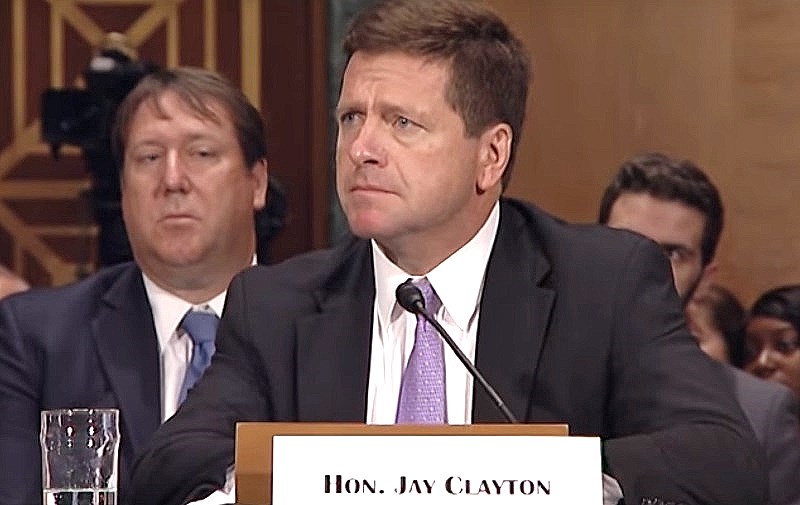

SEC Not Changing Securities Rules to Accommodate ICOs [But Bitcoin’s Fine]: Chairman Clayton

SEC Chief Jay Clayton has put several regulatory questions to rest by firmly stating in a CNBC interview posted earlier today that the SEC will not be making special allowances either for tokens that represent the value of a project or for the majority of initial coin offerings (IOC), going on to say in the interview that most ICOs are selling securities.

SEC Won’t Update Securities Framework to Give ICOs Safe Harbor

Clayton clarified that cryptocurrencies which truly act as currencies used for carrying out transactions — such as bitcoin — will not be SEC regulated.

“Cryptocurrencies: These are replacements for sovereign currencies, replace the dollar, the euro, the yen with bitcoin,” Clayton said. “That type of currency is not a security.”

However, any currencies which represent an investment in a venture affecting the value of the token are categorically securities according to Clayton, and will be regulated just like any other under SEC jurisdiction. This means big changes in the American and global cryptocurrency markets as exchanges will have to register to deal in those tokens and ICOs or IPOs (initial public offerings) will have to be licensed by the SEC.

“A digital asset where I give you my money and you go off and start a venture, and in return for giving you my money you say you know what, I’m going to give you a return, or you can get a return on the secondary market by selling your token to somebody – that is a security, and we regulate that. We regulate the offering of that security, and we regulate the selling of that security.”

“If you have an ICO or a stock, and you want to sell it in a private placement, follow the private placement rules. If you want to do any IPO with a token, come see us. File financial statements, file disclosure, take the responsibility our laws require,” he added.

Clayton Mum on Whether Altcoins Are Currencies or Securities

Clayton said he would not support the redefining of securities to accommodate the new technology. He refused to comment on specific altcoins as to whether they were or were not securities, but referred the interviewer to his definition — anything representing an underlying asset or the value of a project will continue to be considered a security.

While he gave a clear answer on most of the questions put to him in the segment, Clayton didn’t have a set answer for the regulation of projects which started out selling securities but have since become decentralized projects with no leadership.

“That’s a question that is out there and will be answered under specific facts and circumstances, but we’ve been doing this a long time and there’s no need to change our fundamental approach,” he concluded.

Featured Image from YouTube