15,000% Gains: The 5 Best and Worst Crypto Performers of 2019

It has been a volatile year for cryptocurrencies, one that has seen teh market grow tremendously. | Source: Shutterstock

Given the meteoric rise in the value of the cryptocurrency market since the turn of the year, one might assume every major altcoin recorded growth in the six months since January 1st.

Yet a glance at the year-to-date figures for coins in the crypto market cap top 100 tells a different story. Many household-name cryptocurrencies are in the red for 2019, while the year’s best performers so far are mostly small-cap tokens which catapulted onto the scene during the past six months.

Here are the five best and worst performers of the year so far.

Crypto Winners in 2019

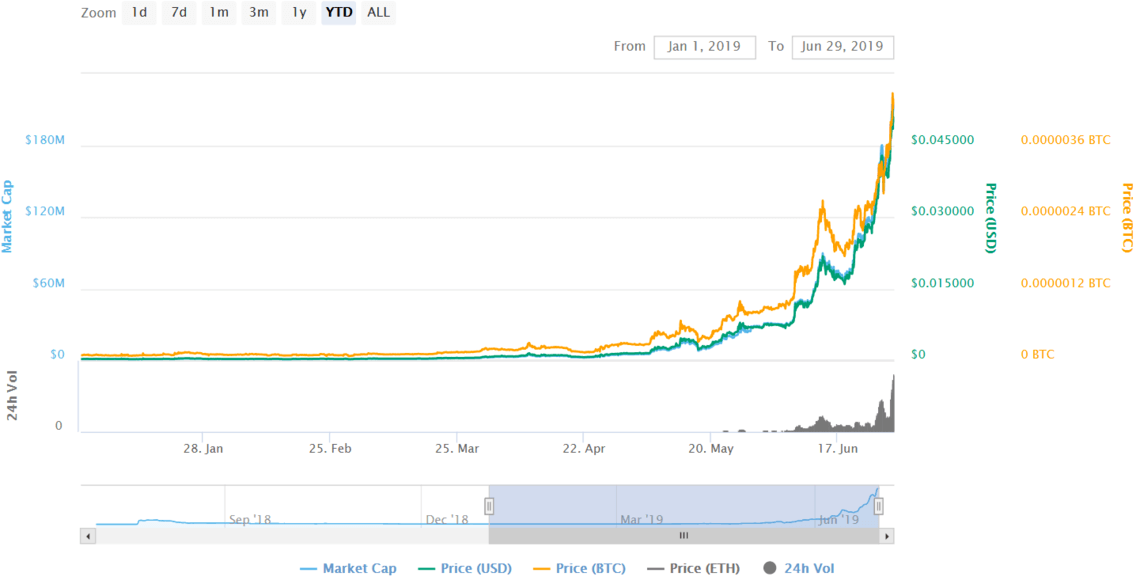

Egretia (EGT): +15,455%

This little-known altcoin burst onto the scene in mid-June when a 170% weekly surge sent it marching into the market cap top hundred. Self-described as “the world’s first HTML5 blockchain engine and platform”, EGT is 2019’s best performer by a mile.

From January 1st’s starting point of $0.000342, the value of EGT has done nothing but soar – climbing to $0.053200 at the time of writing.

That amounts to ridiculous 15,455% gains and leaves EGT ranked 42nd in the world. Egretia is an Ethereum-based token, overseen by Egret Technology, a publicly-traded company out of China.

