Warren Buffett Broke His Cardinal Rules for Investing By Purchasing Airline Stocks

Did the Oracle of Omaha misread the airline industry? | Image: REUTERS/Rick Wilking/File Photo

- In a rare move, Warren Buffett has disposed of shares in an airline around a month after adding a stake.

- The move suggests Berkshire Hathaway lacks confidence in airlines over the short term.

- A government bailout of airlines has proved to be no sweetener for the Oracle of Omaha.

A little over a month ago, the Warren Buffett-led investing conglomerate added its stake in Delta Air Lines (NYSE: DAL) by nearly a million shares. But in a dramatic turn of events, Berkshire Hathaway (NYSE:BRK.A) has reversed course and reduced its stake in the carrier by nearly 20% .

Berkshire has also sold off shares in Southwest Airlines (NYSE:LUV).

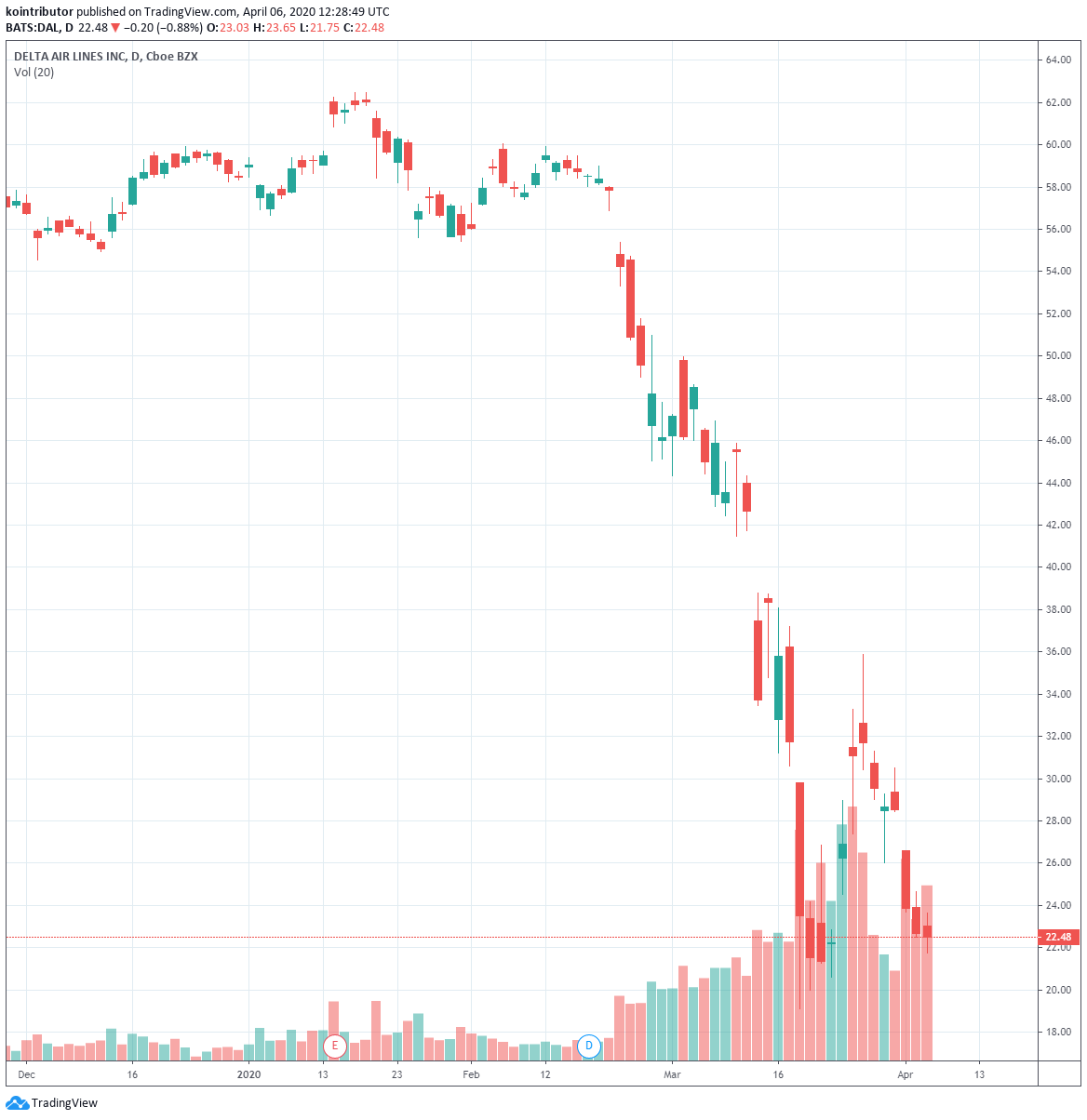

Buffett’s stakes in the big-four U.S. airlines have plummeted over 50% year-to-date.

Delta, which was Berkshire’s biggest airline holding, has lost over 60% of its value since the beginning of the year. Berkshire boosted its stake in the carrier only last month.

