The U.S. Housing Market Crash Has Begun, Unofficially

A recent plunge in listing prices suggests the U.S. housing market crash may already be under way. | Image: AP Photo/Elise Amendola

- New homes in the U.S. are being listed at a discount.

- The lack of liquidity could force more sellers to list their properties at lower prices.

- Uncertain times ahead for the U.S. housing market as the coronavirus wrecks the economy.

The novel coronavirus pandemic is about to wreak havoc on the U.S. housing market. That is evident from Weiss Analytics’ latest report, which indicates a sharp decline in the asking price of newly-listed homes.

The report says that 25% of homes listed for sale are priced at a discount compared to pre-COVID-19 levels . This is not surprising, as housing sales have been plunging in the wake of the pandemic, which has probably forced sellers to list their properties for less to attract buyers.

Lower List Prices Point to Potential Crash

Weiss Analytics says that 30% of homes priced at $200,000 or less have been listed at a median discount of 6.3% compared to February. On the other hand, 37% of homes with a value of $600,000 or more have been listed at a median discount of 7.7%.

The price decline coincides with a drop in new home listings. Zillow estimates that listings of high-end homes have dropped 46%. Affordable homes have witnessed a 32% drop in new listings.

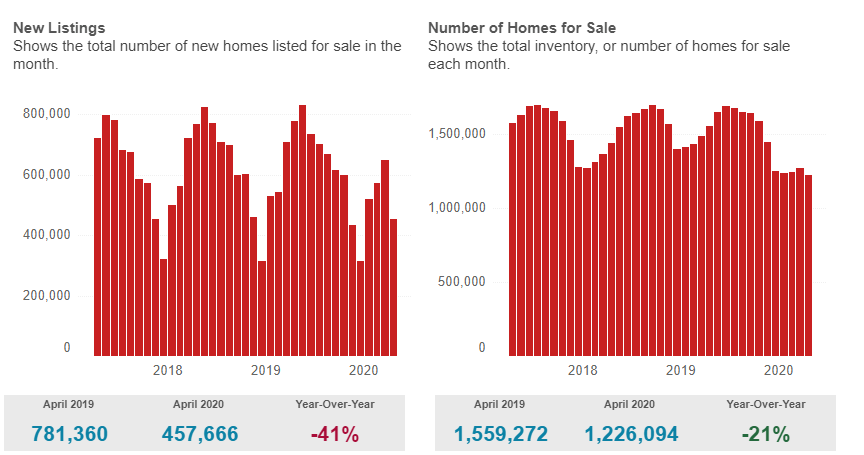

According to data from real estate listing firm Redfin , there was a sharp annual decline of 22.7% in home sales last month. At the same time, new listings plunged 41% annually in April. Housing inventory also declined by 21%.

Despite these headwinds, the median sale price increased 5% year-over-year to $304,000 during the month. But that’s not an indicator of long-term strength, as homes originally contracted for sale in prior months would have pushed prices higher.

The discounted rate of new listings provides a better idea of where the housing market is headed. It won’t be surprising to see sellers offer bigger discounts in the coming months as buying a home becomes more difficult despite low mortgage rates.

Prices Set to Go Further South

Housing market bulls believe that low mortgage rates in the U.S. will be a tailwind and help attract buyers. But that’s not a given as banks are tightening lending criteria in light of the worsening employment scenario.

The novel coronavirus pandemic has led 36.5 million Americans to file for unemployment claims over the past eight weeks. Consumer spending has taken a beating, and it is likely that outlays on big-ticket items such as a house will decline.

This has created fear among banks, which have decided to withdraw certain housing-related financial products in light of the employment crisis.

Declining employment prospects and a dismal macro environment could result in a flight to liquidity. In such a scenario, homeowners may be forced to put their houses on sale to get access to cash.

But getting a loan may not prove to be easy, and the number of potential buyers may not be big enough thanks to weak employment conditions. As a result, sellers may compete against each other to unload properties, resulting in higher discounts.

The recent drop in list prices indicates that the U.S. housing market may have started crashing already. But this may just be the beginning as the true impact of COVID-19 takes time to play out.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.