Tether Market Cap Goes Sub-$2 Billion as Coinbase Stablecoin Steals the Show

Tether (USDT), the controversial USD-backed cryptocurrency that has long been the most popular “stablecoin,” continues to shed market share in the wake of its descent below dollar parity.

Tether Market Cap Drops to January Low

The tether token, which as recently as Oct. 9 had a market cap of $2.8 billion, now has a total valuation of less than $2 billion, representing an intramonth decline of approximately 29 percent. The last time USDT had a market cap below $2 billion was in January when the token eclipsed that threshold for the first time.

The decline has largely been the result of a stampede of USDT redemptions, spurred by a combination of the token’s discount to its supposed $1.00 value, increased competition, and concerns about the stability of the issuer’s banking relationships.

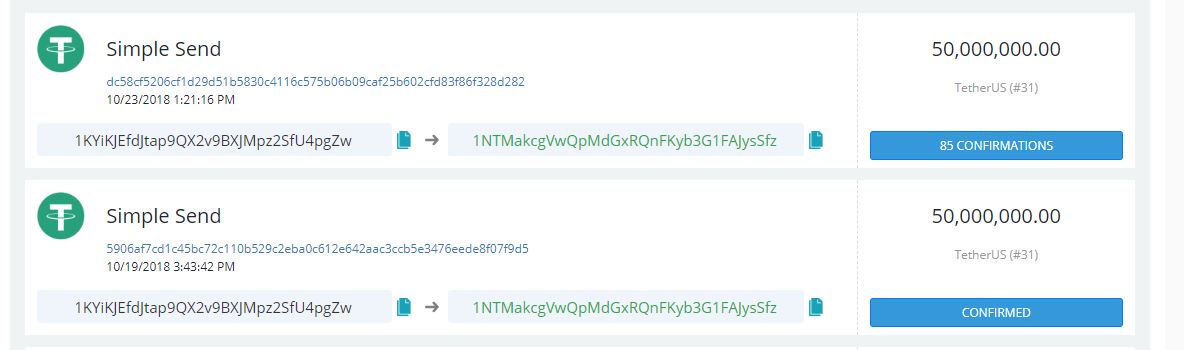

The latest redemption occurred on Tuesday when cryptocurrency exchange — and close associate of Tether Limited, the USDT token’s issuer — Bitfinex sent 50 million USDT to the Tether treasury address, indicating that those tokens had been redeemed for their nominal value of $50 million. Nearly 800 million USDT have been yanked from circulation in October alone, and just under 1 billion tether tokens are now sitting in the treasury address.

USDT Creeps Toward $1.00 But Still Trades at Discount

Meanwhile, the tether price has made a marked recovery since briefly dropping to $0.92 on Oct. 15. According to CoinMarketCap, USDT is priced at a global average of $0.987, though the token continues to trade as low as $0.97 on Kraken and other exchanges that offer direct pairs against physical USD.

Overall tether trading volume has also declined since the token dipped below $1.00. While USDT remains the second most traded cryptocurrency (trailing only bitcoin) with a daily volume of $1.8 billion, it has seen a steep drop off from the $3 billion+ in daily volume regularly experienced throughout late September. That said, aside from the flurry of trading that occurred in the 48 hours surrounding the loss of tether’s USD peg, the decline in USDT trading volume has largely tracked its decline in market cap.

Could Tether Itself be Redeeming USDT?

Mike Novogratz, the billionaire former hedge fund manager and founder of cryptocurrency merchant bank Galaxy Digital, recently said that Tether had created a lot of its own problems by operating with an insufficient degree of transparency compared to newer competitors such as Gemini Dollar (GUSD). Nevertheless, he stressed that the rapid decline in the circulating USDT supply through redemption is an “important” signal that, as he said that he believes, the token is fully-backed by physical dollars.

Research from pseudonymous cryptocurrency analyst Hasu and Three Arrows Capital CEO Su Zhu has speculated that the redemptions may even be coming from Tether itself, which could be buying up discounted tokens and then internally crediting itself with the full $1.00 per token. This could be occurring for any number of legitimate reasons, ranging from profit-seeking, the desire to help USDT return to dollar parity, or even a long-term plan to unwind the firm’s stablecoin operation altogether.

They wrote :

“I know of several ‘non-Tether’ arbitrageurs, so Tether is certainly not the only one at it. But it’s not conceivable to me that $600M would have been withdrawn from Bitfinex in such a short time frame. If my assumption is correct, Tether is buying up USDT on the market for a discount, retiring them and internally crediting itself $1. That is fine and there is nothing shady about it. It’s no different from public companies buying back their shares when they think the market undervalues them relative to their fair price.”

Bitfinex, notably, has called the analysis “surprisingly fair given the multitude of accusations we face,” according to remarks cited in CoinDesk .

Supporting this analysis is the fact that while tether’s stablecoin competitors have seen large inflows since their respective launches, many more dollars have been pulled from the market via USDT redemptions than have entered through other stablecoin issuances. That’s particularly significant considering that most of the major tether competitors are trading at $1.01.

Tether Sheds Market Share amid Increased Competition

However, over the long term, it would not be surprising to see USDT eclipsed by one or more of the new crop of “regulated” stablecoins, namely USD Coin (USDC), Paxos Standard (PAX), Gemini Dollar (GUSD), and TrueUSD (TUSD) — the latter of which launched earlier this year.

Most recently, crypto-kingmaker Coinbase announced that it would join fellow fintech unicorn Circle as a founding member of CENTRE, the consortium that governs the issuance of the dollar-backed USDC cryptocurrency. As such, traders can now buy and sell USDC through Coinbase’s popular brokerage service, giving the token a leg up on its peers, particularly PAX, which had taken an early lead in the post-September stablecoin sprint.

According to CoinMarketCap, USD Coin now has a market cap of $85 million, making it the largest of the three major stablecoins launched in September and the 71st-biggest cryptocurrency overall. Most of that increase has come in the day following Coinbase’s announcement, enabling the token to vault past Paxos Standard and its $79 million market cap.

Featured Image from Shutterstock. Charts from TradingView .