Stock Market Braces For a Big Fall as Bad News Piles On: Key Events This Week

Uncertainty around U.S.-China trade talks could spell trouble for stocks this week. | Image: Johannes EISELE / AFP

Strategists anticipate the U.S. stock market to have a tough week ahead as the global economy stalls and trade-talk uncertainties intensify.

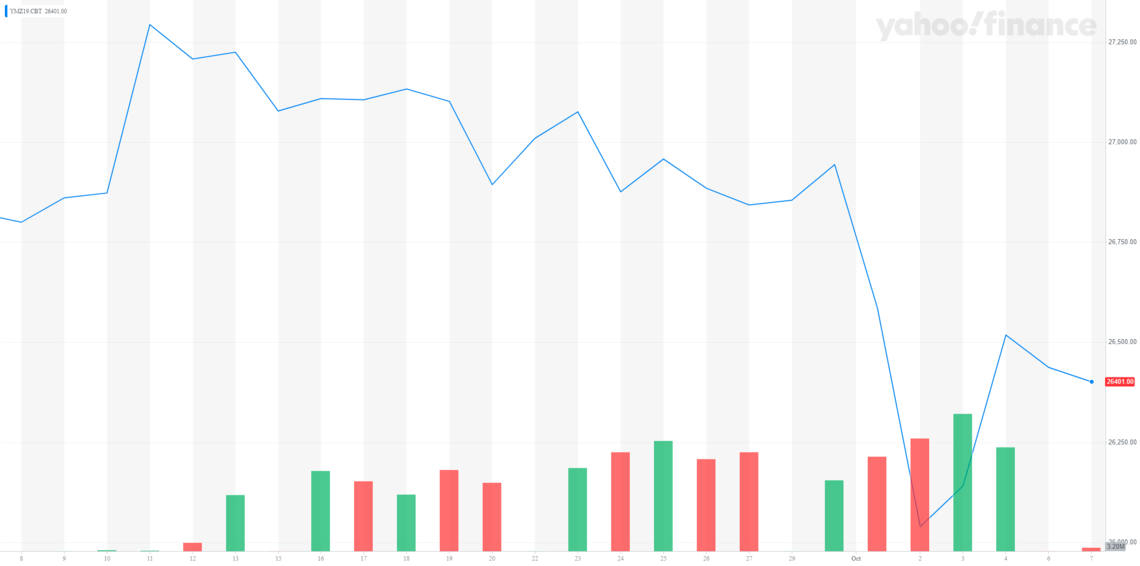

The U.S. stock market closed with improved sentiment last week as the Dow Jones surged by well over 300 points.

With the Asian stock market showing a steep decline as a result of the expected lackluster progress in trade talks, U.S. equities are expected to quickly follow suit.

U.S.-China trade talks likely to end in disappointment

Ahead of the upcoming round of trade talks, Chinese Vice Premier Liu He firmly stated that the proposal drafted by the government of China will not include industrial policy reforms.

The U.S. has demanded key changes to China’s industrial policies and government subsidies as a core part of the trade discussions, which in large part has contributed to the stalled agreements.

Pre-market trading shows that investors in the U.S. stock market are not at all optimistic towards the trade talks following Liu’s comment.

Previously, as reported by Bloomberg, President Trump said that he would only consider an all-inclusive trade agreement with China, emphasizing that he is willing to walk away if some parts of the deal is not favorable. In other words, the Trump administration is not willing to accept a partial deal at this time.

“We’ve had good moments with China. We’ve had bad moments with China. Right now, we’re in a very important stage in terms of possibly making a deal. But what we’re doing is we’re negotiating a very tough deal. If the deal is not going to be 100% for us, then we’re not going to make it,” Trump said .

Against this backdrop, a no-deal October has become a real possibility.

The U.S. stock market, which is said to have priced in most of the progress in the trade talks, could see a sell-off if October comes to an end without a partial deal.

According to Scott Minerd, Global Chief Investment Officer at Guggenheim Partners, rising trade tension combined with strong economic data would only sow uncertainty regarding the Federal Reserve’s stance. This uncertainty could continue to build up pressure on the stock market.

“The divergent issues of stronger economic data, increasing trade tensions, and rising oil prices will only complicate the communication challenges for Fed Chairman Powell,” said Minerd.

Global economy is slowing

Primarily due to the imposition of tariffs and the decreasing likelihood of a resolution for the trade dispute between the U.S. and China, the growth of the global economy has declined from 3.8% to 2.9% in the past two years.

Central banks in virtually every major region in Europe and Asia have responded with consistent cuts to the interest rate but the pressure applied upon the global economy by lagging manufacturing and investment sectors has prevented a swift recovery.

Investors have started to flock to the bond markets for safety, a sign of a decline in confidence towards the short term trend of the stock market.

Still, Ryan Detrick, senior market strategist at LPL Financial, said that it is difficult to forecast recession as credit markets haven’t flashed any major warning signs and consumer demand remains solid.

“Three takeaways as recession talk heats up. 1.) Household debt payments as a percent of income near generational low equals consumer healthy 2.) High yield spreads are tight equals credit markets aren’t worried yet 3.) NYSE Advance/Decline line still in an uptrend equals broad participation still,” noted Detrick.