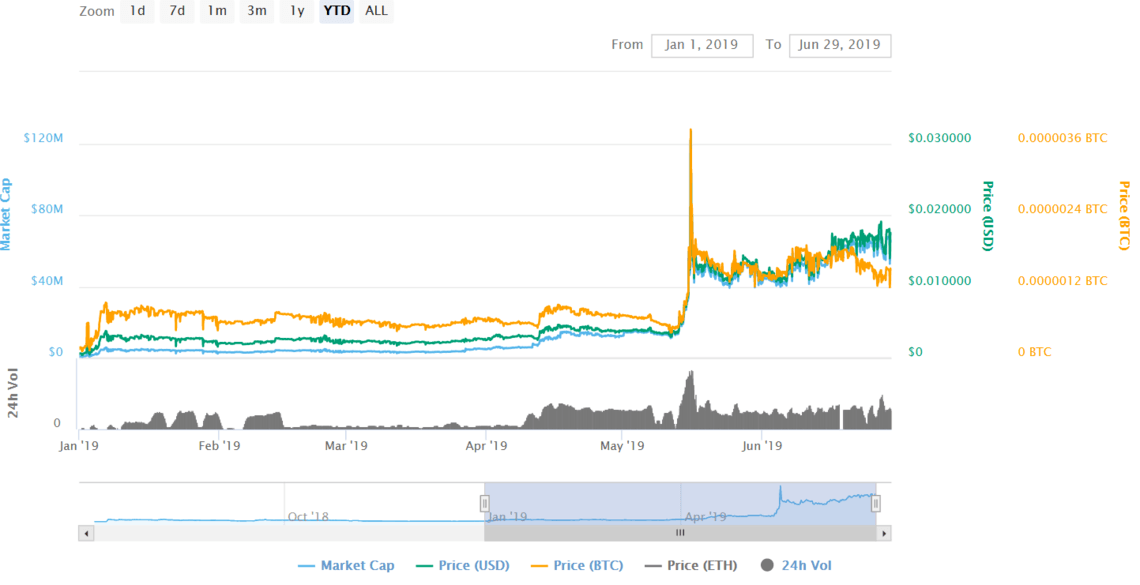

Clipper Coin (CCCX): +2,905%

Clipper Coin (CCCX) launched in mid-2018, bearing the promise of bringing professional financial services to the blockchain. That includes setting up a standardized rating system for ICO launches to provide “objective project valuations”.

The evolution of ICOs into IEOs in the meantime hasn’t stopped Clipper Coin’s growth. CCCX is up 2,905% for the year, climbing from a token price of $0.000597 up to $0.017404.

CCCX only just makes this list by virtue of being ranked 100th by market cap – a position which changes hands regularly.

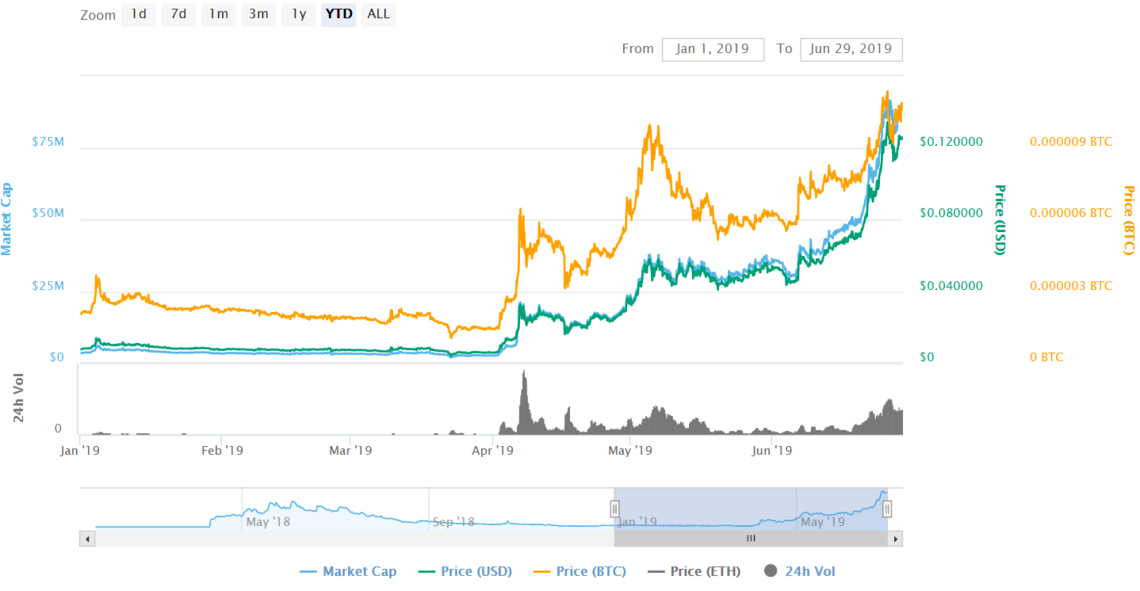

EDUCare (EKT) : +1,567%

EDUCare (EKT) launched right in the middle of January 2018’s altcoin bull run and immediately soared to an all-time high which still stands to this day.

But like most crypto tokens born in a bull market, the only way for EKT to go was down, and it subsequently lost over 99% of its value throughout the rest of 2018.

