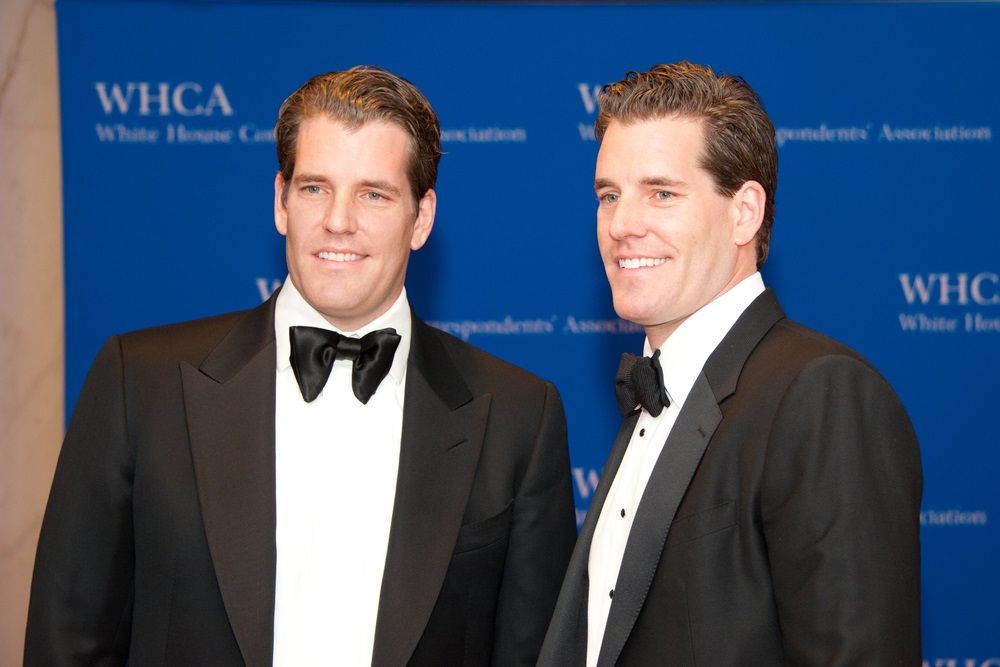

Winklevoss-Led Gemini Becomes ‘World’s First Licensed Zcash Exchange’

Source: Shutterstock

Gemini has become the “world’s first licensed Zcash exchange,” the company announced on Monday.

The New York City-based cryptocurrency exchange — which was founded by Cameron and Tyler Winklevoss — today revealed that it will open zcash trading markets (ZEC/USD, ZEC/BTC, and ZEC/ETH), which it says makes it the “first licensed Zcash in the world.”

Zcash will be just the third cryptocurrency listed on Gemini. At present, the platform supports trading pairs for bitcoin and ether.

“Zcash picks up where Bitcoin left off,” Tyler Winklevoss, CEO of Gemini, said in a statement, adding “Bitcoin has many strengths, but privacy is not one of them.”

“Bitcoin and Zcash are two revolutionary technologies vying for different mantles,” added Cameron Winklevoss, the exchange’s president. “Bitcoin being digital gold and Zcash being digital cash.”

The addition of zcash — a privacy-centric cryptocurrency — is notable, given that Gemini is regulated by the New York State Department of Financial Services (NYDFS), whose “BitLicense” framework is considered to be one of the most strict regulatory regimes faced by US cryptocurrency exchanges.

The exchange said that it went through an extensive approval process with the NYDFS before formally deciding to support zcash trading. At launch, users will be able to make deposits from both shielded and unshielded addresses, but they will only be able to withdraw funds to unshielded address — likely due to concerns over compliance with anti-money laundering (AML) regulations.

“This action continues New York’s longstanding commitment to innovation and leadership in the global marketplace. With smart and thorough regulatory oversight, the development and long-term growth of the industry will remain thriving,” said Maria T. Vullo, superintendent of the NYDFS.

ZEC markets will officially open for trading on Tuesday at 9:30 am EDT, but customers can begin making ZEC deposits on Saturday, May 19.

Notably, Gemini supplies pricing data to Chicago derivatives exchange CBOE, which was the first regulated US platform to create a bitcoin futures product. CBOE has not been shy about its desire to list more cryptocurrency-based derivatives, so the addition of this asset to Gemini could hasten the production of zcash futures.

The NYDFS has also given Gemini approval to list bitcoin cash and litecoin, though the exchange has not yet announced plans to do so.

The zcash price surged following the unexpected announcement, peaking as high as $345 on Bitfinex before settling down to a present value of $331. This represents a 24-hour increase of approximately 32 percent.

Images from Shutterstock