Bitcoin Mining Difficulty Decreases for First Time in Almost Two Years

The difficulty of Bitcoin mining has decreased, for the first time since December 2012, by .62%. For 20 months now, the difficulty has steadily risen to cope with added hashpower from large mining outfits like Ghash.io. But now, though not for the first time, difficulty has decreased.

The difficulty of Bitcoin mining has decreased, for the first time since December 2012, by .62%. For 20 months now, the difficulty has steadily risen to cope with added hashpower from large mining outfits like Ghash.io. But now, though not for the first time, difficulty has decreased.

Also read: Judge Considers Allowing Butterfly Labs to Reopen

Security Intact

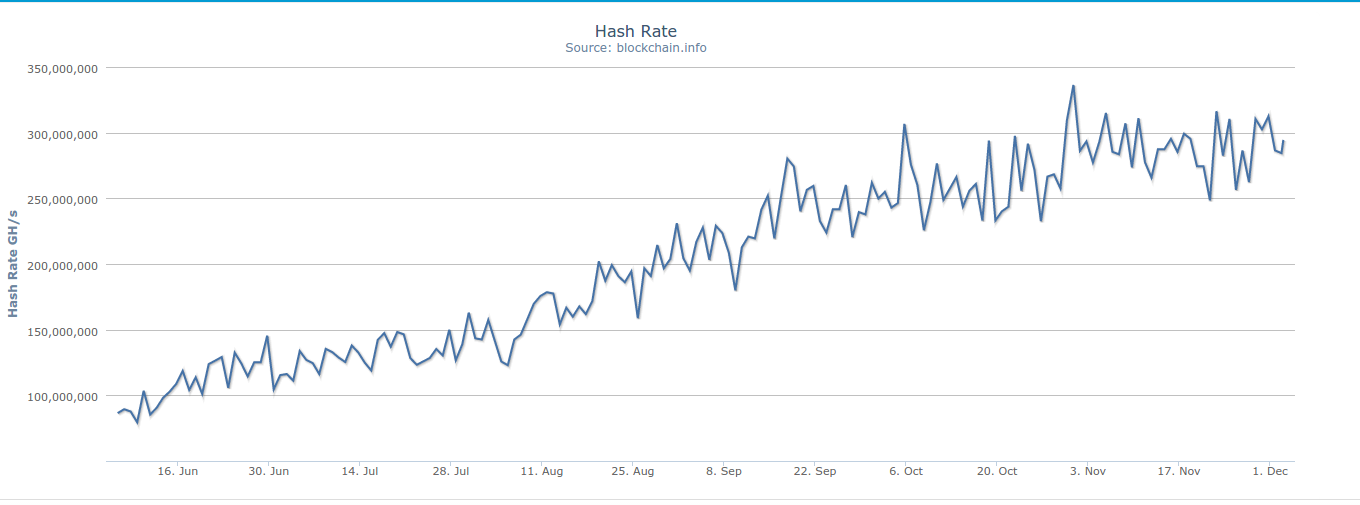

Speculation aside, it is important to note that at the network’s current hash rate of roughly 294 million GH/s, security is not in danger. According to Blockchain.info, this time last year the network totaled just 6 million GH/s, and things were secure then, too.

Possibility of Hashpower Diversion

Now for some speculation: why are there fewer miners being added to the network? Put simply, it comes down to money. The present fiat value of Bitcoin combined with the cost of mining creates a situation wherein adding more hashing power to existing operations is simply not the most profitable thing for them to do at the moment.

Conceivably, a certain amount of hashing power has thus been diverted to some of the more profitable altcoins. Some coins like Bottle Caps and Solarcoin have reached stable price points of 2,000 Satoshi each and with the same amount of investment, miners could comfortably reap a much higher reward with these coins, and then convert them to Bitcoin or in some cases directly to fiat, the same as they do with Bitcoin.

The Foreminer blog had this to say about it:

There is a few possible reasons that the difficulty may decrease, but in the end there only one rational reason, economics. […] Evidence seems to suggest that even the biggest hashing farms, with the cheapest electricity have reached the point where at the current price of bitcoin cannot justify adding new hashrate to the network.

10-Minute Blocks Forever

The purpose of mining difficulty is to maintain the block time of ten minutes. As more hashpower is added to the network, the difficulty increases to slow the finding of blocks, and as hashpower is removed from the network, it decreases to compensate.

The Bitcoin wiki puts it this way:

The difficulty is adjusted every 2016 blocks based on the time it took to find the previous 2016 blocks. At the desired rate of one block each 10 minutes, 2016 blocks would take exactly two weeks to find. If the previous 2016 blocks took more than two weeks to find, the difficulty is reduced. If they took less than two weeks, the difficulty is increased. The change in difficulty is in proportion to the amount of time over or under two weeks the previous 2016 blocks took to find.

If present trends continue, we could see a downward slope of the difficulty over the next months until either the price rises or new, more electrically efficient mining hardware is developed. Miners leaving the network can be a good thing for some people but overall a diverse, large number of miners is good for network security, so we can only hope the latter happens in case the former takes a long time to happen.

Does the difficulty drop concern you? Comment below!

Images from Pixabay, Blockchain.info and Shutterstock.