Since the turn of the year, however, the Ethereum-based multi-chain platform came backfiring. The coin price soared from $0.007651 all the way to $0.127585, leaving EKT up 1,567% since January.

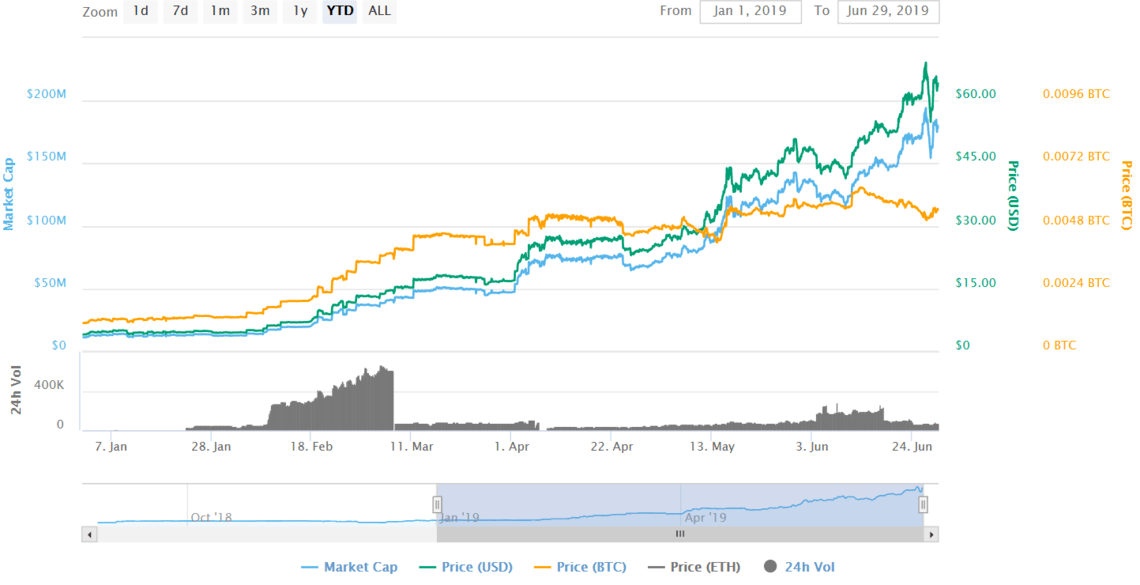

Qubitica (QBIT) : +1,487%

This top fifty ranked altcoin launched in late 2018, and declined right up until the turn of the year. Being born in a bear market didn’t stop QBIT from recording 1,487% growth since the turn of the year.

That carried the token price from $4.09, all the way up to $64.92 by the time of writing. An all-time high was set on June 26th at $70, but Bitcoin’s sharp decline dragged QBIT down with it.

Self-described as a “decentralized global community of developers, companies, and organizations”, the goal of Qubitica is to “share innovations in the field of DAOs (Decentralized Autonomous Organizations)”. QBIT tokens are required to participate in the community.

