While Dow Surges, This Key Metric Reveals Professional Investors are Calling the US Stock Market’s Bluff

The ongoing Dow Jones really indicates that the bulls have the upper hand on Wall Street, but Gary Shilling warns that the market could suffer a reckoning. | Source: Shutterstock

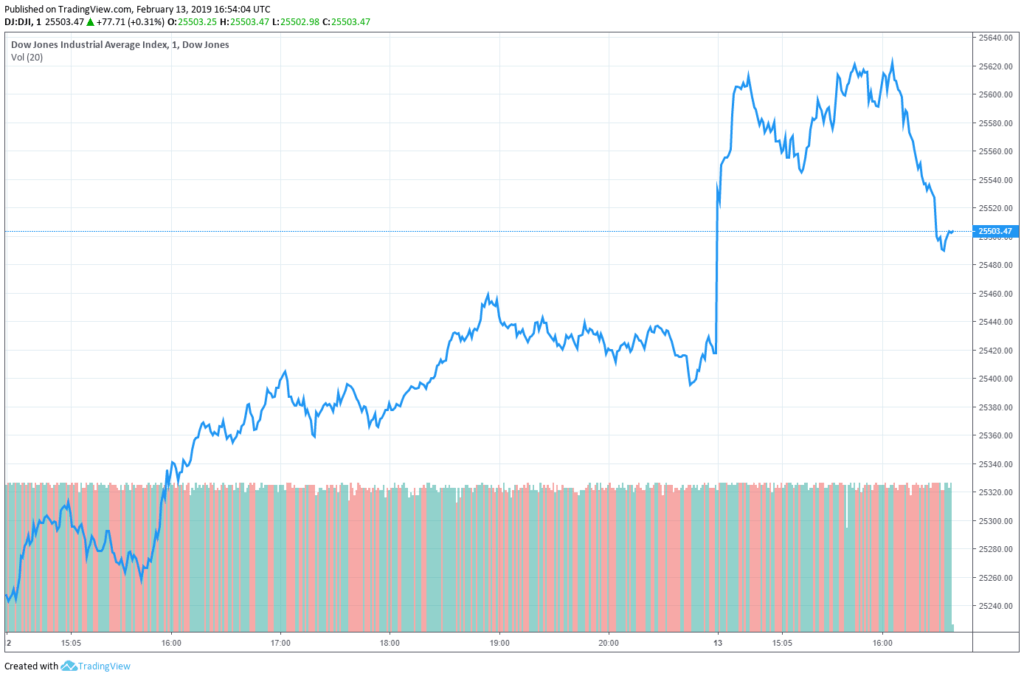

The Dow and wider US stock market raced higher on Wednesday, adding to Tuesday’s mammoth 372 point gain.

Dow Builds on 372 Point Rally

Traders are excited that efforts are underway to avoid the government shutdown. While that was good news, investors were particularly enamored with news over China tariff negotiations. This was based on some optimistic words from President Donald Trump.

The S&P 500 closed above its 200-day moving average, which it hadn’t seen since Dec. 3, and analysts such as Fundstrat’s Tom Lee said that this was a bullish flag for the stock market’s performance in 2019.

As Stock Market Flashes Green, Pros Flee to Cash

Tuesday’s market gains were naturally great news, but some market players were throwing shade on the equities rally before the closing bell even rang.

For example, Bank of America Merrill Lynch published a survey that gauges where professionals around the world are positioning their investments. Despite the recent highs in the stock market, professionals aren’t taking hefty positions in equities. Instead, they are beefing up their cash positions.

The survey showed the biggest net overweight position cash positions being taken since January 2009. The time period is symbolic because it marks the months ahead of the market’s bottom. It was also the beginning of the longest bull run in Wall Street history, CNBC noted in its reporting on the survey.

According to the survey:

“Allocations to global equities fell 12 percentage points to a 6 percent overweight, or the level compared with what would be typical. That’s the lowest since the market turbulence of September 2016.”

Bank of America’s chief investment strategist said that despite the recent rally, investor sentiment remains bearish. Sentiment moving to extremes has been a reliable contrarian indicator for the market historically, CNBC points out.

He added:

“Fund managers’ positioning is still a Q1 positive for risk assets.”

Concerns remain about global growth, as 55% of those surveyed say they are pessimistic about the economy and inflation.

Pundits Stress A Recession Is Coming

Bank of America’s findings about global growth and economic concerns are being bandied about everywhere.

Earlier this month, CCN.com reported that Raymond James said the U.S. stock market has no more room left to grow.

Paul Tudor Jones, founder and CIO of Tudor Investment, weighed in, saying he’s very bullish on the U.S. stock market.

He said:

“Last year we walked into a situation with a lot of euphoria and a huge amount of investor positioning long equities in the U.S. and globally. We took those positions and pretty much washed them into a trillion dollars of corporate buybacks.

“Fast forward to where we are today, all that leverage position in particular from the long-short community, the macro community, discretionary asset managers, that’s all been washed out. But we still have, like a terminator, one trillion-plus in buybacks.”

CCN.com recently reported that George Maris, the co-head of equities of Americas at Janus Henderson, is also worried about a recession. He argued that a recession in the U.S. clearly remains a near-term risk, which could fully reverse the bullish trend of the U.S. stock market.

And yet the Dow continues to move higher.

Featured Image from Shutterstock