Stock Market Legend Warns of Depression, but He’s Been Wrong Before

The Bridgewater Associates co-chief investment officer warns that the stock market could be gearing up for a repeat of the 1930s. | Source: Shutterstock

Forget all the recession talk, Wall Street tycoon Ray Dalio is afraid an economic depression could be in the cards. The Bridgewater Associates co-chief investment officer warns that conditions in the financial markets are beginning to look a lot like the 1930s when the U.S. economy was mired in the Great Depression. As fate would have it, an adage from the 1930s says: “Sharp indecision is resolved sharply,” as pointed out by stock market strategist Carter Worth on CNBC. Based on the choppy performance in the S&P 500 lately, the current market cycle is going to end extremely well or very badly. Ray Dalio appears to be in the camp of the latter outcome, but is he right?

Stock Market’s Roller Coaster Ride

Dalio’s reasons for the ominous outlook are three-pronged, comprised of the central bank effect (or lack thereof), “wealth gap,” and U.S./China trade war. He stated in a LinkedIn post :

“If/when there is an economic downturn, that will produce serious problems in ways that are analogous to the ways that the confluence of those three influences produced serious problems in the late 1930s. “

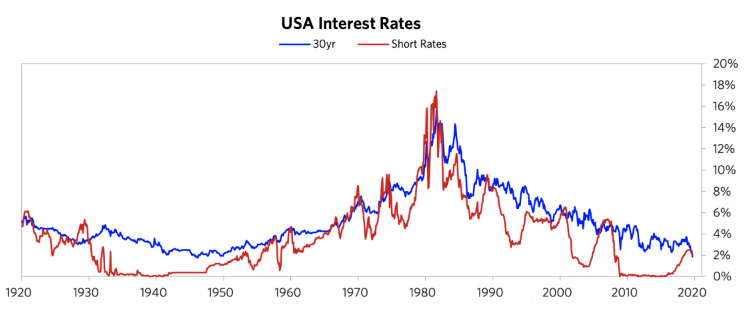

Bridgewater Associates oversees $160 billion in assets under management, giving it the title as the world’s biggest hedge fund. While the firm has earned bragging rights, there is no denying that they took the wrong side of the bet by siding with the bears on global interest rates. The Pure Alpha fund, which according to Bloomberg is the firm’s “flagship fund” and whose strategy is macroeconomic trends, is underperforming its peers, shaving 6 percent off its value year-to-date, roughly. Meanwhile, Pure Alpha Fund II is underperforming the broader stock market, having suffered 9% declines year-to-date while the S&P 500 has delivered double-digit percentage gains, even throughout the stock market roller coaster ride. Ouch.

So why should investors put any faith in Dalio’s forecast that a perfect storm is forming in the U.S. economy, one that could play out like the single-worst financial event in the history of the Western world? Because Dalio has been right a lot, too. Last year, the Pure Alpha fund delivered returns of nearly 15 percent to investors. Indeed, 2018 was kind to Dalio, reportedly netting him a payday of roughly $2 billion . His most recent gloomy outlook for the stock market appears to be predicated on the fact that history repeats itself. Whichever way the coin decides to fall on the stock market, it’s going to land with a bang for either the bears or the bulls, if there’s any truth to the aforementioned adage from the 1930s.