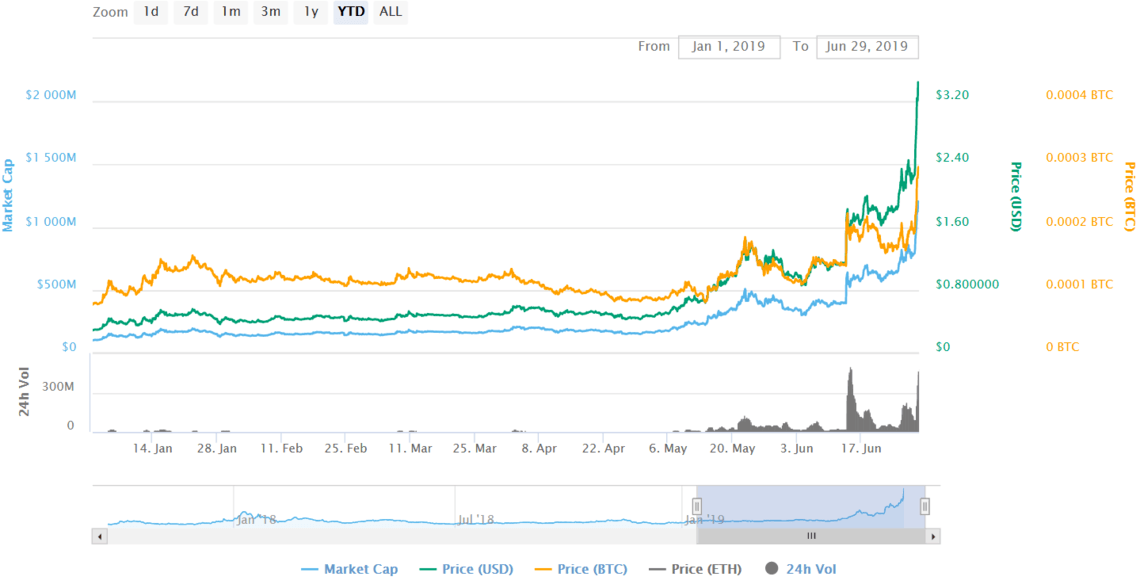

ChainLink (LINK): +1,416%

One of the biggest success stories of the year so far, ChainLink had a great month in June. First it was picked up by Google as a blockchain oracle provider , as the firm tested linking its cloud data platform with Ethereum.

Shortly thereafter it was announced that ChainLink (LINK) would be added to Coinbase . Within that two week timespan, the value of LINK almost trebled.

And since the turn of the year ChainLink has seen more than 10x growth, climbing from a price of $0.289485 up to $4.39.

That’s 1,416% growth, with more than 100% coming on June 29th alone as Link struck a new all-time high.

Crypto Losers in 2019

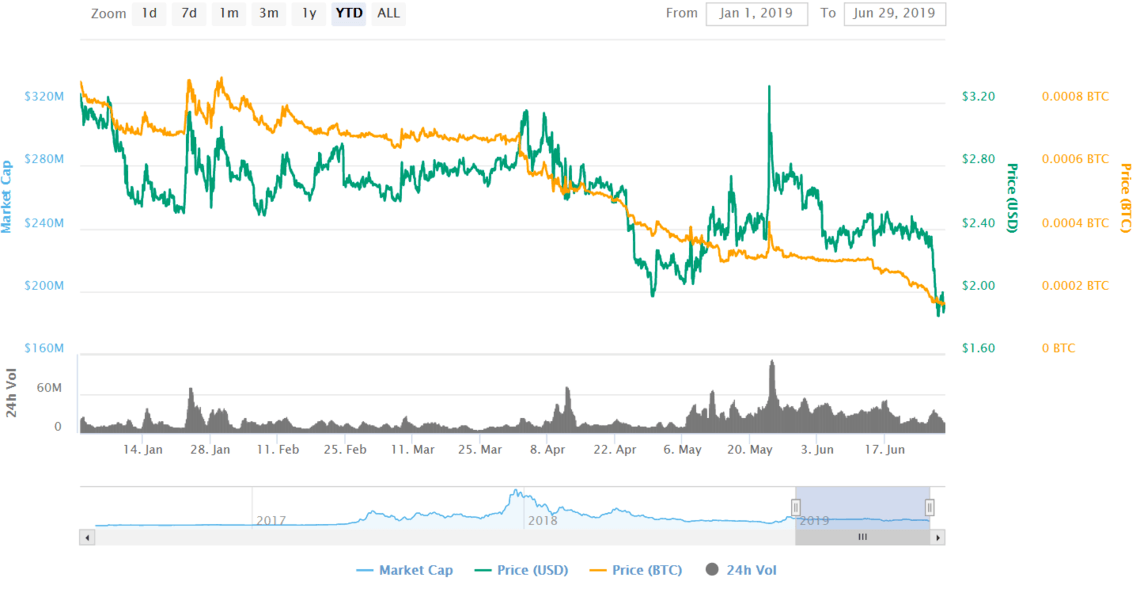

Waves (WAVES): -40%

Blockchain platform Waves recorded nearly 400% growth between November and December of 2018 alone. If market equilibrium is a real phenomena then that might explain why Waves has been lagging so far in 2019.

From the January 1st coin price of $3.26, the value of Waves has dropped to $1.93. That leaves anyone who bought in at New Year down 40%. Waves is ranked around the top fifty coins by market cap, and has existed since early 2016.

Stratis (STRAT): -17%

This blockchain-as-a-service provider is up over 6,000% since its launch date in 2016. But since the beginning of 2019 STRAT’s performance has been less spectacular.

