Warren Buffett’s Berkshire Hathaway Bloodbath Warns of Monday Market Crash

Wall Street is bracing for a tense Monday session following Berkshire Hathaway's disastrous earnings call. | Image: AP Photo/Richard Drew

- Warrant Buffett’s Berkshire Hathaway took big losses in the Q1 2020.

- Berkshire’s dump of airlines sets the stock market up for Monday Massacre.

- Renewed trade tensions and Amazon’s stall, on top of Berkshire news, also threaten to crash the market.

Warren Buffett may have just set up the next leg of a significant stock market crash. At Berkshire Hathaway’s 2020 annual meeting, Buffett admitted that even oracles make big mistakes.

Berkshire Hathaway Falls Out of the Air

Getting back into airline stocks–something Buffett once promised he’d never do again–resulted in a hard landing for Berkshire’s first quarter.

Buffett once joked he would declare himself an “air-o-holic” if he ever invested in airlines again, but, in 2016, he jumped back in the cockpit.

Unsure now of where the industry will eventually land, the Berkshire pilot chose to eject once again :

The world has changed for the airlines. And I don’t know how it’s changed…. I don’t know if Americans have now changed their habits … because of the extended period [of coronavirus lockdown]…. I think there are certain industries … the airline industry among others … that are really hurt by a forced shutdown … far beyond our control…. It turned out I was wrong about that business….

Conducting a live-stream meeting during the coronavirus lockdown, Buffett announced that Berkshire sold off Delta and Southwest Airlines shortly after the coronavirus shutdown of the transportation industry began.

All told, $6.5 billion worth of United, American, Southwest and Delta Airlines flew out the window.

The airline business — and I may be wrong and I hope I’m wrong — but I think it’s changed in a very major way.

Does Berkshire Set Up a Monday Morning Market Crash?

Because of Buffett’s announcement that Berkshire Hathaway ultimately scrapped all of its airline stocks, the transportation sector is virtually guaranteed a Monday morning massacre. Dow theory says falling transportation stocks lead the market down, and this weekend’s news will be another significant blow for the trannies.

That may plunge the whole stock market into a nosedive right off the tarmac.

However, there’s a bigger picture than just Buffett ditching airlines. Buffett reported an unrealized $50 billion Q1 loss and confirmed that Berkshire Hathaway isn’t buying any stocks at today’s prices .

We have not done anything because we haven’t seen anything that attractive to do.

Berkshire is hoarding a record $137 billion in cash. That indicates other anxious investors would be better off staying in cash than moving back into stocks right now if they want to follow the great leader.

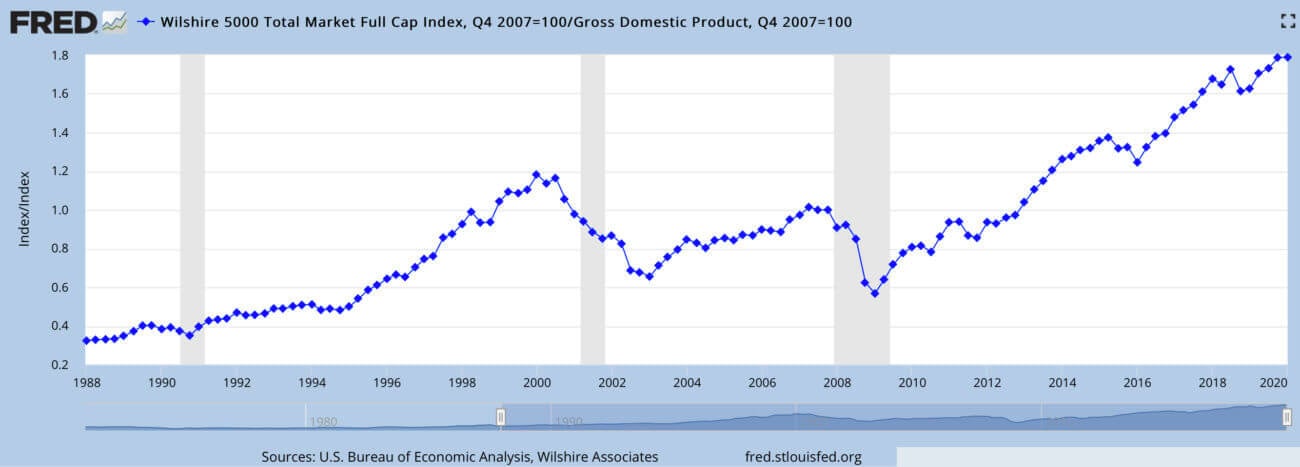

Berkshire’s position says the recent stock market rally has taken shares back to being overvalued. So, the heavy investor is holding out for better bargains. It’s easy to see why when one looks at the “Buffet Indicator.”

Warren Buffet’s favorite gauge of whether stocks are overvalued has not come down in the present crash , but has shot up to record levels:

Warren Buffett’s preferred stock-market gauge hit a record high, signaling that stocks are overvalued and that a crash could be coming. The “Buffett indicator” divides the total value of publicly traded stocks by quarterly GDP. “It is probably the best single measure of where valuations stand at any given moment,” Buffett wrote in a Fortune magazine article in 2001. The famed investor and Berkshire Hathaway boss said it was “a very strong warning signal….” It has a strong track record of predicting downturns.

Buffett’s annual meeting comments show he doesn’t believe the market has put in a bottom. That means he doesn’t believe the current rally is anything more than a bear-market bounce–a bull trap.

Buffett implied the rally is due to the Fed reacting so quickly to the coronavirus pandemic. The speed of the Fed’s maneuvers took Berkshire by surprise, sending stock prices back up before Berkshire could decide on what to buy.

Warren Buffet Speaks

When the Oracle of Omaha speaks, all investors listen. Many investors are guided by Berkshire Hathaway’s positions, and they were anxiously waiting to find out what Berkshire was up to.

Now they know, and what they now know is not likely to encourage market bulls on Monday.

Buffet even said that Berkshire’s own stocks don’t look like a bargain he wants to pick up right now. Apparently, he’ll wait until Berkshire’s value plummets before he’s willing to put any cash into buying back Berkshire Hathaway stocks.

Maybe Buffett’s announcement will help jigger Berkshire Hathaway stocks into a classic Buffett bargain on Monday.

Now really showing his age, the near 90-year-old said,

I don’t know the effect of shutting down our economy…. It hurts some of our businesses a lot.

https://youtu.be/6zuH68qKEHQ

It’s entirely possible a zombie apocalypse looms for the stock market on Monday morning now that the oracle has spoken but not just because he’s spoken.

Other significant forces are pushing the market into a stall and possibly a Monday-morning crash , besides the fact that America’s most famous and successful investor is sitting out the storm-namely, Trump is giving up on the Dow at the worst possible time.

On top of that, Amazon just popped the bubble that said tech stocks were unstoppable. Five leading techs were the only lift the market had. Jeff Bezos suggested investors sit down and buckle their seatbelts before he told them all Amazon profits would be going toward coronavirus costs. No profits ahead.

Amazon’s return to earth, as the biggest of all tech stocks, forewarns investors that the other FAAMB tech companies can fall from the sky under the harsh reality of the coronacrisis, too.

All that Friday momentum may continue down with the extra shove of Berkshire Hathaway’s positions. So, expect a little buffeting on Monday’s flight.

The Oracle of Omaha’s best advice for this journey :

I don’t believe anybody knows what the market is going to do tomorrow. Don’t bet on the stock market. Bet on America.”

Because the stock market, as Buffett notes, can crash on any day.

Disclaimer: The opinions expressed in this article reflect the author’s opinions and should not be considered investment advice from CCN.com.