on Poloniex). However, most of bitcoin’s Asian currency pairs remain closer to $4,000.

More than 20% of bitcoin’s daily trading volume is concentrated on bitFlyer, Japan’s largest exchange; BTC/JPY accounts for more than $750 million of bitcoin’s estimated $3.6 billion 24-hour volume. This pair is currently priced at $3,964, well above the CoinMarketCap average. On Bithumb–South Korean’s largest exchange–BTC/KRW is trading at $3,988, while BTC/CNY is near or above $4,000 at OKCoin, Huobi, and BTCC.

Featured image from Shutterstock.