From a coin price of $1.08, the value of STRAT dropped to $0.888714 by the end of June – marking a 17% loss.

Stratis is ranked outside the top 90 by market cap and looked like it was set for a good year when it more than doubled in December 2018. Since then, it’s been nothing but downward momentum.

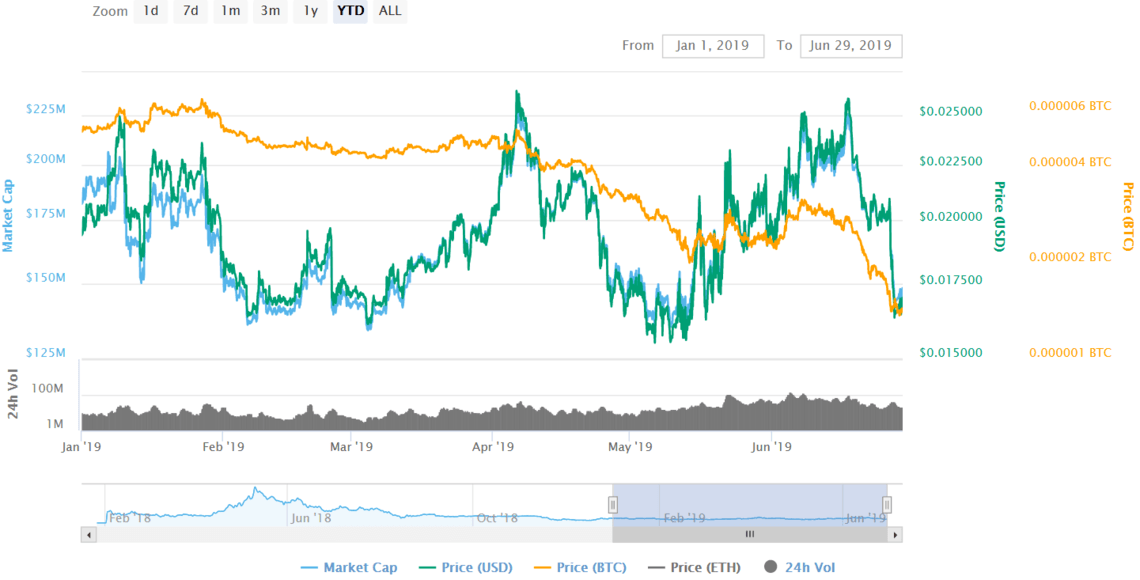

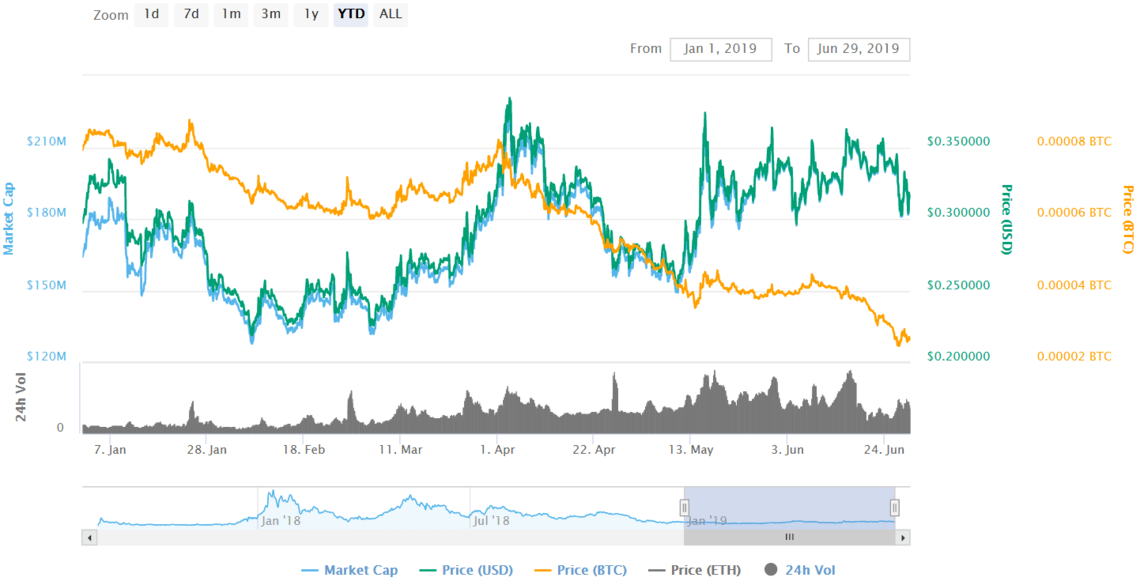

Zilliqa (ZIL): -11%

Zilliqa (ZIL) lost 11% of its value since January, as the token price fell from $0.019417 down to $0.017171.

