Traders: Bitcoin Price Recovery Above $3,400 May Lead to Strong Short-Term Rebound

Image: Shutterstock

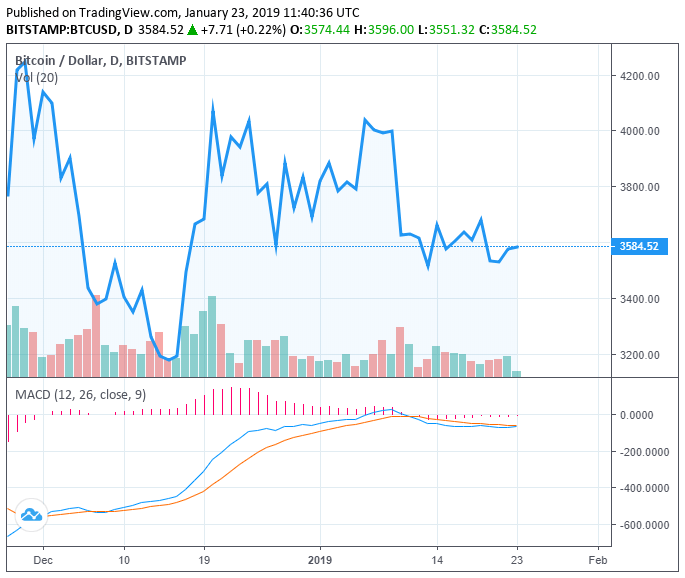

By CCN.com: On January 22, in a steep a sell-off, the Bitcoin price dropped from $3,615 to $3,401 by around six percent on the day.

Although a continuous fall below the $3,400 mark could have led to an extended sell-off throughout January, traders have said that the rebound of Bitcoin from a key support level could allow the asset to recover in the upcoming days.

Not Bullish But Not Bearish For Bitcoin

Since December 2018, the Bitcoin price has shown a high level of volatility in a low and tight price range. In the grand scheme of things, Bitcoin has shown stability in a range from $3,500 to $4,000 and has been unable to break out of or drop below key resistance or support levels.

Alex Krüger, a cryptocurrency analyst and economist, said that Bitcoin’s recovery from $3,400 in the past 48 hours has restored the balance in the short-term trend of the asset.

“BTC failure test of the $3450 weekend low (i.e. push down swiftly rejected) tilted balance back to the long side in the short term. Nothing too exciting though. Short term crumbs for traders. Don’t see any reason for a bullish trend to emerge until sometime after Feb/27,” the analyst said.

Traders including Krüger are in agreeance that Bitcoin has not shown any signs of a major trend reversal. But, its price movement on January 22 prevented a steep fall to the low $3,000 region.

Last month, Krüger explained that due to the volatility of Bitcoin in a low price range and the low probability of major crypto assets breaking out of important resistance levels, it is of less risk for traders to aim for longer trend changes.

He said :

In my opinion, investors likely better off waiting for a trend reversal or sentiment change to start buying. That said, price is around long term trendlines. From that perspective, these levels should be attractive for those with a bullish Bitcoin investment thesis.

Where are Other Crypto Assets Heading to?

Major crypto assets in the likes of Bitcoin Cash and EOS have recorded gains in the range of four to eight percent against the US dollar in the past 24 hours.

If Bitcoin continues to demonstrate short-term momentum in the next three to four days, alternative crypto assets and low market cap tokens are expected to record decent gains against both the dominant cryptocurrency and US dollar.

DonAlt, a cryptocurrency technical analyst, suggested that Bitcoin could still be vulnerable to a short-term drop unless it breaks out of $3,700.

While the daily volume of the cryptocurrency market has slightly declined since mid-January, the volume of Bitcoin remains strong at $5.5 billion, which could contribute to the gradual recovery of the asset.

Fueled by the positive trend of the price of BTC, the cryptocurrency market has added more than $3 billion in the last 24 hours to its valuation.