WeWork IPO Likely Delayed. The Writing Was on the Wall

The WeWork IPO that was originally expected to happen this month is now postponed until October or later, the Journal reports. | Credit: Reuters

WeWork, the flexible workspace wonder, is taking a cue from the stock market. The newest unicorn has decided to delay its upcoming IPO, according to The Wall Street Journal , and in doing so is saving face with investors – for now. WeWork’s abrupt decision comes just as the company planned to launch its roadshow to drum up support for the new offering, demand that already began to fade amid a valuation that was slashed by more than half in recent days.

The truth is that the stock market hasn’t been kind to high-profile IPOs this year, and WeWork was about to wade into the very same waters that have punished the likes of Uber and Lyft for similar issues that the workspace startup struggles with. The good news is they decided to wait. The bad news is they could still make their public market debut before year-end.

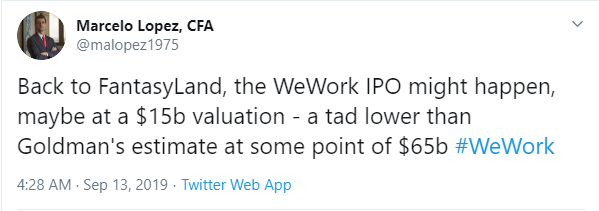

The WeWork IPO that was originally expected to happen this month is now postponed until October or later, the Journal reports. While the decision to delay may have been a reality check for WeWork CEO Adam Neumann, Wall Street saw it coming, including hedge fund Marcelo Lopez, who tweeted:

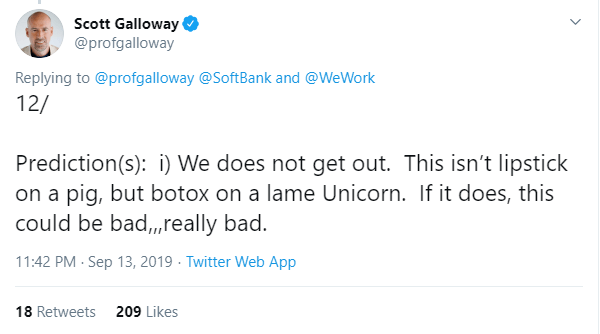

Chief among investors’ concerns are the company’s governance structure and its ability to turn a profit amid mounting losses. WeWork, whose official name is We Co, already made a host of concessions amid lagging demand for its shares, including slashing the voting rights of the CEO in half as well as seemingly giving the board more control over Neumann’s fate. This, coupled with an anticipated $750 million capital injection by Japan’s SoftBank, has done little to allay investors’ fears. In fact, it may have just made things worse considering that SoftBank would have the potential to exit the stock and leave investors holding the bag. Professor of Marketing at NYU Stern Scott Galloway warns investors:

Shortly after its market debut, Lyft faced a class-action lawsuit for allegedly misleading investors. WeWork might want to tread lightly if it wades into the IPO waters at all.