S&P 500 Will Rally in 2019, Predicts ‘Stubborn Bull’ Joseph Zidle

Joseph Zidle does not believe the government shutdown will have a prolonged effect on the S&P 500. | Source: Shutterstock

Blackstone’s new chief strategist, Joseph Zidle, says the government shutdown won’t have a lasting effect on the US stock market and predicts that the S&P 500 is heading for a 15% rally.

Zidle Not Concerned about Government Shutdown

Zidle recently succeeded the legendary strategist Byron Wien at Blackstone. Speaking this week on CNBC’s “Fast Money ,” he said of the shutdown and its impact on the stock market:

I don’t see any real lasting effect here because people are going to get paid and they’re going to be made whole.

Other Wall Street analysts are starting to raise concerns about the government shutdown. It’s now into its 26th day, and US President Donald Trump, Republicans, and Democrats can’t seem to find common ground.

JP Morgan CEO Jamie Dimon believes the shutdown could cut economic growth in the US to zero and called for “good government policy.”

The White House says the shutdown may hit US growth by 0.1 percent each week, and nearly four weeks in that could be 0.4% off growth.

800,000 government workers and an estimated four million contractors might also not agree with Zidle. Though furloughed workers will be paid eventually, the contractors won’t. After missing a first paycheck on Friday, affected government workers are already going into debt and running the risk of losing their homes.

Delta Airlines CEO Ed Bastian predicted that the shutdown would cost the airline $25 million in January alone as fewer government workers and officials travel.

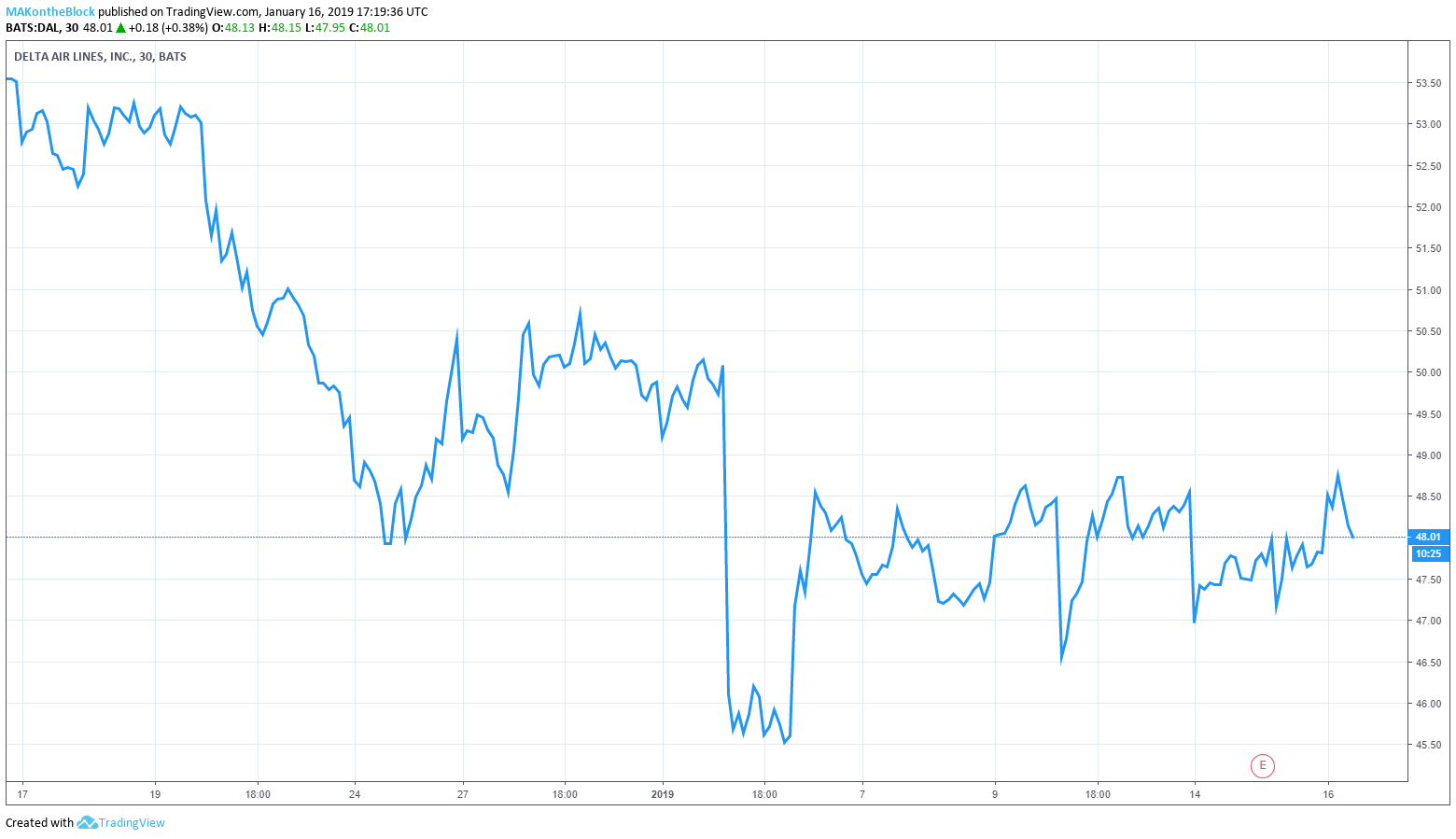

Delta’s share price has fallen back over the last couple of days but is recovering today.

S&P 500 to Rally 15%

Zidle says the shutdown’s impact on the markets will be short-lived. He expects the S&P 500 to rebound to 2,875 this year after its decline at the end of 2018. He says:

If we do see a drop to first quarter growth or if we see some sort of hit to corporate profits, I think [in] the second quarter we’re going to see all that coming back and more.

But, the trade war and tariffs between the US and China is a “completely different issue” to Zidle and may affect US equities:

I think we need to get that wrapped up in order to have any type of meaningful rally in the stock market.

After falling back on Monday, the S&P 500 is climbing again today, 0.26% up at the time of writing. The Dow Jones is also up 0.46%, and the Nasdaq is up 1.63%.

The Dow Jones Industrial Average shook off yesterday’s Brexit debacle to trade sharply higher this morning. The overall impact of Brexit on the US stock markets could be minor, but lower economic growth in Europe may impact the US and world markets over the long-term.

Featured Image from Shutterstock. Price Charts from TradingView .