Ranked among the top 70 by market cap, Zilliqa is another coin which pumped like crazy in 2018, only to cool off considerably moving into the new year.

That’s despite the spread of rumors that Facebook was lining up Zilliqa for use in its own blockchain venture back in December, and the launch of the Zilliqa mainnet earlier this year.

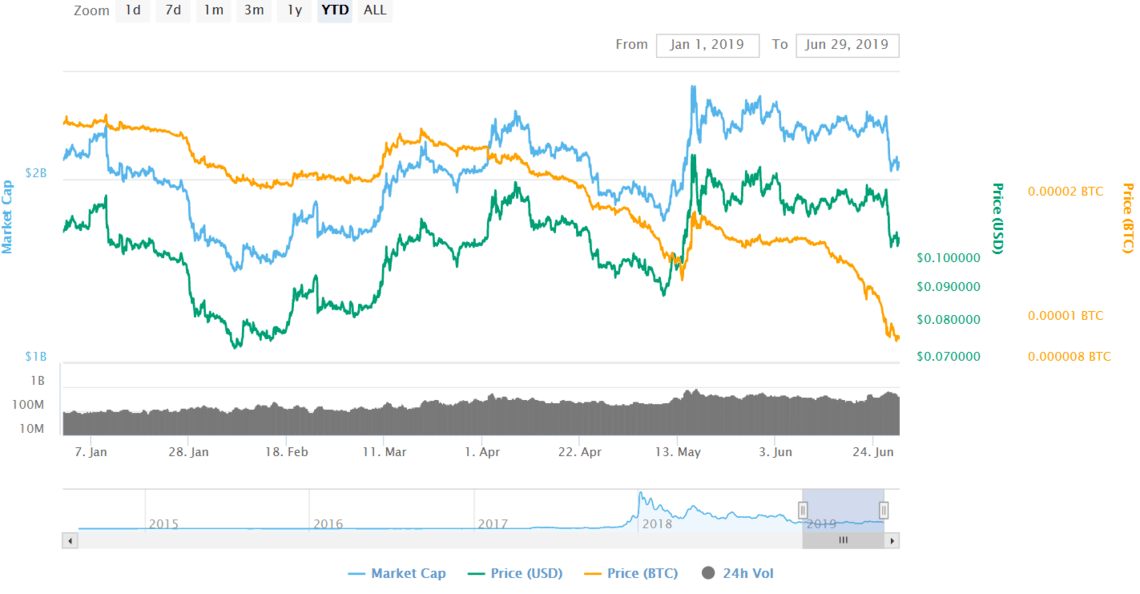

Stellar (XLM): -2.4%

Previously a mainstay feature of the market cap top 10, Stellar now finds itself ranked 12th after failing to keep up with recent market movements.

From the January 1st price of $0.113861, the value of XLM declined by 2.4% over the past half-year, falling to $0.111085. XLM’s performance against BTC was even worse – falling 69% as it dropped from around 3,000 satoshis to just over 900.

Stellar’s stagnation comes as a surprise given recent developments. Digital asset management firm Greyscale launched an XLM-based trust in January. Stellar was also snagged as a partner by EU-based crypto exchange, Wirex, in April.

0x (ZRX): +5%

Staying among coins in the top 100, the worst performers of the year don’t necessarily need to have recorded losses. That’s the case for 0x (ZRX), which is up 5% against the dollar – the lowest positive growth among all major cryptos.

ZRX made modest gains, climbing from $0.297092 up to $0.314888. The coin’s performance against BTC was much worse, as ZRX’s satoshi value fell from 7920 to 2628 – a drop of 66%.

Note: This list excludes projects which launched during 2019, like the Bitfinex token – UNUS SED LEO (LEO), and Cosmos (ATOM) . It also excludes stablecoins. Data accurate as of June 29th.