The Next Recession Won’t Be Triggered by a Housing Market Crash: Economist

The next "housing market crash" won't be about housing at all. | Source: AP Photo / Mark Lennihan

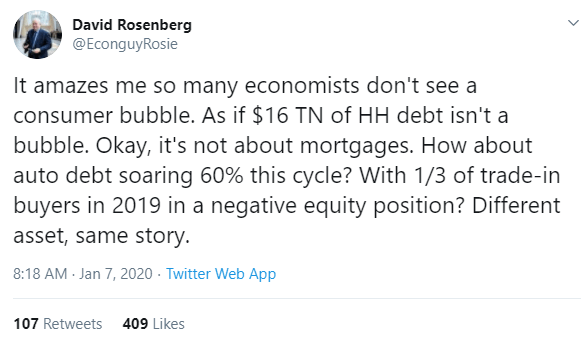

- Famed economist and global financial market consultant David Rosenberg expects household debt to spark the next recession.

- Terrifying consumer credit and auto loan data are a colossal debt bubble in plain sight. They’re on the verge of crashing the economy.

- $16 trillion in household debt and soaring auto debt puts Americans in a precarious position to weather headwinds and shocks.

David Rosenberg’s Twitter feed was full of some positively scary data this week. He says we’re in a consumer bubble, and it’s “too late” to stop an impending recession.

The global economic strategy consultant is hoping the heavy dose of hard-to-swallow pills might scare other economists straight.

$16 Trillion Household Debt Bubble Ripe To Burst

Rosenberg says to forget about a housing market crash: “it’s not about mortgages.” He’s looking at the $16 trillion in US household debt, and the one-third of 2019 auto trade-ins that were underwater with negative equity .

Mr. Rosenberg didn’t provide a citation for the $16 trillion debt figure. But at the end of last month, Fox Business reported household debt is up to $15.99 trillion:

A guest commentator said these numbers are fine… unless something changes.

Right now with the economy strong, these numbers, these ratios are okay. But here’s the thing we always have to worry about. What if there’s say a bubble? What if we go into a recession? What if our asset values fall? What if our household income falls?

The Fox Business anchor pointed out previous bubbles caught people by surprise.

NASDAQ is setting these records not seen since ’97 or ’98. Back then we didn’t know, or not a lot of people knew that the bubbles that were forming were forming.

If the figures quoted by Fox Business and David Rosenberg are correct, US consumers took on $2 trillion in household debt in just two quarters since June 2019 (!).

The massive expansion of consumer credit over two quarters coincided with record charge offs unseen since 2012 . Rosenberg points to more Fed “easing” as the cause.

Anti-Recession Measures at Fed Flood Risk Assets

Soon after assessing a household debt bubble, Rosenberg pointed out a hair-raising pattern in the New York Fed recession model. The probability of recession dropped suddenly from all-time highs right before the dot-com crash and Great Recession hit.

History shows we’re not out of the woods yet. Last month, Rosenberg went on CNBC’s “Closing Bell” to discuss the recession risk. He pointed out ongoing Fed operations are fueling the household debt bubble.

That liquidity injection that’s ongoing has caused the money supply numbers to go gangbusters at a time when business credit’s actually contracting, which is interesting because that excess liquidity hasn’t found its home in the real economy.

So where did the money go? It fueled the bull market for stocks on Wall Street and blew up the record consumer credit bubble to dangerous levels.

It’s found its way into risk assets. By the way, not just the equity market, but look at what credit markets have done. Look at what money markets have done.

Maybe the record consumer debt bubble is why Time reported Monday that Gen X women get less sleep than any other generation . And why last week, Gallup data found Americans are some of “the most stressed out” people in the world .

Disclaimer: The opinions in this article do not represent investment or trading advice from CCN.com