Why Buffett is reducing his stake in airlines

Buffett recommends investors to “be fearful when others are greedy” and “greedy when others are fearful.”

With airline stocks being some of the worst-hit equities by the coronavirus pandemic, it’s hard to argue that Buffett is not being fearful along with the herd.

The only question: Why is the Oracle of Omaha bowing out when the federal government is set to bail out airlines ?

Myriad problems suggest the mess airlines are currently in will take long to be cleared. It’s no secret that airlines are highly leveraged.

Before air travel was disrupted by the coronavirus pandemic, the largest four U.S. airlines collectively held around $76 billion in debt.

With the government bailout, the problem will only get worse as another form of leverage is added.

Burning cash like there’s no tomorrow

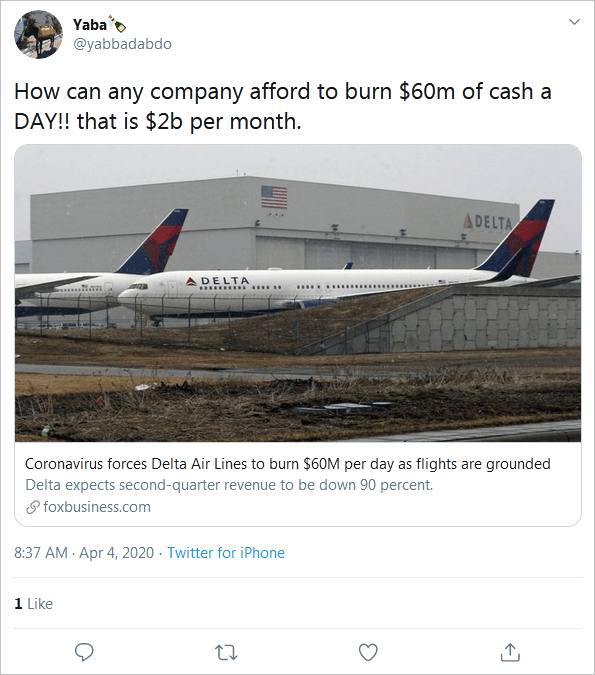

With thousands of flights canceled, the cash burn rate of airlines is soaring. The few remaining flights are operating at drastically reduced capacity.

For instance, Delta is estimated to be burning through cash at a rate of $60 million per day .

Airlines For America (A4A) estimates that U.S. carriers are collectively burning through cash at a rate of approximately $10 billion per month .

With air travel not expected to resume to pre-COVID-19 levels until after a cure or a vaccine is found, expect the cash burn rate to continue worsening.

Even after air travel returns to pre-coronavirus levels, airline stocks are unlikely to enjoy any upside. This is yet another reason for Warren Buffett to slash his stakes in them.

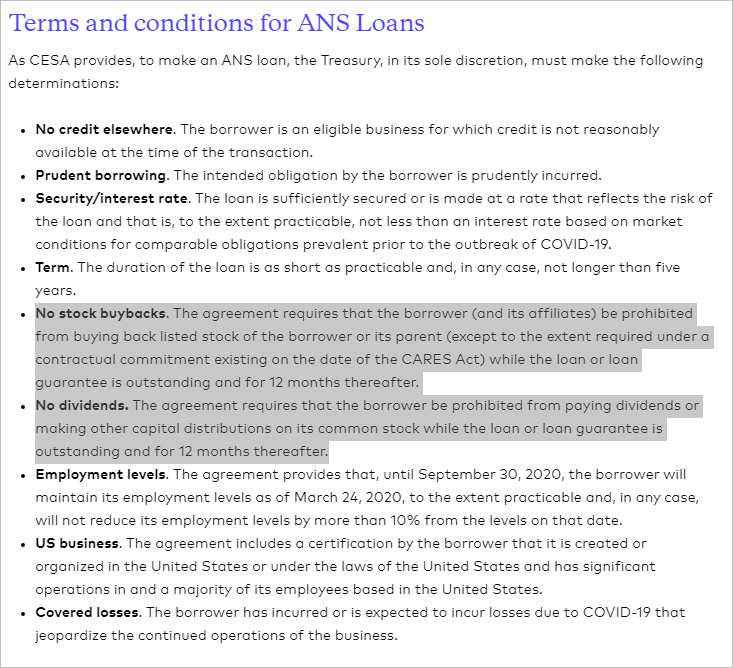

Bailout conditions stipulate that airlines, and other corporate beneficiaries of government assistance, will not be allowed to buy back shares. This will apply until 12 months from the date of the loan being fully repaid.

The airlines will additionally not be allowed to pay dividends until 12 months after the loan has been repaid.

Did Buffett break a key investing rule?

The plunge in airline stocks is especially galling for Buffett considering he has long been skeptical of them.

After staying away from airline stocks for most of the 20th century, Buffett bought stakes in the big four U.S. airlines in the middle of the last decade. This was on the “hope” that their money-losing days were over.

In 2017, he said:

It’s true that the airlines had a bad 20th century. They’re like the Chicago Cubs. And they got that bad century out of the way, I hope.

Well, hope has once again been revealed to be a poor investing strategy.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.