Spooked Wealthy Investors Swerve Fat Cash Piles from Stock Market

A pandemic and a nation rocked by protests is rattling the stock market that the 'smart money' continues to sit out. | Source: Spencer Platt/Getty Images/AFP

- Investors in the U.S. hold lots of cash but are mainly targeting low-risk bonds.

- Wells Fargo and BlackRock executives say investors are trying to scoop up any kind of yield at this point.

- Growing uncertainty and geopolitical risks have spooked institutional investors or ‘smart money’.

The U.S. stock market has been relatively stable in the past week. Investors are patiently observing various economic data as the nation reopens. But, institutions and high net-worth individuals are still not ready to re-enter the market.

The Dow Jones Industrial Average (DJIA) increased by 7% in the last month from 23,723 to 25,383 points. Despite the strong uptrend of the U.S. stock market, the demand for bonds continues to surge as yields drop.

Wells Fargo And BlackRock Say Bonds Are Becoming More Popular

On Bloomberg Real Yield, Wells Fargo head of credit strategy Winifred Cisar Stieglitz said investors are holding onto cash.

Rather than the stock market, Stieglitz said investors are interested in investment grade, especially low-risk bonds that can generate decent returns in the short to medium-term.

Stieglitz said :

It seems investors have a lot of cash, we continue to see record inflows into investment grade. We don’t want to buy triple Cs haphazardly, we don’t want to buy energy haphazardly, but we need to put our cash somewhere.

Investors seemingly fear that the uncertainty around the pandemic, growing tension between the U.S. and China , and intensifying protests in major cities like Minneapolis will worsen market sentiment in the coming weeks.

Institutions and billionaire investors are approaching the stock market with a similar stance. They are increasing their cash buffer , lowering risks, and building larger hedge positions.

The trend is not exclusive to the world’s wealthiest billionaires like Warren Buffett and Paul Tudor Jones.

BlackRock chief investment officer Jim Keenan echoed the sentiment of Stieglitz, stating that investors are trying to buy any kind of yield regardless of its return.

Keenan noted:

Now, the story is you’re seeing the stability of earnings and so what you’re seeing is everyone comfortable that you’re not going into recession environment and people are trying to buy any kind of yield at this point in time that they can get stable earnings because all returns are going to be low at current valuations.

The demand for bonds is rapidly increasing as geopolitical risks rapidly grow and investors expand their cash reserves.

Record Inflows Into Low-Risk Bonds Show a Stock Market Sell-Off is Likely

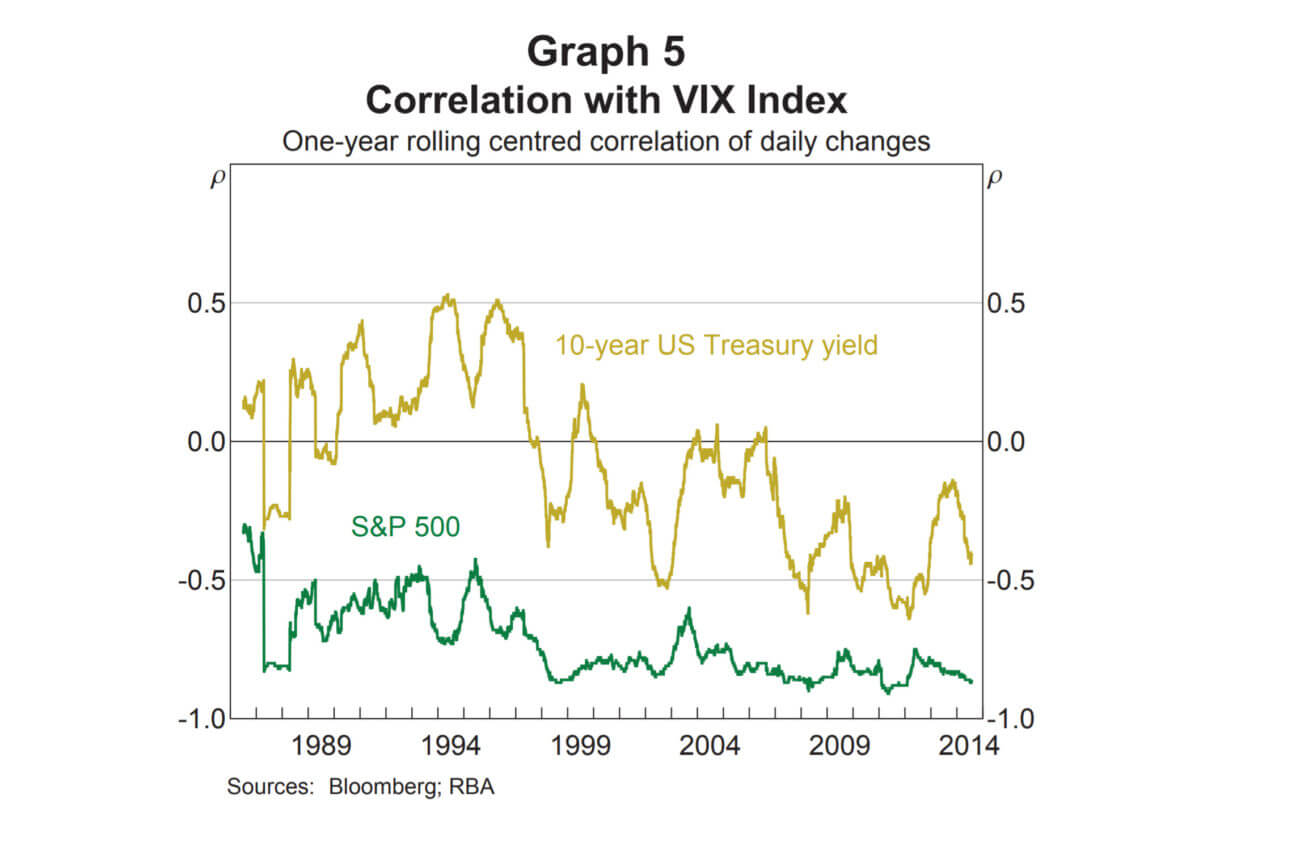

Historically, the yield of the 10-year U.S. Treasury maintained a rough correlation with the S&P 500. Whenever the yield of the Treasury fell substantially, the stock market saw a sizable sell-off.

A study published by the Reserve Bank of Australia on the stock-bond correlation in the U.S. reads :

This [persistent stock-bond correlation] has occurred alongside a decline in short-term rates and has probably led to the equity risk premium having a proportionally larger influence on the discount rate for equities. As a result, equity prices may have become more sensitive to uncertainty about real growth, and thus more positively correlated with bond yields.

A confluence of growing appetite for cash, low-risk bonds, and hedge positions indicates smart money distrusts the ongoing stock market upsurge.