This Brutal Bear Model Predicts Nightmare 70% Stock Market Crash

This bearish-outlook model is the most-painful thing you'll see today. | Source: REUTERS/Brendan McDermid

- U.S. stock market will bottom out as much as 79% – 89% below its record high, according to one researcher.

- His model, based on the Great Depression and dot-com bubble, predicts a final bottom in Q4 2022.

- But not everyone agrees. Wall Street is shifting back to risk-on mode as legend Howard Marks starts buying.

We’ve seen plenty of bearish stock market analysis lately, but this might be the most painful yet. According to one model, the Dow Jones and S&P 500 could still fall another 70% from today’s levels.

As you can see in the chart above, that would take us below even the deepest troughs of the Great Recession and the dot-com bubble.

Nightmare scenario for the stock market

That nightmare prediction comes from Bulls ’n’ Bears researcher Michael Markowski. He uses data from the Great Depression in the 1930s and the dot-com bubble to reach his conclusion. He predicts a three-year bear market, bottoming out at the end of 2022 .

The final bottom for the Crash of 2020 will occur in Q4 2022 with a decline of 79% to 89% below 2020 highs.

He says this recent crash shares the same “genealogy” as the Great Depression and will lead us into a drawn out contraction. Other analysts, including London’s Odey Asset Management have also used the Great Depression analogy .

89% wiped off the S&P 500?

According to Markowski, there will be plenty of spikes, relief rallies, and interim bottoms on the way down to his nightmare levels. Here are some of the milestones he predicts:

- New stock market lows by May 4th

- An interim bottom 41% – 44% below record highs by the end of the year.

- Final bottom in Q4 2022.

The recent bounce off the lows, he says, is a classic relief rally. This will top out before April 14th , according to his statistical analysis.

100% statistical probability is that the relief rally highs from the March 2020 lows have been reached or will be reached by April 14, 2020.

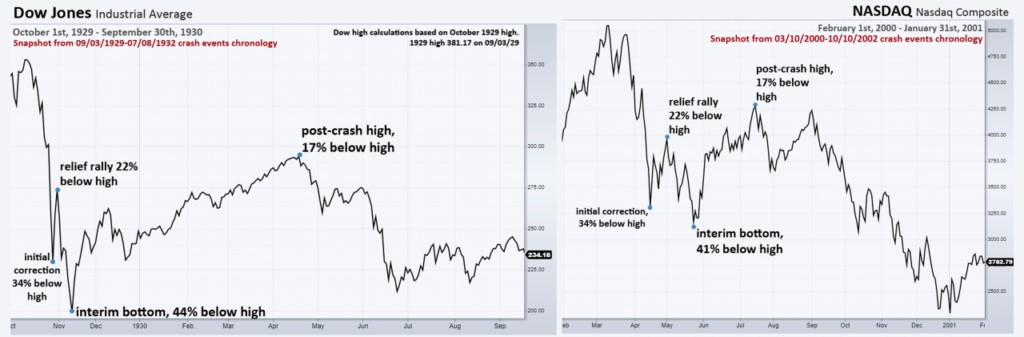

In the chart below, he illustrates the 1929 stock market crash and the 2001 Nasdaq bubble. Both had steep corrections, followed by a relief rally ending 22% below the recent high.

In comparison, the 2020 crash has a similar pattern. A steep 30%+ correction, followed by sharp relief rally. Whether the rest of his prediction plays out remains to be seen.

Not everyone agrees on the dire stock market future

While many analysts on Wall Street think the S&P 500 will retest its March 23rd lows, few share Markowski’s brutal analysis. Some think the bull market hasn’t even ended! Investing legend Howard Marks is even starting to dip his toes back into stocks .

I feel it’s a time when previously cautious investors can reduce their overemphasis on defense and being to move toward a more neutral position or even toward offense (depending on how sure they want to be of grasping early opportunities).

Like many, he thinks there’s a good chance this relief rally fades, but that doesn’t mean you shouldn’t start looking for discounted stocks.

The bottom line for me is I’m not at all troubled saying (a) markets may well be considerably lower sometime in the coming months and (b) we’re buying today when we find good value.

I guess time will tell who was closer to the mark!