USD-Pegged Cryptocurrency Tether Returns to Dollar Parity as Supply Sinks

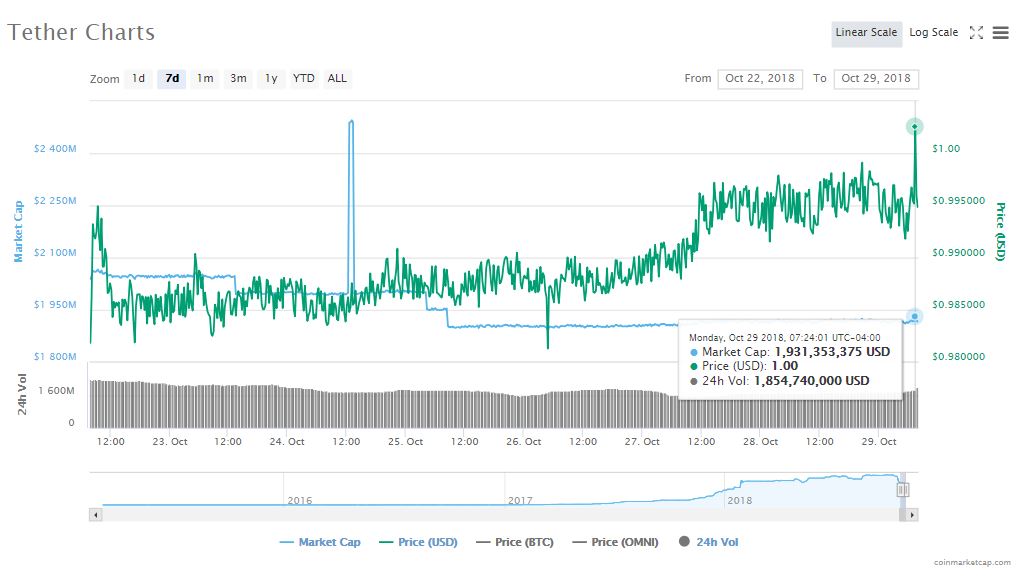

Tether (USDT), the USD-pegged cryptocurrency that spent nearly half of October trading below $1.00, finally returned to dollar parity on Monday, though it remains to be seen whether it will stay there amid mounting competition from heavyweight competitors.

Tether [Briefly] Returns to Dollar Parity

The controversial stablecoin, which is supposedly backed by physical USD at a 1:1 ratio, briefly touched the $1.00 mark this morning, putting a temporary end to the USDT/USD discount that originated at the beginning of October.

Initially, that discount represented just a fraction of a cent. However, it gradually deepened throughout the first half of the month until Oct. 15, when the USDT/USD peg snapped completely, sending the tether price as low as $0.92 on the global market and careening as far as $0.85 in Kraken’s lightly-traded USDT/USD market.

Nevertheless, the tether price steadily crept back toward dollar parity, bolstered by the redemption of hundreds of millions of dollars worth of USDT tokens, which helped restore confidence in issuer Tether Limited’s claim that it is holding enough funds to cover the outstanding tokens.

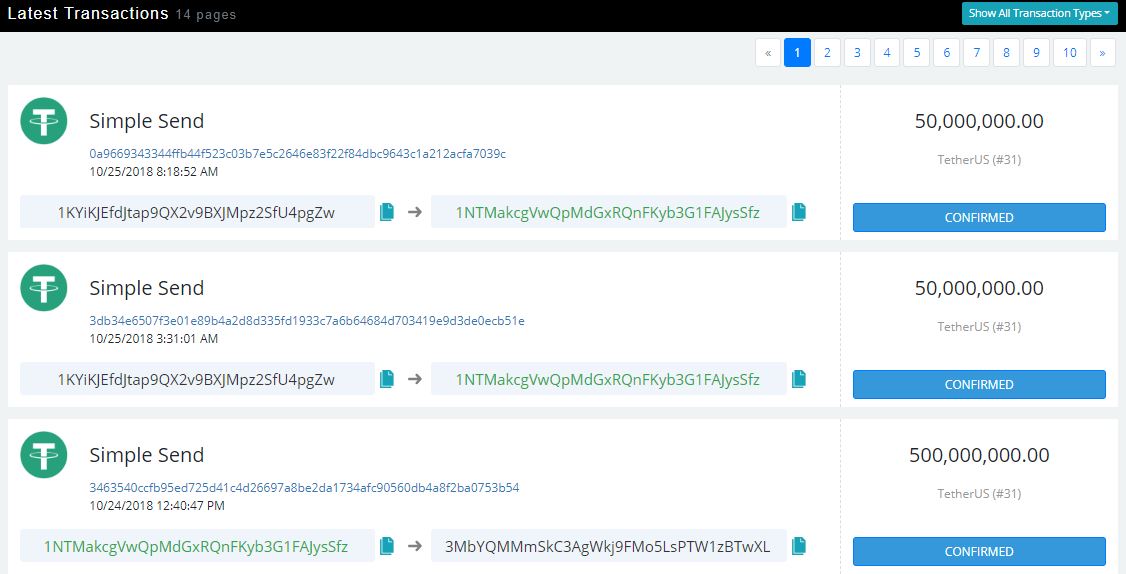

As CCN.com reported, those redemptions caused tether’s market circulating supply and market cap to plummet throughout the month. Two transactions made last Thursday diminished the USDT supply by a further 100 million, reducing the USDT supply to 1.9 billion units, down nearly one-third from the more than 2.8 billion tokens that were circulating just three weeks ago.

Altogether, USDT holders have redeemed $890 million worth of tether tokens during the month of October. Indeed, the number of non-circulating tokens sitting in the Tether Treasury grew so large that the firm permanently destroyed 500 million of them, leaving the remainder in the treasury address to account for new capital inflows.

USD-Backed Cryptocurrency Competition Intensifies

However, whether tether will see many new capital inflows remains an open question, given the flowering of competition that has entered the stablecoin market, long dominated by USDT. TrueUSD (TUSD), which launched earlier this year, currently has a $179 million market cap, though USD Coin (USDC) — issued concurrently by Circle and Coinbase through the CENTRE consortium — is quickly gaining ground with a $126 million valuation. Paxos Standard (PAX) has also emerged as a strong challenger, dwarfing USDC’s trading volume despite a smaller market cap. Gemini Dollar (GUSD) has been slower out of the gate but still boasts strong backing.

Tether remains the most liquid stablecoin (and it’s not even close), with more than $2.2 billion in daily turnover — including $223 million in a single trading pair, BTC/USDT on OKEx. However, paying $1.00 for a cryptocurrency token that is worth less than that amount is not an enticing prospect, so one would expect inflows to slow, at least until USDT demonstrates that it can sustain its USD peg.

By the time of writing, tether had slipped ever-so-slightly below that peg and was priced at a global average $0.995. Notably, it continued to trade somewhat lower, at $0.986, when positioned directly against the dollar on Kraken and other cryptocurrency exchanges with USDT/USD markets.

Featured Image from Shutterstock