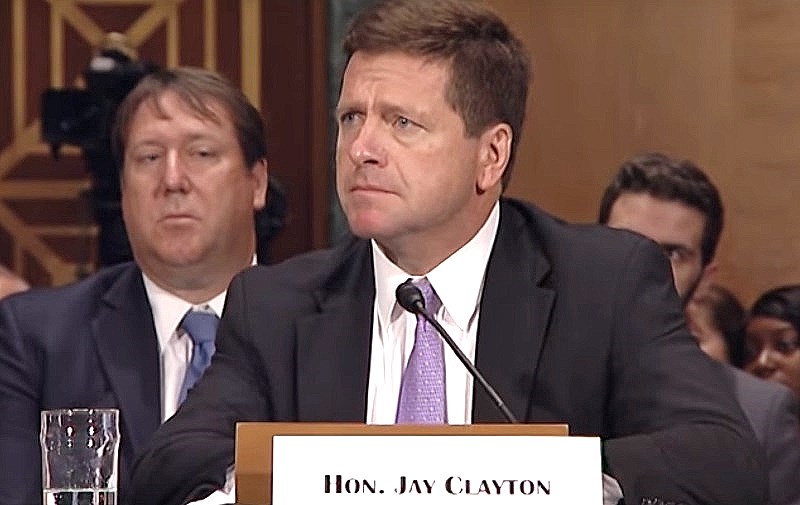

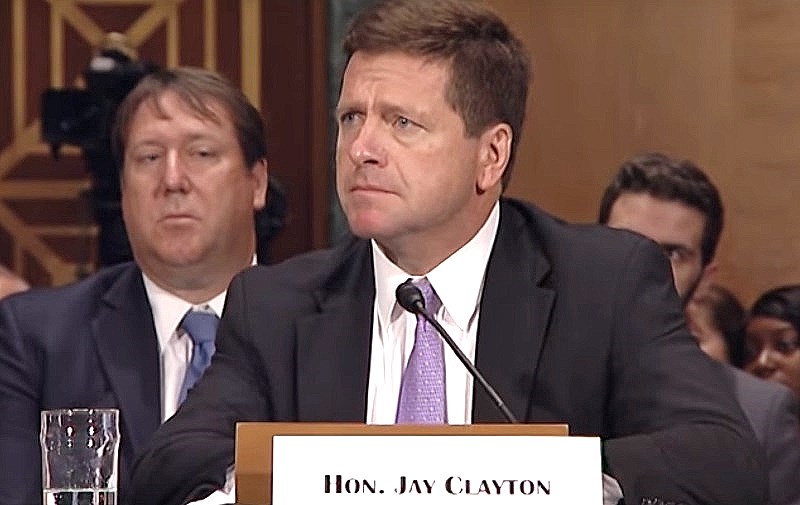

SEC Chair: Not All ICOs Are Frauds

Jay Clayton, the chairman of the Securities and Exchange Commission, said contrary to speculation, the SEC does not believe that all initial coin offerings are fraudulent.

“Absolutely not,” Clayton said when asked if the SEC’s recent crackdowns on ICOs signals such a stance. Clayton made the remarks during a speech on “Cryptocurrency and Initial Coin Offerings” at Princeton University on April 5.

Clayton said stamping out fraud in the crypto market is critical to protect consumers. He also said increased regulatory scrutiny will actually benefit the industry by ridding it of fraudsters and scam artists who give the entire space a bad name.

And driving out bad actors early on will ensure that the government won’t eventually adopt such a hard-line stance that it will effectively choke off the budding industry, Clayton reasoned.

“Is the approach taken in Washington by the SEC adversely affecting distributed ledger technology in other areas? My hope is that it’s actually helping, because this technology is being used for fraud,” Clayton said. “And to the extent that it’s being used for fraud, history shows that government comes down harshly on that technology later.”

He added: “If we don’t stop the fraudsters, there is a serious risk that the regulatory pendulum – the regulatory actions – will be so severe that they will restrict the capacity of this new security.”

In February 2018, Clayton signaled that his agency would investigate cryptocurrencies when he testified before the U.S. Senate Banking Committee. At the time, he said: “I believe every ICO I’ve seen is a security.”

Weeks later, the SEC targeted ICOs by issuing “dozens of subpoenas” to crypto-related tech companies and advisors to investigate how ICOs are structured.

$32 Million ICO Halted For Fraud

On April 2, the Securities and Exchange Commission filed fraud charges against Sohrab Sharma and Robert Farkas, the co-founders of Centra Tech.

Sharma and Farkas are accused of raising $32 million by selling “unregistered securities” during the Centra ICO, which was promoted by boxing champ Floyd Mayweather and record producer DJ Khaled.

Meanwhile, the SEC is now considering two bitcoin exchange-traded funds — the ProShares Bitcoin ETF and the ProShares Short Bitcoin ETF — for listing on the NYSE Arca, the first all-electronic exchange in the United States, according to public documents .

Cboe President Urged SEC To Allow Crypto ETFs

The SEC consideration of bitcoin ETFs comes shortly after Cboe president Chris Concannon urged the agency to allow crypto ETFs.

In a March 23 letter to the SEC , Concannon dismissed criticism that virtual currencies are too illiquid and volatile to be treated like other established commodities.

“Because of its innovative features as a digital asset, bitcoin has gained wide acceptance as a secure means of exchange in the commercial marketplace and has generated significant interest among investors,” Concannon wrote.

Concannon also said there is enough “reliable price information” from the bitcoin futures market on Cboe Futures Exchange and CME that should ease regulatory worries about its opaqueness as an investment vehicle.

“There is real-time trade data available 24 hours a day from a number of different trading platforms around the world, with a collective volume in the billions of dollars daily,” Concannon said. “Between these various potential pricing sources, there is more than sufficient information for cryptocurrency ETPs to create reliable and robust valuation methodologies for bitcoin and potentially for other cryptocurrencies.”

Featured image from Shutterstock.