This Sleeper Chart is Forecasting a Sizzling U.S. Stock Market Rally

The economic fundamentals are pointing to complete support for a market to rally to last another six weeks, according to one Wall Street analyst. | Source:REUTERS/Lucas Jackson

- Economic Cycle Research co-founder Lakshman Achuthan says a summer uptrend in the U.S. stock market is imminent.

- Various fundamental factors shown by the “weekly leading index” suggest a smooth economic recovery that supports a rally expected to last a further six weeks.

- Two macro risks remain as significant threats against the ongoing rally of stocks.

Lakshman Achuthan, the co-founder of Economic Cycle Research Institute, believes a new stock market uptrend is brewing.

The strategist said that the U.S. stock market is closely following the trend of his “weekly leading index.” The index weighs various fundamental data points, including critical economic figures.

He said:

This weekly leading index objectively in an apolitical way tells us what do all these positives and negatives, the crosscurrents, add up to. So far, so good… The cyclical recovery is on track.

The U.S. stock market climbed another 1.78% on July 6, surging by more than 5% since June 26.

Strong fundamentals are backing the stock market recovery

Wall Street analysts remain cautiously optimistic towards the current stock market rally.

Echoing JPMorgan strategists last week, Achuthan stated investors have to remain “vigilant” while observing the economic recovery.

For now, the strategist emphasized that various fundamental factors are supporting the stock market rally. He does not believe that speculative mania around stocks will fizzle away in the near-term.

In recent days, the momentum of global equities further bolstered the uptrend of the U.S. stock market. Stocks in Asia, especially in China, recovered. The global trend hints at a rising appetite for risk-on assets across varying markets.

Welt market strategist Holger Zschaepitz said :

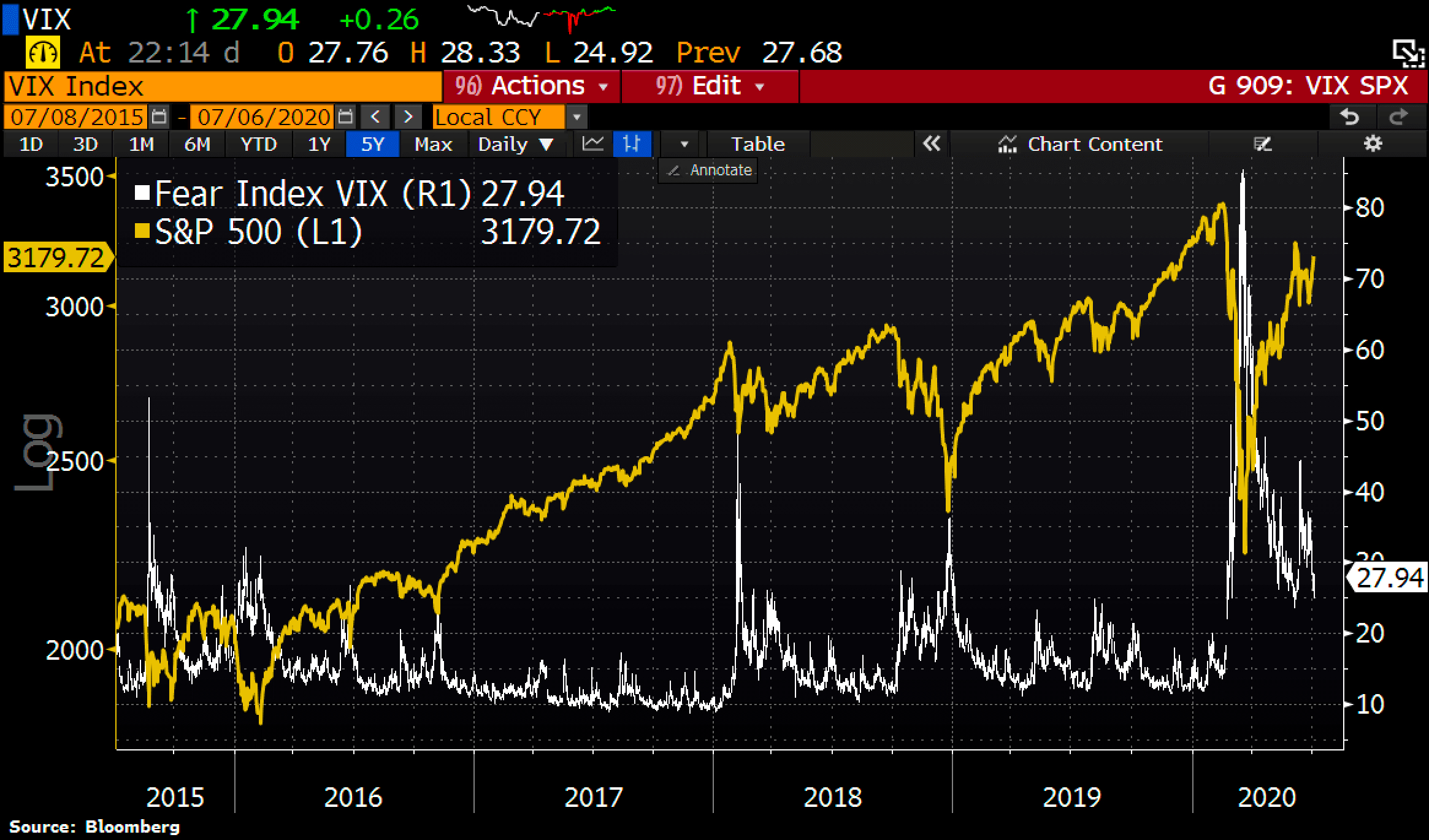

Wall Street traded up for the 5th straight day, following global equities higher. Sentiment positive after Shanghai Comp posted record-breaking gains, which was then reinforced by constructive US macro data. However, signs of caution remained. Gold continued rising, while VIX ended the day higher.

As economic data improve, such as the unemployment rate in the U.S., strategists foresee a smooth stock market recovery.

The resilience of the U.S. stock market despite struggles of reopening the economy across many states has investors positive.

Two significant macro risks remain

In the near-term, the U.S. stock market faces two grave threats that may hinder its recovery.

First, the U.S. government is placing additional pressure on China by clamping down on TikTok.

ByteDance, the parent company of the popular mobile application, is reportedly valued at $100 billion . There is a risk that China might respond with counter-measures against American companies to protect Chinese firms.

Intensified geopolitical risks amidst a weak economic recovery could hamper the momentum of U.S. stocks.

Second, a group of 239 scientists recommended the World Health Organization (WHO) to acknowledge the airborne-nature of the virus . Hundreds of scientists worldwide signed a letter to urge the WHO to recognize airborne-transmission.

Fear towards a new virus transmission route could accelerate uncertainty in the U.S. stock market.

The scientists said:

Most public health organizations, including the World Health Organization, do not recognize airborne transmission… but in our view, insufficient to provide protection from virus-carrying respiratory microdroplets released into the air by infected people.

Pre-market trading indicates a slight 0.7% drop, suggesting investors are treading cautiously in anticipation of the WHO’s decision.