A Bitcoin ETF is ‘Virtually Certain’, Only Matter of time for SEC Approval: Wall Street Advisor

A major Wall Street advisor has opined that it's merely a matter of time before a bitcoin ETF is approved by the SEC. | Source: Shutterstock

The prospect of a Bitcoin ETF is ‘virtually certain’ according to finance manager Ric Edelman, who is confident that either VanEck or Bitwise will satisfy the demands of the SEC.

The founder of Edelman Financial Engines told CNBC’s Bob Pisani on Monday’s ETF Edge:

“It’s virtually certain. The only question is when. And I don’t know how soon it will the happen; the SEC has several legitimate thoughtful concerns that the industry has to overcome, and I’m confident that they will, and eventually we will see a bitcoin ETF. And it’s at that stage that I will be much more comfortable recommending that ordinary investors participate.”

CBOE, VanECK ETF Certain?

The dramatic pendulum that is the ETF saga swung dramatically in the past few weeks. First CBOE withdrew its ETF application due to the government shutdown, then barely a week later re-filed the application with the SEC – with little fanfare from the crypto community.

Given that new applications are subject to a 240-day deadline; and given the SEC’s tendency to make full use of that deadline, the general feeling was that there would be no ETF until the far end of 2019.

However, opinion in the crypto space is nothing if not varied, and Edelman believes that the SEC’s demands will be met, ‘in short order’. He said:

“We’ve got some serious players. Fidelity has made a major announcement in the custody issue. We’ve got Kingdom Trust and a number of other very serious players on the custody side, and I’m confident that in very short order, VanEck or Bitwise will satisfy the custody concern of the SEC.”

When asked by Pisani how the ETF would be viewed in light of price manipulation, particularly from overseas traders, Edelman compared the digital asset class to that of gold and oil, saying:

“Another thing is manipulation: I put Bitcoin in the same category as oil and gold – globally traded assets beyond the control of the SEC; and the SEC is just going to have to shrug and say ‘that’s the way it is’.”

Demand Among Investors

Also interviewed was ETF analyst Tom Lydon, who said he has personally witnessed a simmering demand for a Bitcoin ETF among financial advisors. Lydon said:

“There is pent-up demand. We interview advisors all the time. Seventy-four percent say they’ve talked to clients about their interests in bitcoin so they need to step up when this happens because that money is going to go elsewhere.”

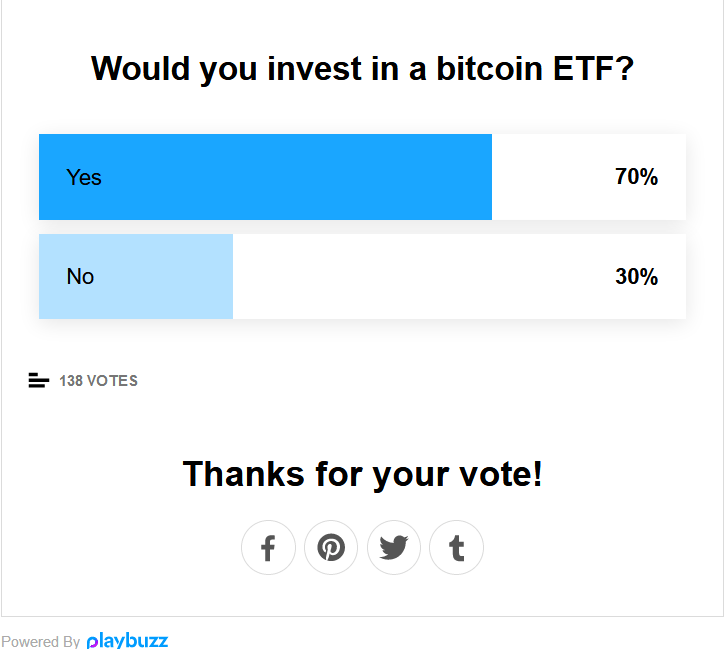

CNBC’s coverage of the interview ended with a poll asking readers if they would invest in an approved Bitcoin ETF. The answer was 70% in the positive (from an admittedly small sample size).